Announcing The Forrester Wave™: Omnichannel Order Management, Q3 2014

Order management systems (OMS’s) typically haven’t garnered the same attention as other commerce technology. Orchestrating online orders from the point of purchase through to the point of fulfillment was viewed (through the eyes of eBusiness professionals) as a back-office process. In fact, eBusiness professionals have historically paid little attention to these systems and were happy for them to be developed and minded by supply chain or enterprise architecture professionals. But like the awkward kid at school, Omnichannel OMS systems have blossomed and turned into the must-have technology for almost every eBusiness leader.

So what’s all the fuss about?

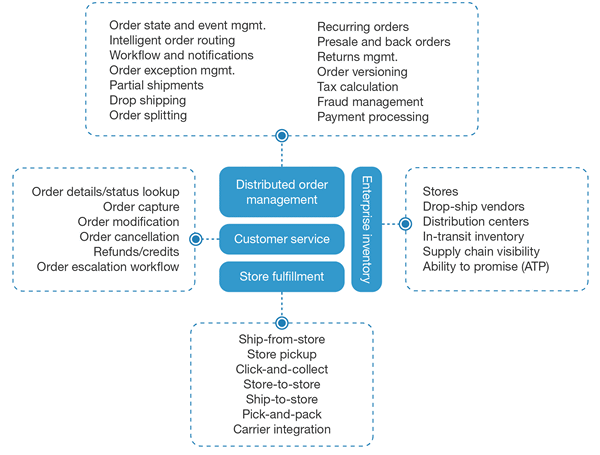

It’s quite simple – quickly fulfilling orders to meet rising customer expectations is a now a strategic competitive advantage in the world of omnichannel retail. Retailers must compete with Amazon Prime’s 2-day fulfillment promise and consumers increasingly want to order online and pickup instore, or buy from the endless aisle when in a store. Trying to execute a transformative omnichannel strategy without an OMS is like going into battle with a wooden stick. Today’s order management systems still do the basics of capturing orders and orchestrating them through complex fulfillment workflows, but now they also have intelligent order routing algorithms that empower eBusiness professionals to source inventory from across the enterprise and fulfill orders not just from the web distribution center (DC), but also from stores, drop shippers and third-party logistics facilities. Furthermore, today’s order management (OM) systems support complex edge-case order scenarios that include recurring orders, pre-orders,back orders, partial shipments, split orders, drop shipments, and digital or service items. Beyond the core “distributed order orchestration” capabilities of these platforms, OMS systems provide three other mission critical capabilities:

- Store fulfillment. Retailers and brands with physical stores seek tools that will enable their store associates to efficiently fulfill online orders from store inventory. Most retailers find that their existing warehouse management solutions are ill-suited for deployment in a retail store environment.Building custom logic and screens into legacy point-of-service (POS) terminals to support store fulfillment is time-consuming, inefficient, and costly. Subsequently, retailers are increasingly turning to dedicated store fulfillment modules from their OMS vendor.

- Enterprise inventory. It is the role of the OMS to function as the broker and trusted source of inventory data across the enterprise. At most enterprises, inventory on the shelves of the distribution center(s) is the domain of the warehouse management system (WMS), inventory on the shelves of the stores is the domain of the POS or retail merchandising system, and inventory in the supply chain is the domain of the enterprise resource planning (ERP) system. The role of the OMS is to consolidate in near-real time inventory from these disparate systems into a single, enterprise view of inventory.

- Customer service. Modifying an existing order is no easy feat. A complex array of constraints and dependencies determine if orders can, in fact, be cancelled or modified. Doing so requires the de-allocation and re-allocation of inventory, pricing and promotion adjustments, tax recalculation, and the processing of additional payments or refunds. Only the OMS has true visibility into the life cycle of an order post-submission and thus the OMS is the true authority on if, when, and how an order can be modified.

Adam Silverman & I spent the past 5 months identifying and evaluating the leading vendors in this space by scoring them across 77 critiera. To see how the 9 vendors – eBay Enterprise, hybris (an SAP company), IBM, Jagged Peak, Manhattan Associates, Micros, NetSuite, OrderDynamics, and Shopatron – stacked up, please read the Wave report. It is important to remember that this research is intended to be a starting point only and we encourage clients to review the detailed product evaluations and adapt the 75 criteria weightings to fit their individual needs through the Forrester Wave's Excel-based vendor comparison tool. We also encourage clients to leverage their Inquiry access to learn more about these vendors before embarking on a selection process.