Everywhere you look, eCommerce is booming—and loudly.

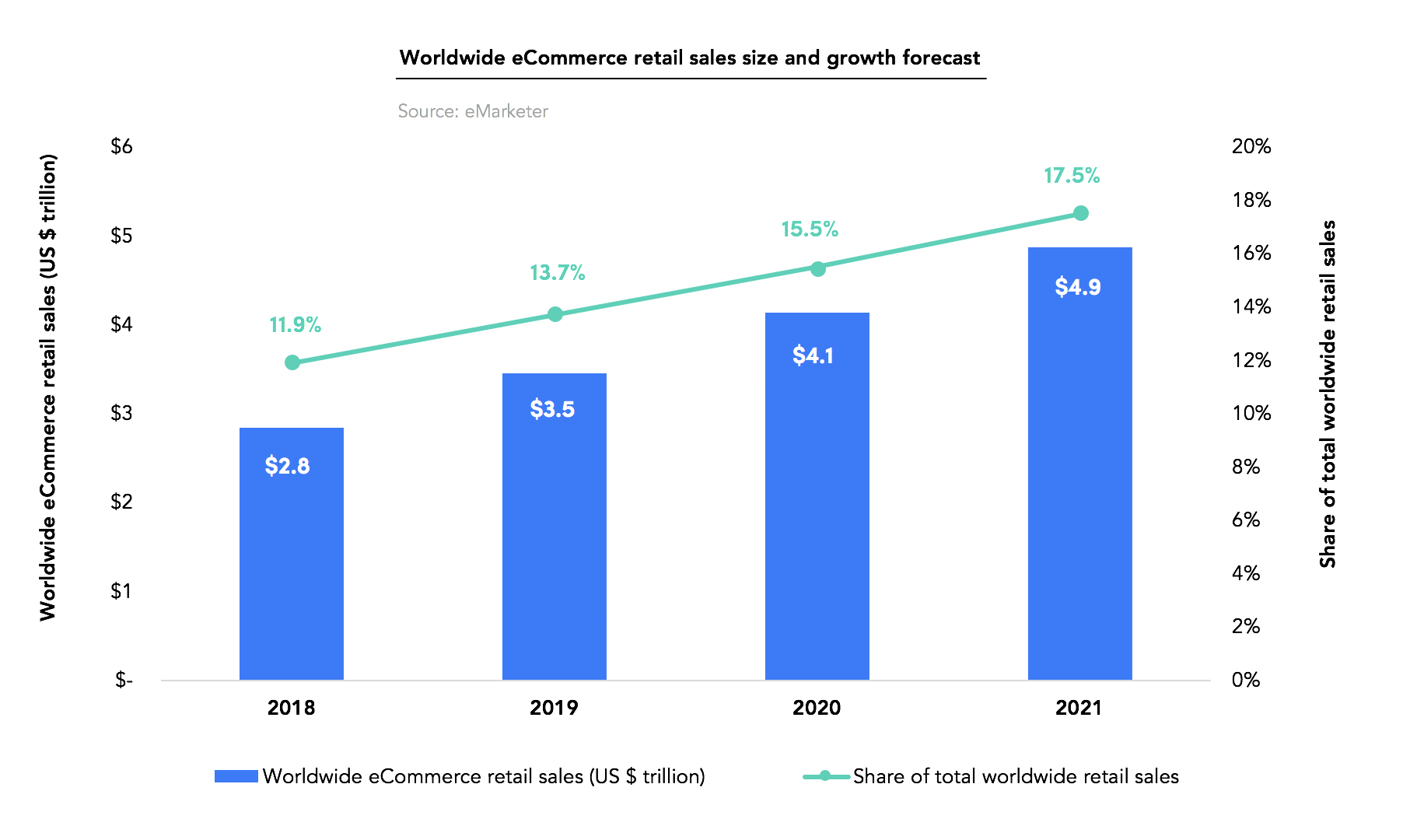

- eMarketer projects worldwide retail eCommerce sales will grow at a staggering compound annual rate of 21.5% from 2016 to 2021—which is nearly 4x faster than overall retail sales projections. eCommerce sales are expected to reach $2.8 trillion by the end of 2018 and could nearly double again to $4.9 trillion by 2021, amounting to more than 17% of total retail spending.

- Though eCommerce sales are estimated to account for just 2-3% of total CPG sales in the U.S. today, a Boston Consulting Group study projects digital sales could represent half or more of the nation’s CPG sales growth in the next several years. The latest Nielsen/FMI study says that online grocery adoption in the U.S. is accelerating with 70% of consumers predicted to be shopping online in the next 5-7 years.

- Online will remain the U.K.’s fastest growing grocery channel in the next five years, according to IGD’s latest forecasts. With sales of £11.4 billion in 2018, online grocery accounts for 6% of the country’s total food and grocery sales today. IGD predicts this figure will grow at a compound annual rate of 8.7%, reaching £17.3 billion and 8% share by 2023.

The disproportionate share of growth alone is enough for many brands to make digital retail a strategic priority.

However, for many executives, the upside opportunity of eCommerce may not be enough.

A hard truth: eCommerce may not be incremental

For market-leading incumbent brands, emerging channels, like eCommerce, are often viewed skeptically—or with outright disdain.

Recall how, in past decades, brand marketers experienced similar cycles of shock, anger and grief with the emergence of the warehouse club and discount channels. Commercial leaders eventually had to recognize and accept their enduring importance. The same now goes for eCommerce.

Still, some valid questions must be put on the table:

- What if supporting the eCommerce channel shifts demand instead of growing the pie?

- What if channel profitability compares unfavorably to existing distribution channels?

- What if we inadvertently fund the erosion of our most profitable channels?

Some leading brand manufacturers have spent years mired in analysis paralysis on just these types of questions. Large sums have been spent annually trying to quantify precisely the ratio of net new (incremental) sales generated in the online channel versus volume shifted from more established distribution channels.

But the hard truth is that eCommerce may not be incremental. There’s no guarantee that someone buying toothpaste, dog food, toilet paper, diapers, chocolate or any of a number of other categories online will buy more than they did offline.

Another hard truth? Many consumers are already buying these products from Amazon and other online retailers. Many more will buy them with each passing month. So the question becomes: Will they buy yours or perhaps turn to some little-known yet fast-growing nascent brand?

It’s becoming increasingly clear, after all, that new entrants are disrupting many categories with many small, emerging brands hitting it out of the park online.

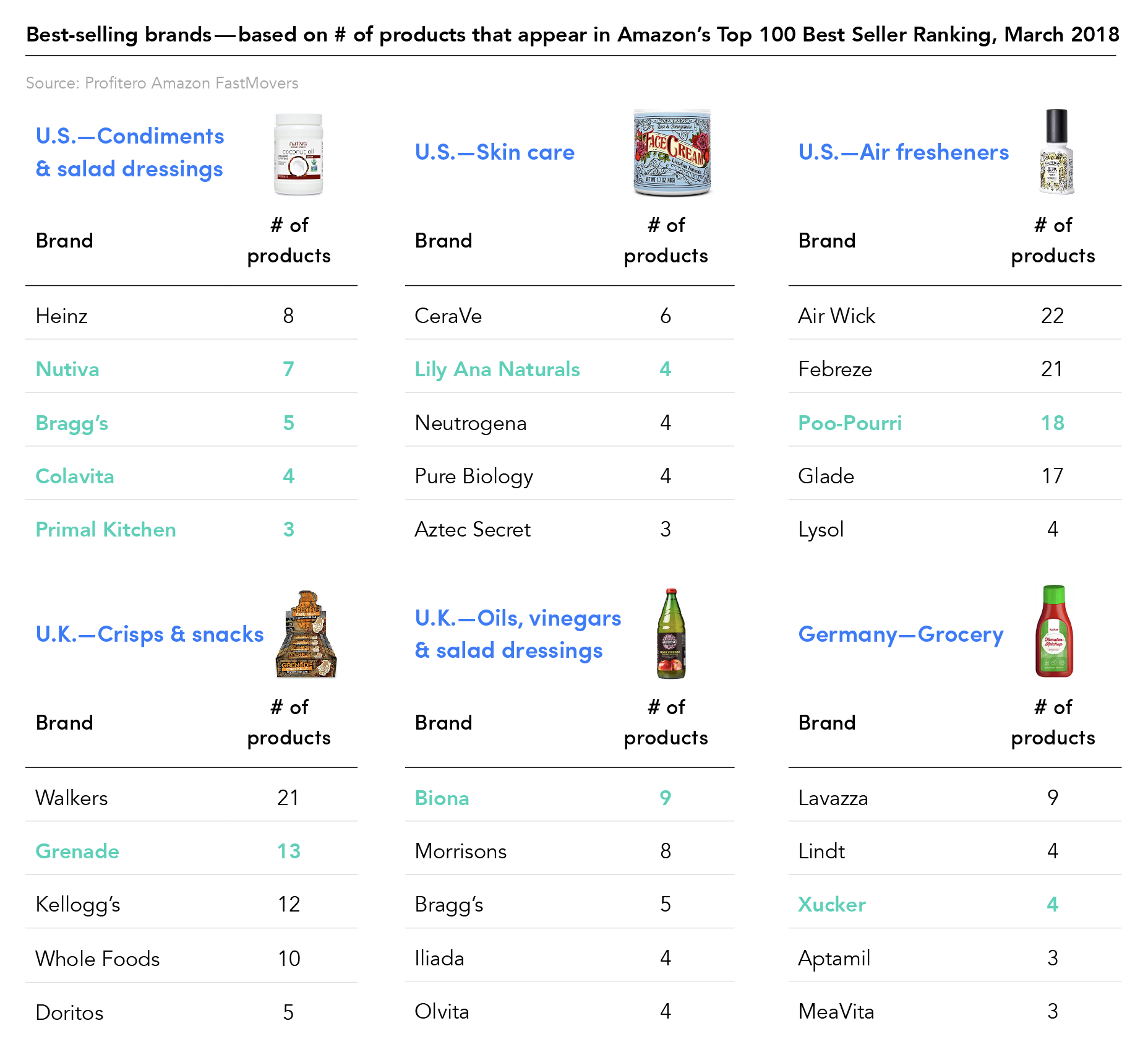

Below are examples of new and emerging brands that have some of the best-selling products in key CPG/grocery categories on Amazon in the U.S., U.K. and Germany.

Why doing nothing in eCommerce is not an option

The inevitable growth of eCommerce means that supporting digital retail isn’t optional, and it isn’t going away. In fact, supporting digital retail is imperative.

Here are some foundational principles to guide the journey ahead:

- Digital is the primary (if not singular) source of growth in consumer goods retailing. It influences offline as well as online sales. Agile competitors are meeting shoppers where they are, so you better do so too.Position eCommerce as a sought-after career progression track for internal candidates.

- eCommerce doesn’t need to be incremental to make business sense. The do-nothing risks of declining share and relevance may be even greater than the do-something upside. If you’re busy analyzing incrementality, get busy analyzing the projected share loss of inaction too.

- eCommerce can be incremental. There are ways to drive incrementality online in certain contexts. For categories with expandable consumption, larger pack sizes and auto-replenishment can increase consumption and minimize switching and substitution. eCommerce can reach shoppers that shop infrequently in-store.

Download Profitero’s guide The Digital Imperative: Why doing nothing in eCommerce is not an option to help you make the business case for why eCommerce should be a strategic priority, so you can get the buy in and resources you need to be successful.