China may be one of the most difficult markets for global consumer brands to tap, but it’s also one of the most lucrative.

With more Internet users than any other country, China is the world’s largest and fastest-growing eCommerce market – driven by the rapid pace of mobile adoption.

In fact, eMarketer predicts retail mCommerce sales in China will top $1.64 trillion by 2020, representing about 23% of total retail sales. And Chinese consumers are among the most engaged online. The Boston Consulting Group finds that China’s consumers spend almost 30 minutes a day on Alibaba’s Taobao marketplace, three times longer than an American consumer typically spends on Amazon.

Needless to say, huge opportunities await brands prepared to win over Chinese consumers, adapt to local market nuances, and put strategies in place which effectively adjust to a dynamic – and mobile centric – eCommerce environment. But how?

In our new white paper, “China Mobile Commerce – How to Expand Reach and Effectiveness in the World’s Biggest eCommerce Market”, we explore this untapped opportunity in full.

But first, read our five quick highlights from the report to get you started.

1. Lead with a mobile-first strategy. Mobile is having a transformative effect on online shopping worldwide, but in China, its impact simply cannot be ignored. More than 95% of Chinese digital consumers are on mobile, according to McKinsey. While according to iResearch Consulting Group, 71.6% of online shopping transactions were made on mobile devices in Q3 2016, up from 47.5% in Q1 2015.

With mobile the dominant way to shop, brands must optimize content accordingly to win. This means shorter product titles and descriptions, common eye-catching keywords, and fast-loading images with clearly visible features and benefits.

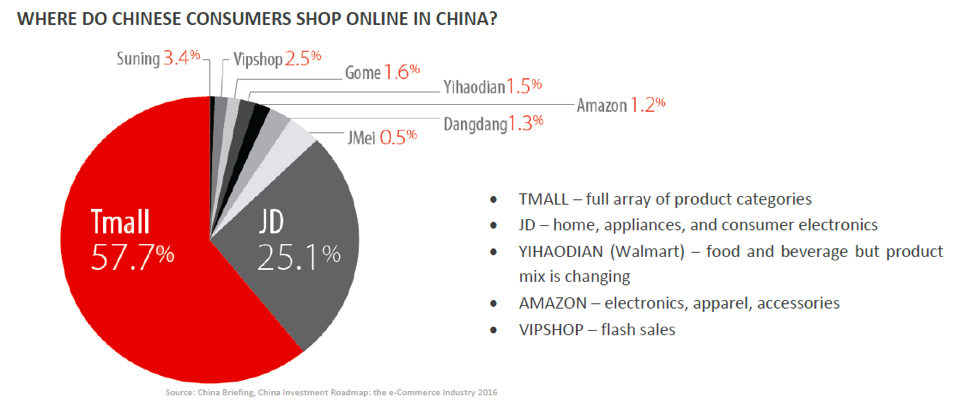

2. Test with Tmall and JD.com. For brands looking to test the Chinese waters, make absolutely sure it’s with one of these two e-tailers. Together, Tmall and JD.com capture 83% of China’s eCommerce sales. They’re the only ones that matter — at least for now. Establishing a flagship store on Tmall is a must-have for an overseas brand.

3. Ensure authentic ratings and reviews. Consumer-generated ratings and reviews carry a lot of weight with Chinese consumers. The basis for this overarching sentiment stems in large part from unfavorable experiences many Chinese consumers initially had with Alibaba’s initial retail marketplace, Taoba, which gained a reputation (warranted or not) for distributing fake products.

Brands must take this inherent skepticism among Chinese shoppers into account and work all that much harder to monitor reviews for negative sentiments, and to ensure ratings and reviews are authentic.

4. Leverage seasonal and shopping festivals. Singles’ Day is the largest online shopping event globally. It first began as a shopping holiday in 2009 by Chinese eCommerce giant Alibaba as a way for young Chinese people to celebrate the fact that they’re proud of being single. More than 40,000 merchants representing thousands of brands participated in last year’s Singles’ Day (11.11). Alibaba made $7 billion dollars in the first two hours and in total, generated $17.8 billion for the entire day, well surpassing the previous year’s $14.3 billion.

Having a presence during this massive global shopping holiday is a no brainer for any brand looking to win in China. But it’s not enough. Frequent content changes — images, pricing, promotions — and a personalized shopping experience – are both required to win during the 24-hour event. Brands must be prepared with analytics to learn and adapt quickly.

5. Frequently update online content. In China there is a word that means “thousand people thousand faces.” In very rudimentary terms in the online space, this fundamentally means that each consumer sees a different face on their smartphone or eCommerce page.

One person, for example, could search and save many favorites so their Tmall landing page, in a sense, is “customized” to display all their favorites. One big implication of this intense focus on the individual is the amount of change brands must manage to win. In fact, China’s digital marketplace is characterized by rapid fire changes in content, offers, products, promotions and more. Monitoring this constant barrage of change requires a flexible strategy as well as a flexible eCommerce analytics solution.