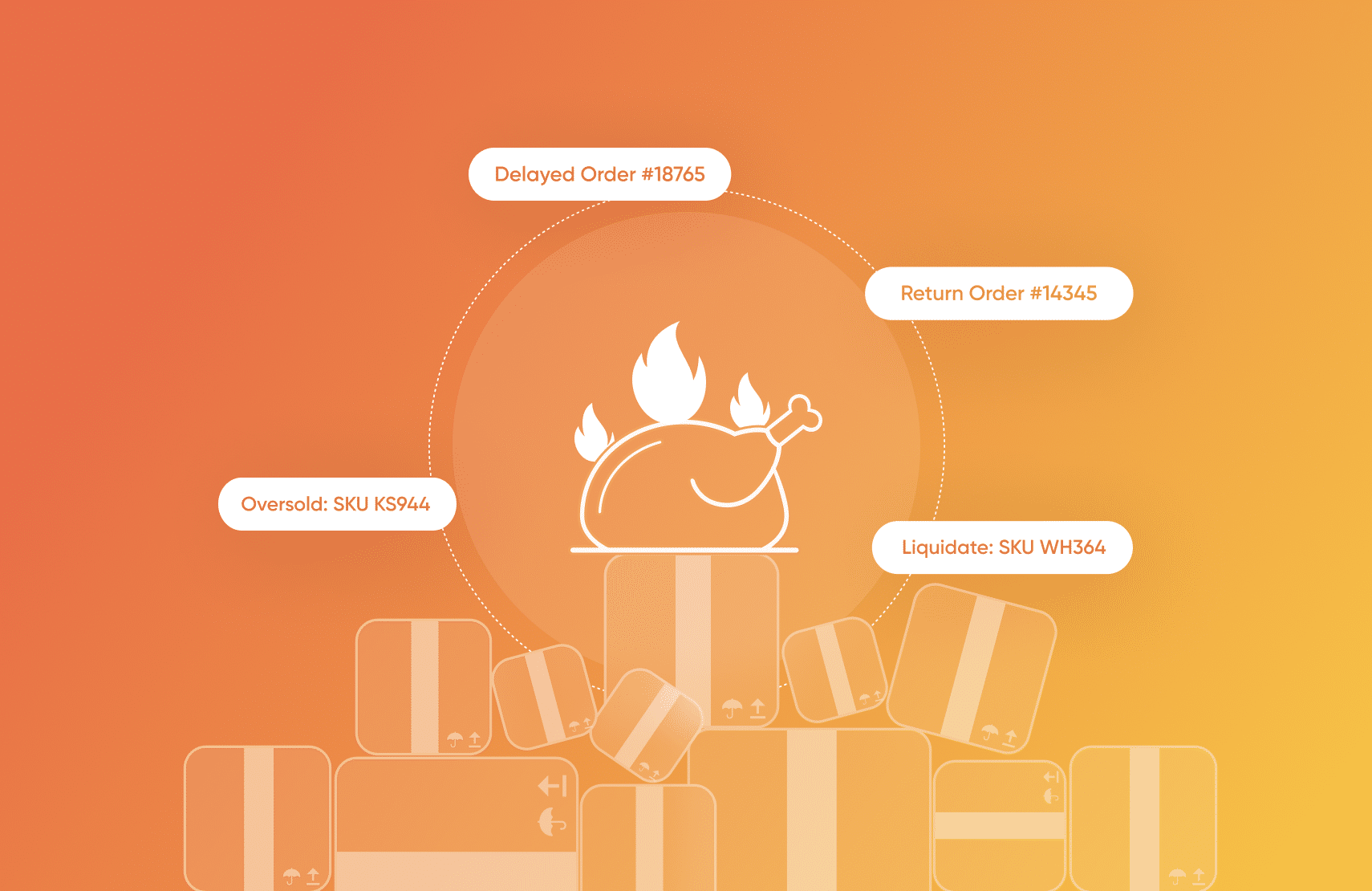

Is Your Retail Model a Burnt Turkey?

Many employees working for traditional retailers will miss their turkey dinner this year. Not because of recent supply chain issues, but because of outdated business models and technology. With 97% of people doing holiday shopping online, employees will scramble to keep websites live, fulfill online orders, and manage customer service issues related to shipping delays and returns.

Traditional retail websites running on monolithic commerce platforms are notorious for crashing during peak holiday traffic. This much is known. What doesn’t make headlines is how outdated business models and technology lead to understocking, overstocking, and poor customer service.

Meanwhile, employees at retailers like Amazon and Farfetch will have time for second helpings this Thanksgiving. Why? Because they have two pieces of technology in place: headless commerce technology and marketplace technology. In this article, I will focus on how retailers can use marketplace technology to save Thanksgiving dinner next year.

The “Burnt Turkey” Retail Model

The traditional retail model encourages retailers to do everything, thereby leaving room for nothing special. According to Deloitte (page 22), this traditional retail model includes eight functions:

- Design (product prototyping)

- Sourcing and buying (purchasing or building inventory)

- Inventory management and distribution (distributing products sold)

- Store and digital storefront operation (in-store POS and online)

- Marketing (promotion of goods)

- Sales (purchase transaction)

- Fulfillment (delivering products)

- Support (helping customers with products and purchases)

Though some retailers try, no retailer does all of this right. And the only retailer to do most of it right is Amazon. That’s because they started by only focusing on three main functions: inventory management, fulfillment, and support. Their marketplace model, technology, and customer obsession powered these functions, and everything else took care of itself.

Newer retailers are following by example and succeeding. Farfetch, a pure play retailer, is a technology company with a global marketplace that aggregates products from luxury fashion brands. Instead of building inventory, distributing products, and delivering products, the company focuses on marketing, sales, and support.

According to Katie Smith of EDITED, a retail data analytics firm, “this model enables them to have a huge assortment without the inventory risks involved.” And it’s why Farfetch beat Yoox Net-A-Porter, a pure play competitor that decided to control the entire retail value chain instead of a few key functions.

Older retailers can adapt too

More classic retailers that once controlled too many functions are adapting, whether from necessity or foresight. You see this with Pier 1 closing all stores and going purely online and Crate and Barrel launching a marketplace. However, instead of building all marketplace functions from scratch like Farfetch and Amazon, they used third-party marketplace platforms like fabric Marketplace.

This technology allowed them to adapt quickly and grow assortment without risk, and it’s the same technology that newer home decor companies are leveraging. According to Modsy, an online interior design service powered by computer vision technology: “fabric Marketplace makes expanding our curated product selection easy, which gives us more options to present in our designs.”

Holding inventory is a turkey burner

What these companies are leveraging to create a successful retail model is referred to as dropshipping. Dropshipping is when a retailer fulfills orders via a third-party supplier who ships products directly to the customer on their behalf. The retailer does not hold inventory of this product and, often, the customer is unaware that their product was sourced differently than traditional inventory.

While typically associated with entrepreneurial efforts like dropshipping T-shirts, dropshipping is actually done by the world’s largest retailers like Macy’s and Bed Bath & Beyond to scale e-commerce. The question is: are they dropshipping enough?

Some researchers say that a mix of holding inventory and dropshipping is optimal for e-tailing, but looking at the growth rate of Macy’s and Bed Bath & Beyond may indicate otherwise. If Macy’s wants to hit $10B in digital sales by 2023, further investing in an asset-light dropship model with retail-grade marketplace platforms can eliminate risk and grow e-commerce revenue. These platforms can replace or augment existing dropshipping systems from Macy’s that are broken.

Of course, Macy’s does not need to completely eliminate inventory. People still enjoy experiencing Macy’s at physical locations and inventory is part of this experience. After all, when a Macy’s store closes, e-commerce sales drop significantly in that area, so taking the same approach as Pier 1 could be unwise. Either way, their retail model of holding inventory must change if they want to compete with technology-led retailers.

For any retailer, buying and holding inventory on every product offering is extremely risky because:

- Your teams have to understand consumer trends and demand months ahead of actual inventory purchasing. With consumer behaviors changing quickly due to pandemics and other phenomena, this is mostly a game of luck.

- Your teams must be great at distributing that inventory and be close to consumer demand. This includes warehousing, logistics, and fulfillment processes that are expensive and hard to manage.

- Your quarterly results depend on you getting inventory right. When distressed retailers spend millions of dollars on McKinsey consultants, they are told to liquidate inventory to clean up the balance sheet. This works for the short term, but you’re quickly back to a place where stockouts occur. It’s a turkey burning spiral of trying to “right-size” inventory.

Instead of holding inventory on everything, more traditional retailers can get inspiration from Nike, Bonobos, and Farfetch that merchandise for experience rather than assortment. This is what Farfetch refers to as the store of the future. In either case, removing the old-school approach of “stack ‘em high and watch ‘em fly” is part of the burnt turkey retail model.

The Retail Model that Saves Thanksgiving

The asset-light, inventory-less model is not a new concept. According to Deloitte (page 24), functions in the traditional retail model were either fragmenting or consolidating with dropshipping and marketplaces in 2015. Around the same time, retail-grade marketplace platforms like Revcascade entered the market.

Here is how functions in the traditional retail model are fragmenting or consolidating:

- Design: Fragmenting as more individuals have access to design tools

- Sourcing and buying: Consolidating via e-procurement and dropshipping

- Inventory management and distribution: Consolidating via cloud services and platforms

- Store and digital storefront operation: Consolidating via marketplaces

- Marketing: Consolidating via social media and online marketing platforms

- Sales: Fragmenting as more individuals are able to establish retail operations

- Fulfillment: Consolidating via shipping services and dropshipping

- Support: Fragmenting as P2P platforms emerge to facilitate ecosystems around products

The trend was clear in 2015: Move to an asset-light retail model by consolidating procurement, inventory management, and fulfillment with dropshipping and marketplaces. Some retailers have acted and other retailers like Express are just getting started after their company became a penny stock in 2020.

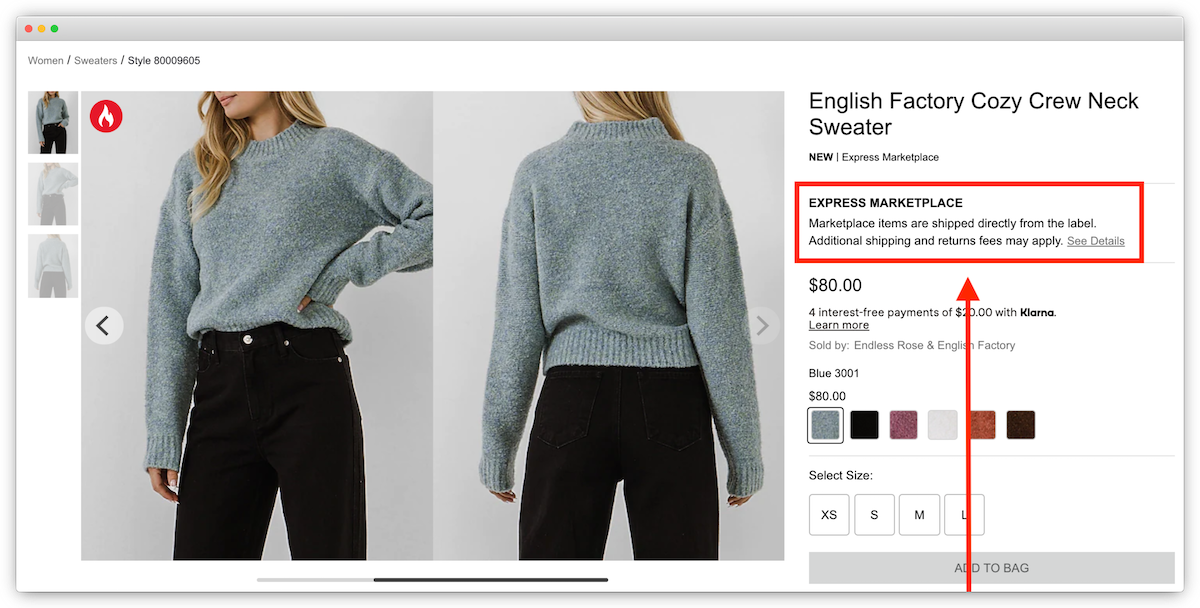

However, it might be too late for Express and similar retailers. With Express, acting as a retailer in the marketplace model seems forced. Marketplace products appear as outcasts from Express products, do not receive customer support, and have antiquated shipping policies. This points to issues with their marketplace model and marketplace platform, Mirakl.

These issues may cause confusion during the online buying experience, much like Macy’s marketplace solution does. For instance, on Express’ product detail pages featuring marketplace items, awkward phrasing such as “shipped directly from the label” is used and additional shipping costs are mentioned (turkey burner!).

The marketplace approach that Express is trying is definitely a move in the right direction, but I’m not convinced they’re on the right side of the marketplace. Instead, it might make more sense for the Express to operate as a vendor in a third-party marketplace. Focus on what they’re good at—product design—and leave everything else to the Farfetches of the world.

After all, according to Deloitte: “While retailers have traditionally performed many, if not most, of the retail functions, technological changes are beginning to break up and recombine the value chain’s elements, making it newly possible for an organization to perform only a single function, or even to reorder the traditional sequence of activities.”

In either case, retail-grade marketplace platforms and dropshipping software are now available to retailers who need to pivot.

Using software to resolve inventory issues

While retail-grade marketplace platforms and dropshippers are still working on last-mile issues, they offer an opportunity that retailers didn’t have before: to solve the inventory issue in the broken retail model with software. With software like fabric Marketplace, traditional retailers can change their trading relationships to be “on-demand” and become asset-lite.

Instead of taking on the risk of inventory from vendors, retailers can connect with them through software. This will allow them to move the inventory risk to the vendor who is best at producing and distributing merchandise. Retailers can get rid of buying teams, fulfillment teams, and supply chain teams and focus on what they do best: listening to customers, curating the best selection, and building the brand.

In conclusion, the model of retailers holding inventory is dead. It’s simply too risky and costly with the way the world is changing so quickly. You must go to an on-demand trading model that connects your consumers with the best products and services, otherwise you’ll be left with a mountain of inventory to liquidate, along with your company.

Co-founder @ fabric. Previously general manager @ Staples, eBay, and Dell Inc.