How 100-Year-Old Firms Stay Relevant

As we’ve reported prior, the majority of legacy Fortune 500 firms are no longer market leaders because their focus remains on protecting their traditional business in this era of digital transformation. In last month’s midwestern US regional Forrester Leadership Board meeting, Stephanie Hammes-Betti, the SVP of innovation design at U.S. Bank, took us through the investments, culture change, and prioritizations she’s helped her firm make to maintain its market leadership.

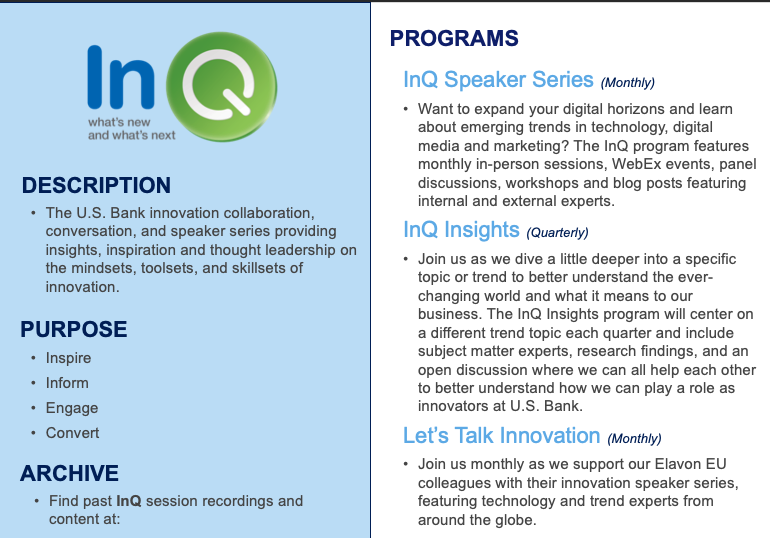

Her team’s focus has been on proactively recognizing and driving banking, technology, and customer life changes. To achieve these aims. they have a team of over 35 full-time members who work collectively with a much broader set of fans and champions. And per our recommendations, their team is broken down into groups that prototype and drive their innovation efforts, shield their disruptive innovations, and drive culture change to more greatly empower innovation efforts and companywide participation. In support of this last one, Stephanie’s team drives highly recommended education and participation programs detailed in the images below:

Three key parts of U.S. Bank’s strategy have been to:

- Look at unmet customer problems. What is happening, why, where, and what are the possibilities for addressing them by banks and other ecosystem members?

- Play dress-up. Explore new values, align them to certain customers’ needs, and determine through trials what they solve.

- Study fintech startups’ solutions. Understand how they are driving new client engagements to inspire new thinking and approaches to engaging customers.

This innovation culture change structure very much aligns with our research on how Fortune 500 firms should be prioritizing their innovation efforts. To be a future market leader, your focus needs to be understanding how your customers’ wants are changing and how you can proactively help them achieve their goals and see your company as an empowering strategic partner. And to ensure that you achieve future market leadership, prioritize tech-driven innovations that disrupt existing services and offerings. Doing so delivers far stronger returns than being a fast follower.

For more on the types of innovations we’re seeing in financial services, read my report on this topic.

Want more guidance on how to drive innovation prioritization at your firm? Ask for an inquiry with me.