Today we’re taking a closer look at the Google Ads of Ritual Vitamins.

The supplement space is hyper competitive. The only way to stay in business is to have a business model that works and to back it up with campaigns that can deliver results.

Ritual nails both components, and is doing a lot of interesting things when it comes to Google Ads.

So in this article, we’ll look at which campaigns they’re running, what they’re spending and what they are making!

Let’s dig in!

Table of Contents

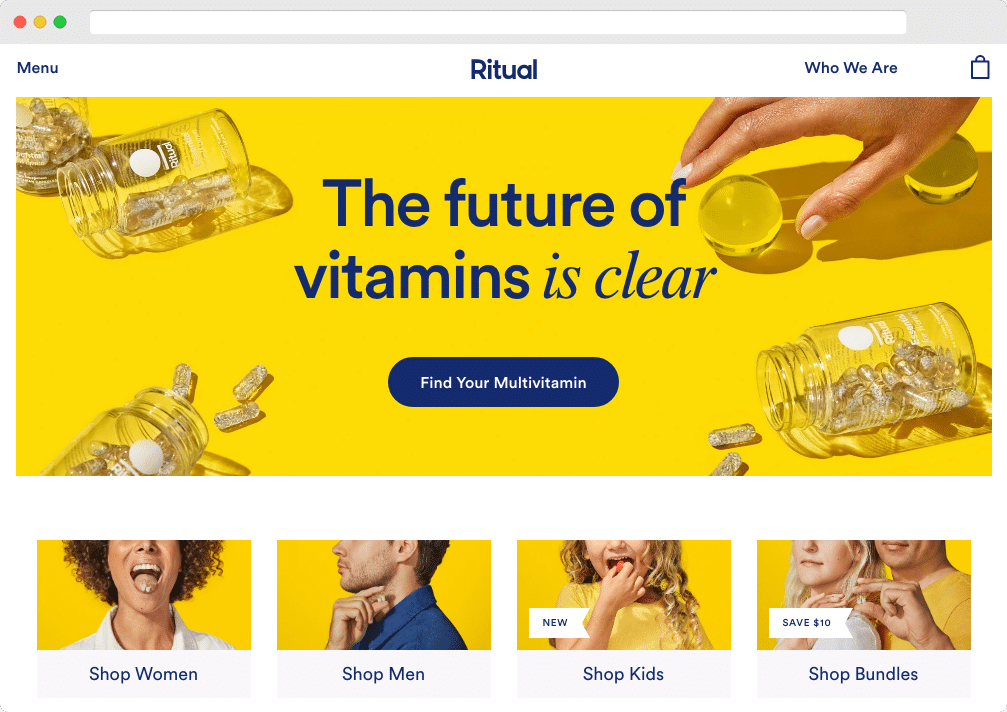

Ritual?

Ritual Vitamins has been around since 2015 and aims to bring more transparency to supplements.

The company has raised a total of $40.5M in venture capital.

They started out with a vitamin supplement specifically for pregnant women (called prenatal vitamins).

They’ve used a lot of the money they raised to further build out their product catalog, develop other multivitamins, and target new audiences like all women, me and kids.

Ritual.com Site Analysis

Let’s start out with taking a high level look at Ritual’s website.

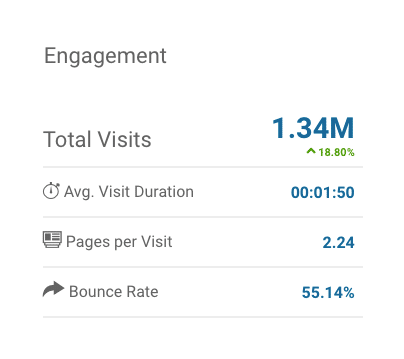

They get around 1.3M visits a month.

Most of that traffic comes from the US:

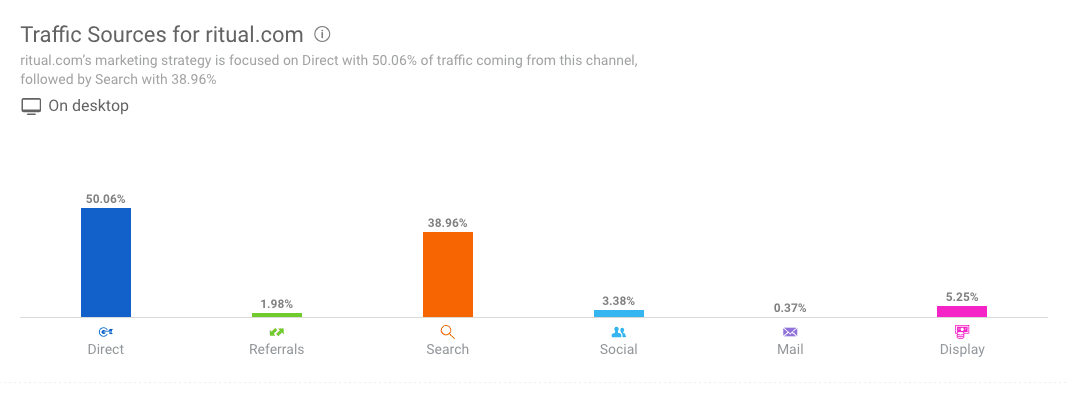

Here is where all that traffic comes from:

39% of all traffic comes from search, which works out to about 536,000 visitors.

60% of those visitors come from organic search, while 40%, 214,000 visitors, come from paid search campaigns.

Ritual Google Ads Campaigns

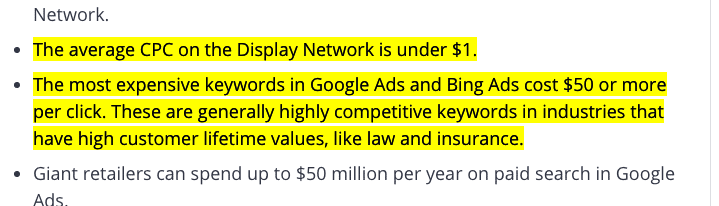

I’ve worked with a few clients in this space and the supplement industry is hyper competitive when it comes to Google Ads.

Clicks are very expensive, so you need to have the product and business model in place to make it work.

From my research, it seems that Ritual has found a way to make it work.

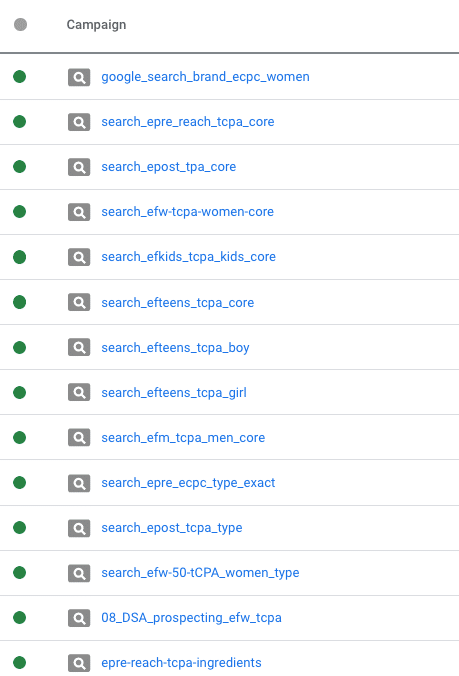

Here is an overview of their campaigns:

| Ad Spend | Clicks | CPC | |

| Search Ads | $176,852 | 55,790 | $3.16 |

| Shopping Ads | $152,210 | 152,210 | $1 |

| YouTube Ads | $2,800 | 3,640 | $0.77 |

| Display Ads | $0 | 0 | $0 |

| TOTAL | $331,862 | 211,640 | $1.6 |

Estimates for January 2021

Disclaimer: Ritual Vitamins is not a client of mine, so everything you’ll see in this article are estimates that are based on publicly available information, tools like Semrush, Similarweb and my benchmarks collection.

Google Search Campaigns

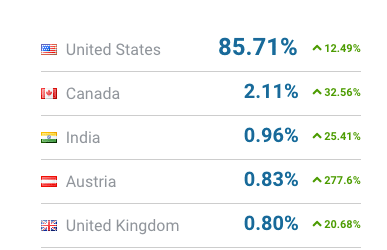

With the ad spend numbers out of the way, let’s look at the second piece of juicy information, Ritual’s Search campaign structure:

Let’s start with the branded search queries. There is a single brand campaign, with different ad groups for the different types of searches.

Probably in a Intent Based Ad Groups type of structure:

Campaign: google_search_brand_ecpc_women:

Pretty straightforward.

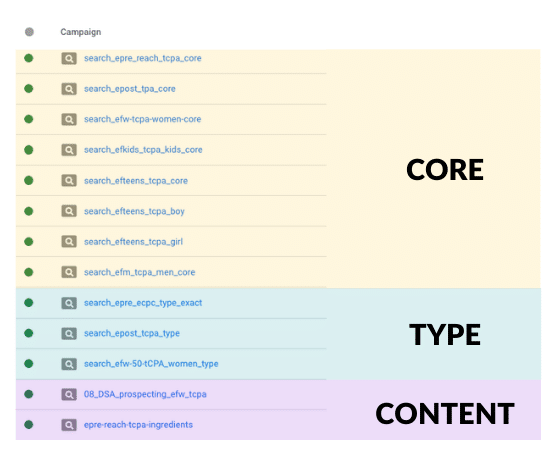

When it comes to the non branded campaigns, there is a lot more going on!

There are three three groups of campaigns:

1. Core campaigns

First one are the “core” campaigns. Each of these campaigns focuses on the core keywords associated with a specific product.

Example:

- Campaign: search_epre_reach_tcpa_core

- Keywords: “prenatal”

I would guess that these campaigns are the main drivers of traffic and conversions.

From the campaign names we can also learn that they all use target CPA as a bidding strategy.

2. Type campaigns

The next group of campaigns are the “Type” campaigns. These are longer tail keywords with probably a bit less traffic, but still very high purchase intent.

Again each campaign focuses on a specific product. Although there doesn’t seem to be any “type” campaigns yet for the kids and men’s products. Maybe that’s because they are still fairly new.

Example:

- Campaign: search_epre_ecpc_type_exact

- Keywords: “multivitamin for pregnancy”

From the campaign naming it seems that this particular campaign uses enhanced CPC.

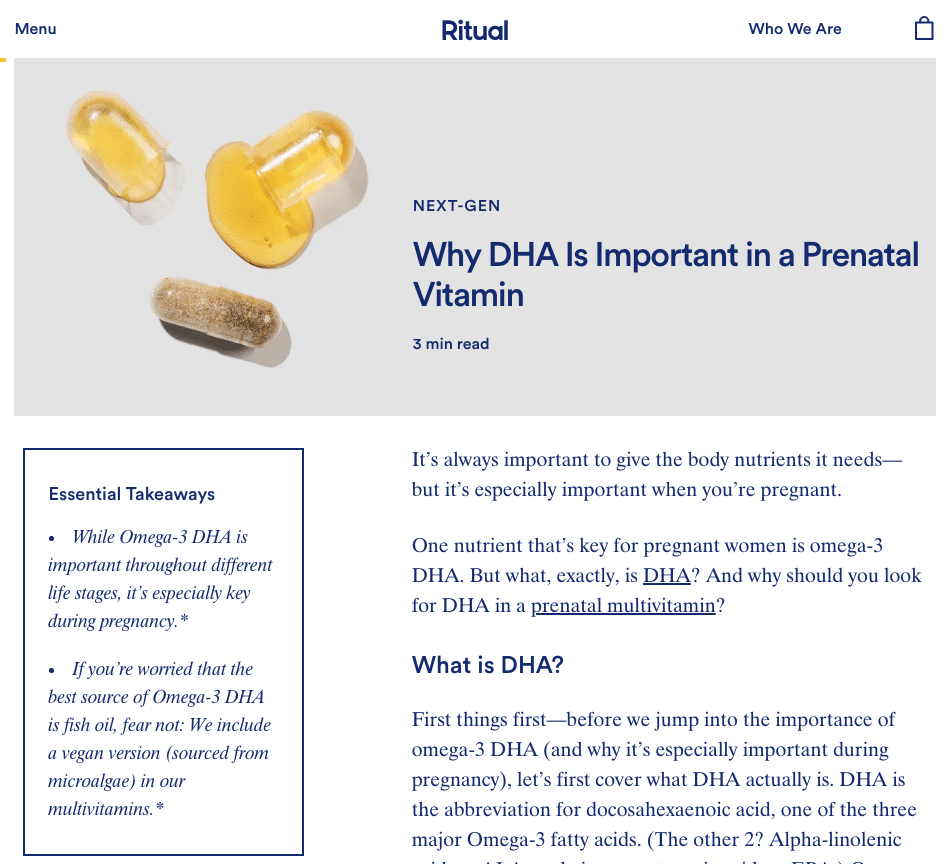

3. Content campaigns

The third group of campaigns are the “content” campaigns.

These still promote the products, but the target search queries that have more information seeking intent.

Example:

- Campaign: epre-reach-tcpa-ingredients

- Keywords: “prenatal dha”

Instead of a products pages, it sends visitors to an article that goes into why DHA is important:

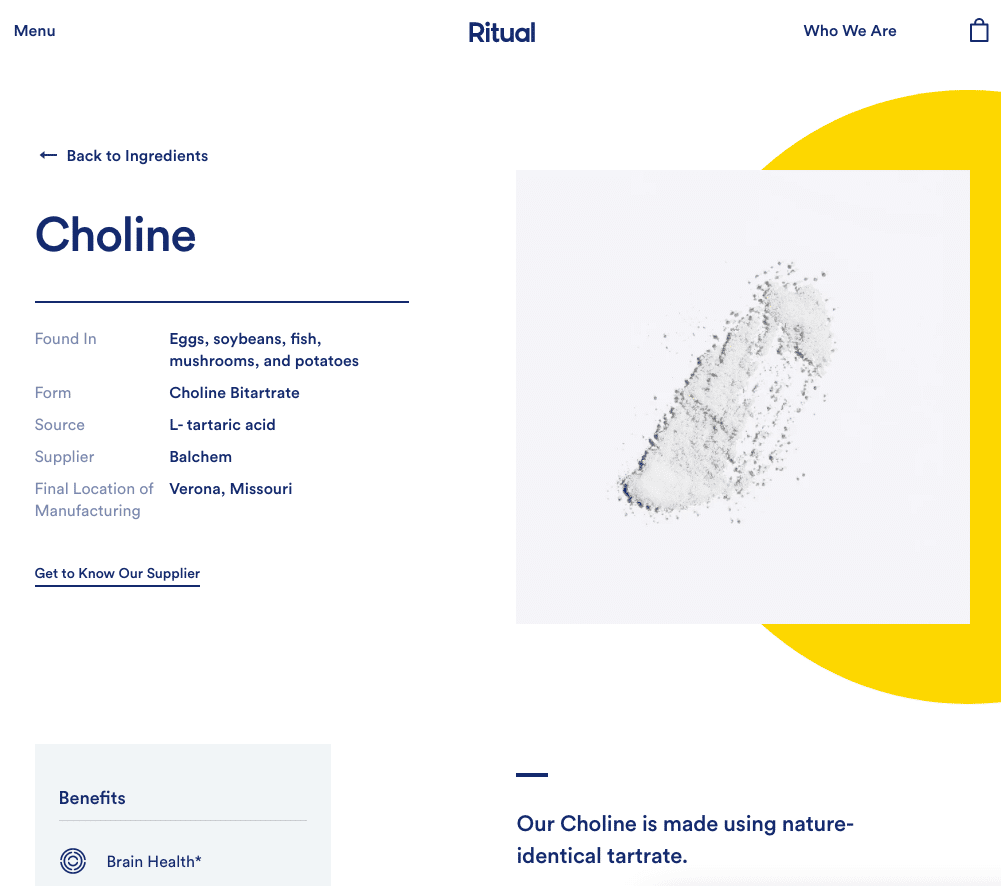

I even found another campaigns that’s pointing people to an even more bare bones landing page that focuses on a particular ingredient:

A second campaign in this “content group has a pretty mysterious name: 08_DSA_prospecting_efw_tcpa.

It’s doing some very interesting things which I’ll cover in the non branded paid search section.

Next, let’s explore the different keywords Ritual is using.

Branded paid search

Branded clicks account for 30% of all paid search traffic (about 17,000 visitors), but only 17% of the total ad spend ($30,064).

That works out to an average cost per click of $1.7.

That’s pretty high for a branded keyword, but as we’ll see below, most branded terms also include a generic one like ritual vitamins. This non branded part of that keyword is pushing up the price.

Top 10 branded keywords:

- Ritual

- Ritual vitamins

- Ritual prenatal

- Ritual vitamins review

- Ritual prenatal vitamins

- ritual vitamins promo code

- ritual multivitamin

- ritual essential for women

- ritual essential prenatal

- ritual com

Landing pages

All of the different branded ads either go to the homepage, or the specific product page. I assume Ritual is testing the effectiveness of both approaches.

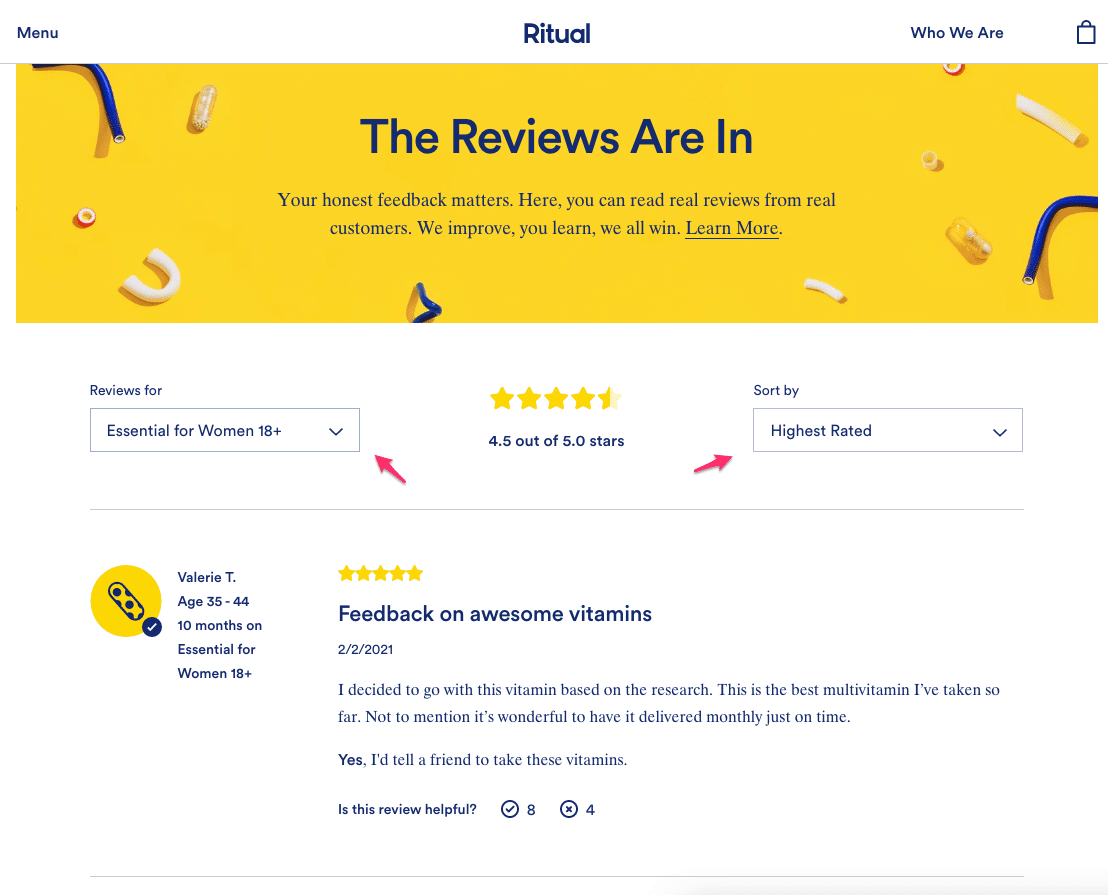

For the more general queries that include the word reviews, they’re using a pretty good landing page:

The filters on that landing page allow people to find the products they’re considering to buy.

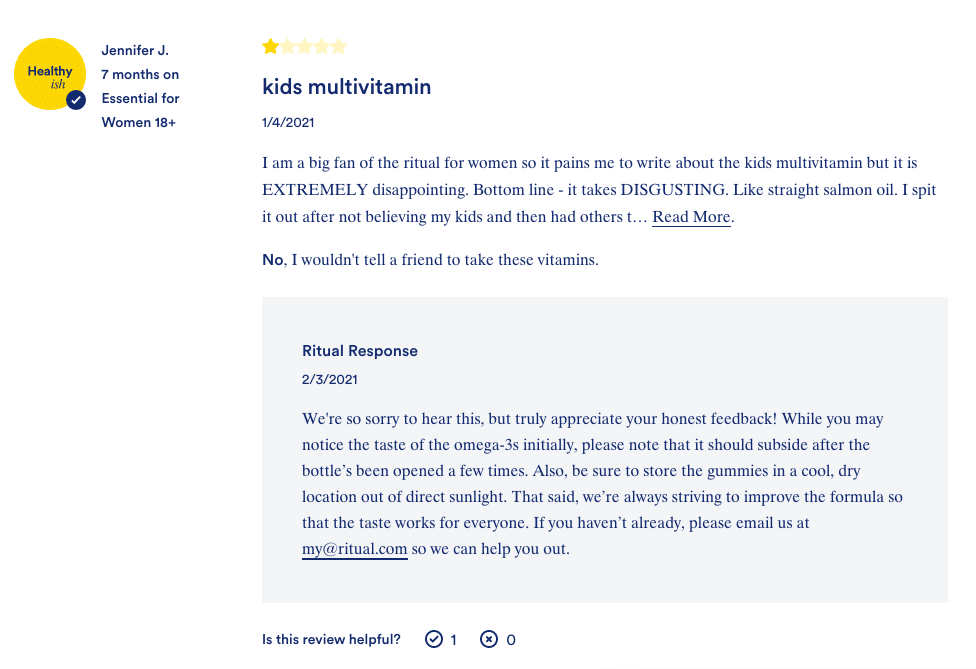

Having ALL reviews in here also allows them to show potential customers how they deal with criticism or and unsatisfied customers:

Non-branded paid search

Search Ads get very pricey in the supplements space. In the overview I’ve mentioned an average Search Ads CPC of $3.16, but that also includes branded traffic.

If we consider the average CPC for non-branded traffic, the number works out to $4.17!

Such high cost per clicks means the only brands that can afford it are:

- Ones that have a lot of VC money to burn

- Ones that have made the business model work

I believe Ritual fits both of those criteria!

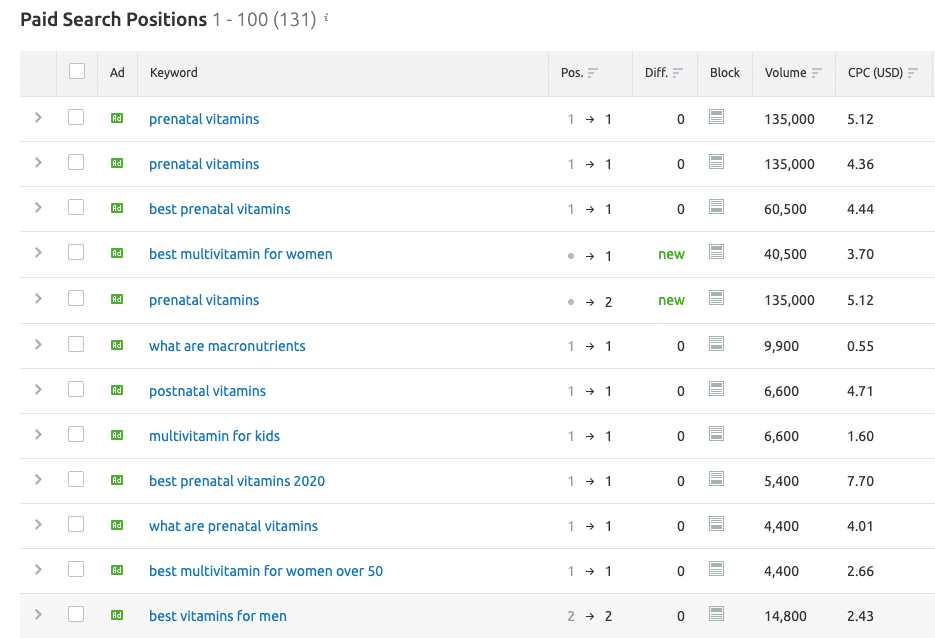

Top 10 non-branded keywords

- prenatal vitamins

- best prenatal vitamins

- best multivitamin for women

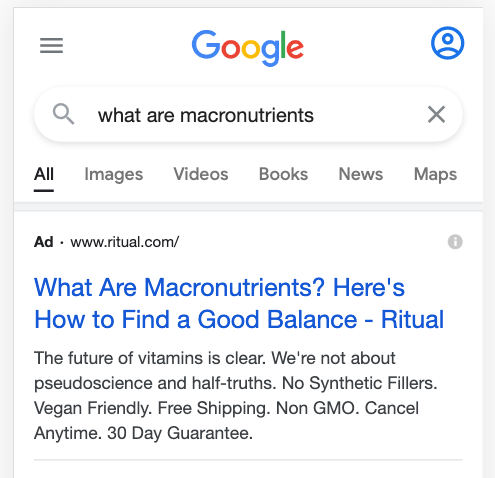

- what are macronutrients

- postnatal vitamins

- multivitamin for kids

- best prenatal vitamins 2020

- what are prenatal vitamins

- best multivitamin for women over 50

- best vitamins for men

While they are not going after the head term for the category “vitamins”, they are pretty aggressive on the next tier of keywords.

Notice how they have almost all first position slots for keywords like “prenatal vitamins”.

Most of the keywords in this list refer to specific products that Ritual sells.

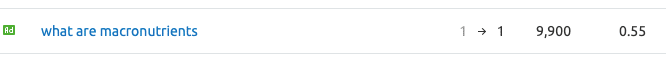

Besides these product searches, there are a few interesting things in this list.

Like this keyword:

At only $0.55 per click, it seems like a bargain compared to the average!

The reason why it’s so much cheaper is that this is an informational search.

That means that the person that’s looking for this is still in the beginning stages of their purchase process.

And because it’s not directly related to a product, the revenue per click will be a lot lower.

Here is what the ad for “what are macronutrients” looks like:

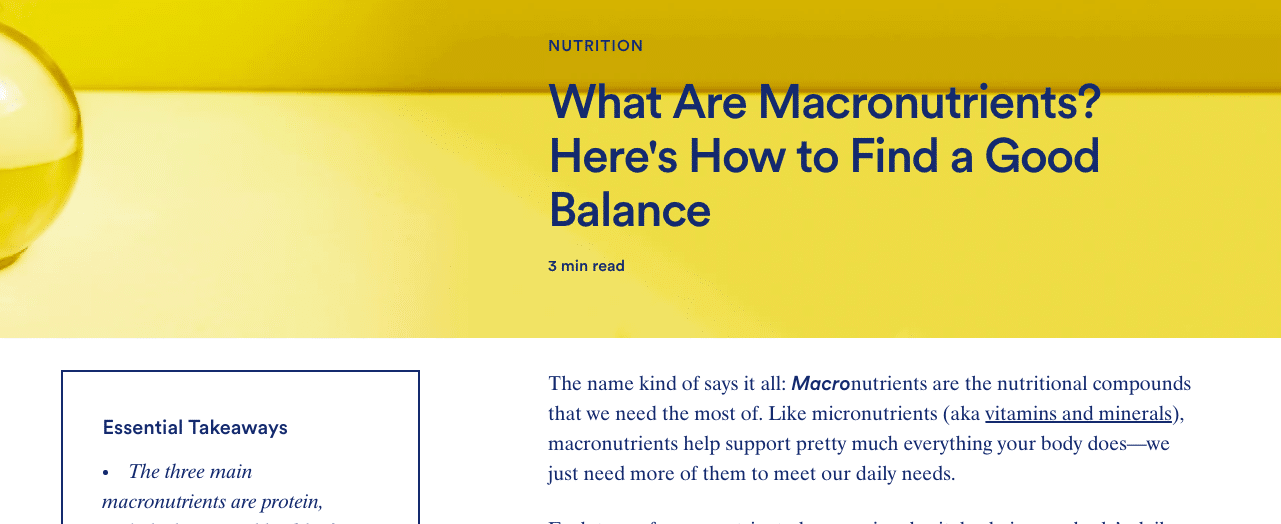

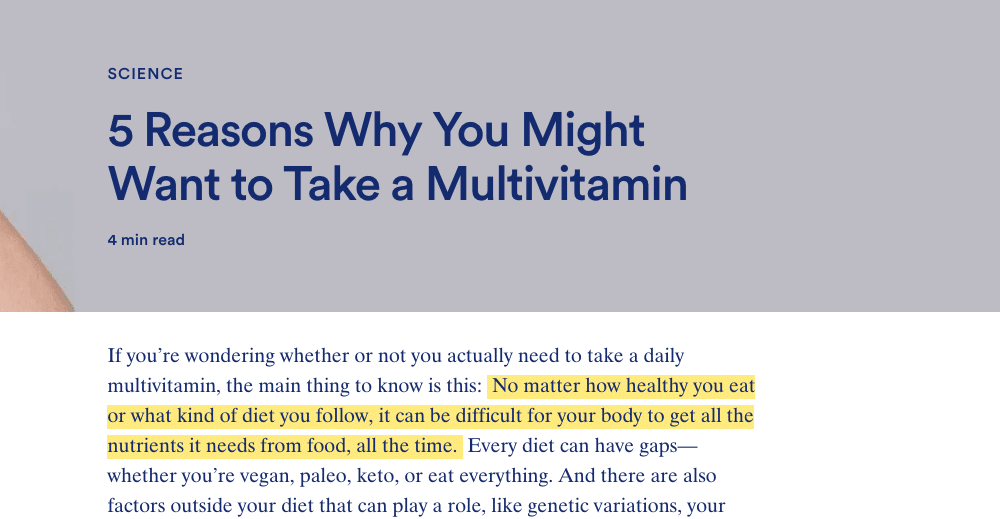

When click, people land on an article on Ritual’s site:

It’s a good article with some soft product pitches.

The Problem With Using Google Ads For Content Promotion

Running a Google Ads campaign that promotes content is one of the hardest types of campaigns to make work for ecommerce businesses.

(As compared to Facebook Ads, where a “presell article” approach is often used.)

As I mentioned above, people that click on these articles are much less likely to purchase, which is reflected in a lower conversion rate.

So if their other Google Ads campaigns convert at 5%, this campaign might be only hitting 0.5%.

And this 10x difference in conversion rates usually isn’t possible to make work for most stores.

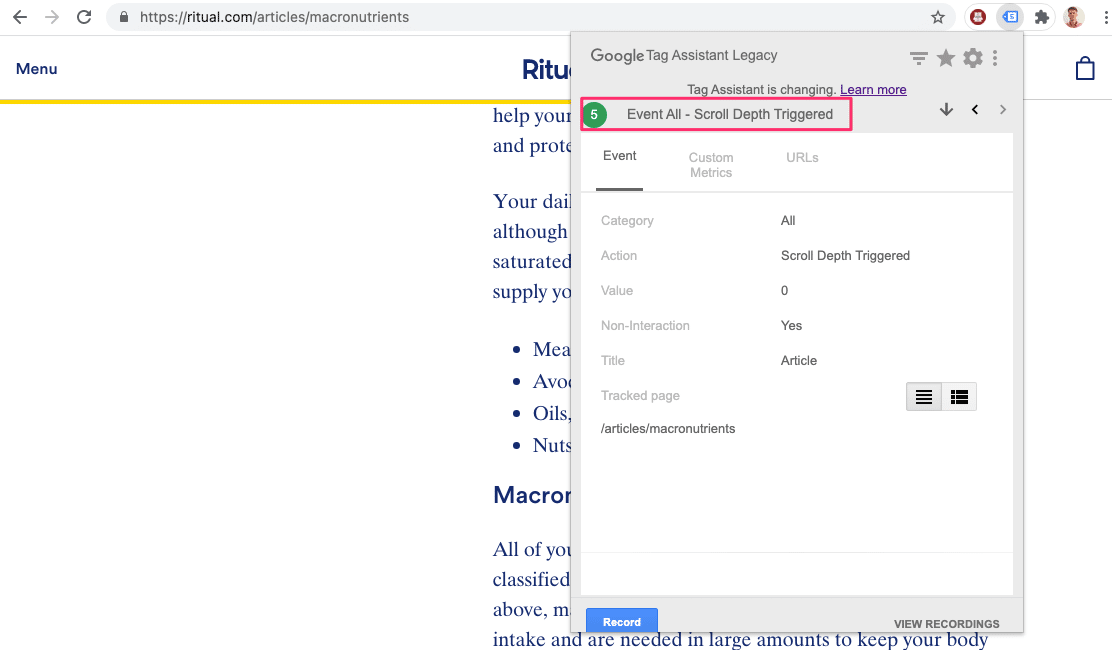

A closer look at the campaign that is serving this ad reveals more interesting things:

Campaign name: 08_DSA_prospecting_efw_tcpa

From the name, we can deduce a few things:

- DSA: Dynamic Search Ads

- Prospecting: ring new people into the funnel

- tcpa: this campaign is using Target CPA as a bidding strategy

If you’re not familiar with dynamic search ads, they work a little bit different from regular Text Ads.

First are the keywords. Instead of providing them, you tell Google which URLs to run ads to, these are your targets.

Second are the advertisements. Google automatically generates the headlines (pulls it from the meta info or from the page), so all you have to provide is the description text.

Because they are using the target CPA bidding strategy, they need to define a CPA they want to hit. So this implies that there is some kind of goal they’re going after.

Perhaps that is a purchase, but it could also be a goal like a visit to a product page, email capture.

Looking at the Google Tag Assistant, I do see a few events firing when interacting with the page. It tracks how deep visitors scroll on this particular article:

This could be used to trigger a conversion if people read 50% of this article.

It can also be used to build a remarketing list of people that have read this article.

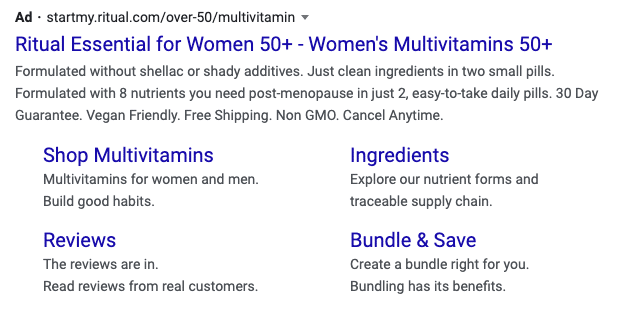

Landing pages

Like most brands, Ritual sends the majority of its traffic to category or product pages.

But there are a few interesting exceptions.

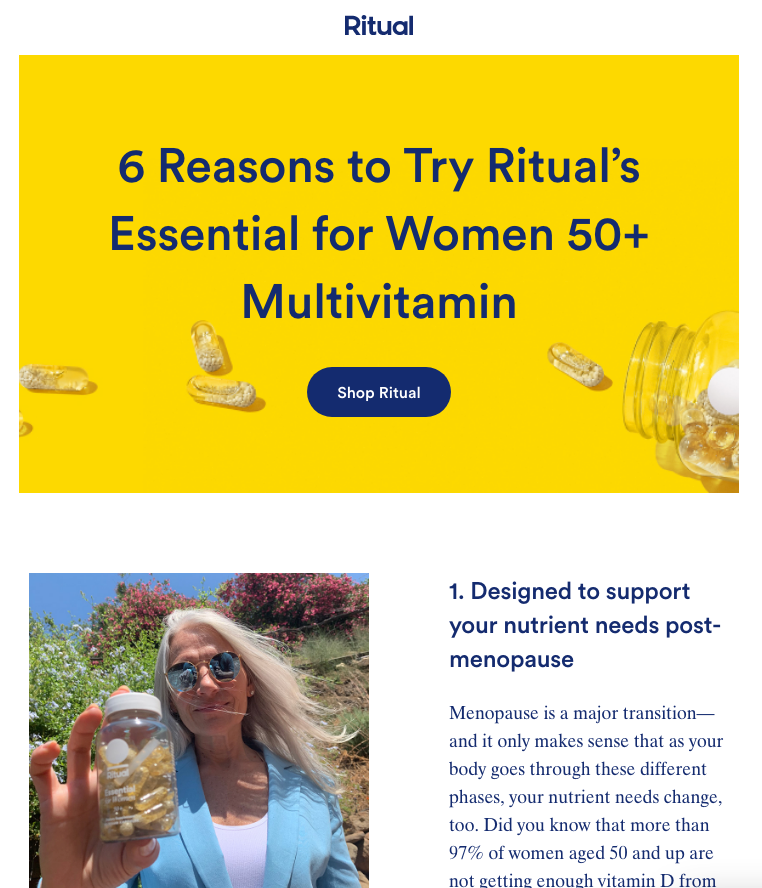

For some ads, Ritual is using a subdomain:

The ad above goes here:

This is a content based landing page that sits somewhere in between the informational article I mentioned above, and a regular product page. The intent is clearly to sell, but it does it in a more appealing, longer form way.

In my research, I found that Ritual was actively testing multiple versions. The other pages had different layouts, headlines, and content on them.

Like we’ve seen in our breakdown of Judy, these ecommerce landing pages can really help to convert more traffic.

Ritual is using Shopify Plus, and these landing pages are probably built with a tool like Unbounce or Shogun.

As I’ve described in the previous section, Ritual also uses Search Ads to send traffic to its articles.

On one of those landing pages, they’re using a pretty interesting hack, yellow highlighting:

I think the goal is to mimic the approach where Google actually highlights snippets if you click through from an organic search result. Like in this example:

Text Ads

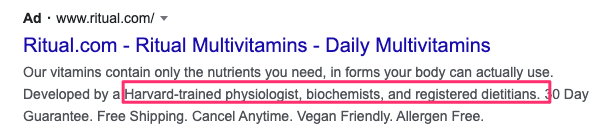

If you think about it from a potential customer’s point of view, a supplement is a pretty hard thing to buy.

It’s expensive, you have no idea what’s inside, if you can trust the company, or whether it will even work.

So it’s the job of the text ads to tackle some of those objections and get people to click.

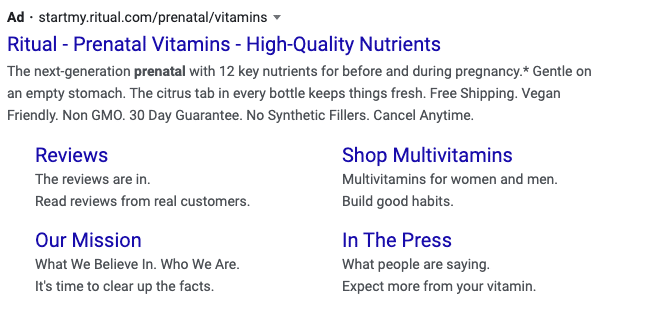

Let’s take a look at how Ritual does this.

The first part I want to look at is the trust & credibility:

Name dropping Harvard and mentioning all the scientists that are working on the products makes it seem a lot more scientific.

The first line of that same ad addresses another common objection: can your body actually absorb the nutrients?

When it comes to the actual ads for the products, they do a lot of selling as well.

Some interesting copy “pieces” from the ad above:

- Next-generation prenatal: implies that it is different vs what is on the market.

- 12 key ingredients: makes you wonder what they are

- Before and during pregnancy: addresses whether it’s for you

- Gentle on an empty stomach: counter morning sickness objection

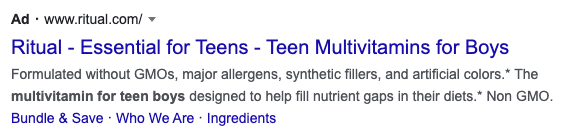

Here is an ad for one of their teen vitamins:

You can see that the language is a bit different. The focus here is on making sure the stuff you give your child is of the highest quality. No GMOs, allergens, synthetic fillers, artificial colors, etc.

That’s probably a major concern for mothers shopping for products for their children.

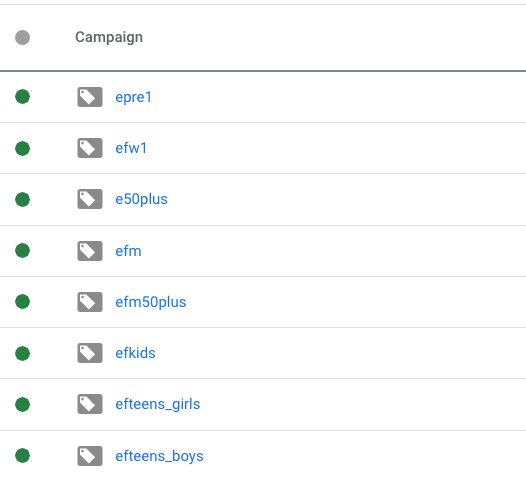

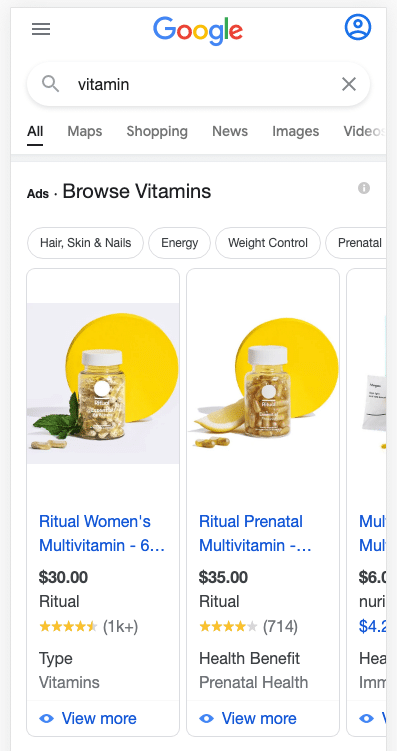

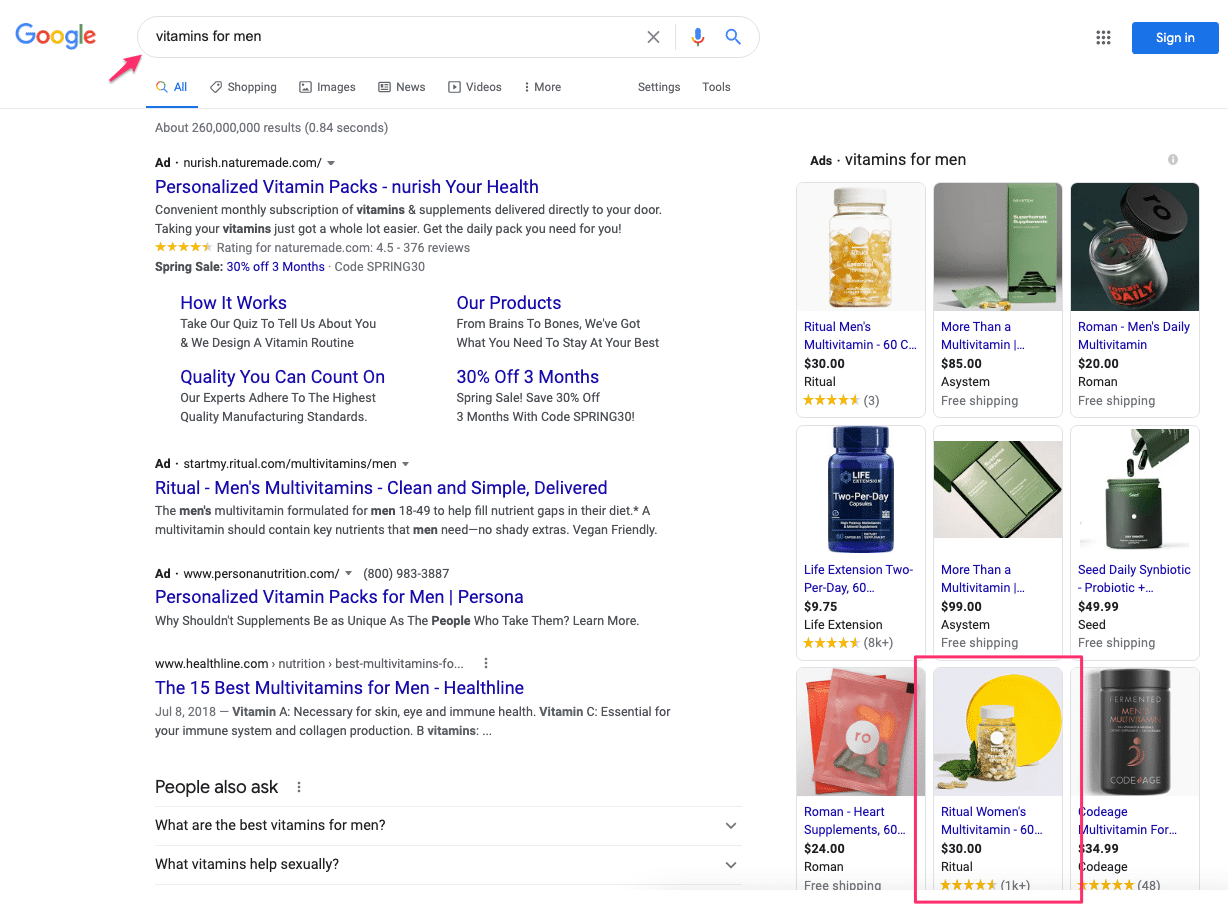

Google Shopping Ads

Google Shopping Ads are responsible for about 75% of all Google Ads clicks.

Ritual spends $152,210/mo to bring 152,210 visitors to the site.

Similar to Search Ads, we also have the campaign structure for the Shopping campaigns:

You can see there are 8 Shopping campaigns in their account, one for each product (except for one).

This simple structure seems to be sufficient for them. No tiered shopping or device segmentation here.

I think these are Standard Shopping campaigns.

They are very aggressive with their budget, so if they were using Smart Shopping , I would get bombarded with remarketing. I didn’t find any remarketing ads, so i think this is a safe bet.

How do I know that they are aggressive with their budget?

Their “Essential For Women” vitamins show up in almost every search that I do.

Another piece of evidence is that this product almost always showing in the top position of the Shopping Ads. So I bet the Absolute Top Impression share is very high for this product.

If I had to guess, the product shown in the first position, a multivitamin for women, is their bestseller.

Even if I search for “vitamins for men”, that other product targeted at women still pops up further in the list of Shopping Ads.

That means that this particular campaign has a very high budget, and gets a much better return compared to the other ones. That’s why it’s showing so often.

Although I wonder if there are some opportunities to exclude the women’s products from men’s searches.

This could be easily done through negative keywords.

Product images

Ritual has a very defined visual identity with the colors, fonts and extras.

Although Google recommends having your product on a white background, Ritual is able to put some of its brand into the images that are part of the Shopping Ad.

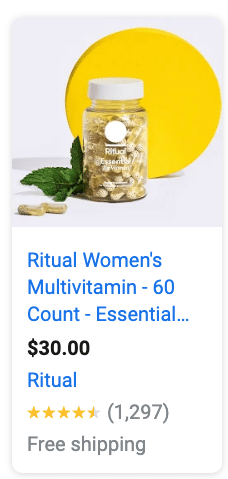

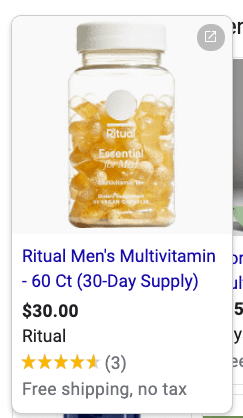

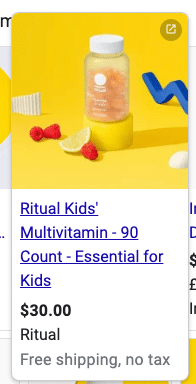

Women products continue the main visual with a couple of mint leaves and a yellow circle:

The more bare bones men’s product:

And the kids products are more colorful again:

Product Titles

When it comes to product titles, Ritual is keeping things short and to the point.

Here is the what’s on the site:

Essential Prenatal

Here is the SEO title:

Prenatal Multivitamin – Essential Prenatal – Ritual

And here is the product title in the feed:

Ritual Prenatal Multivitamin – With DHA & Choline – 60 Ct (30-Day Supply)

The biggest difference is in adding the DHA & choline queries to the title. These are two ingredients which they want to make sure Google sees.

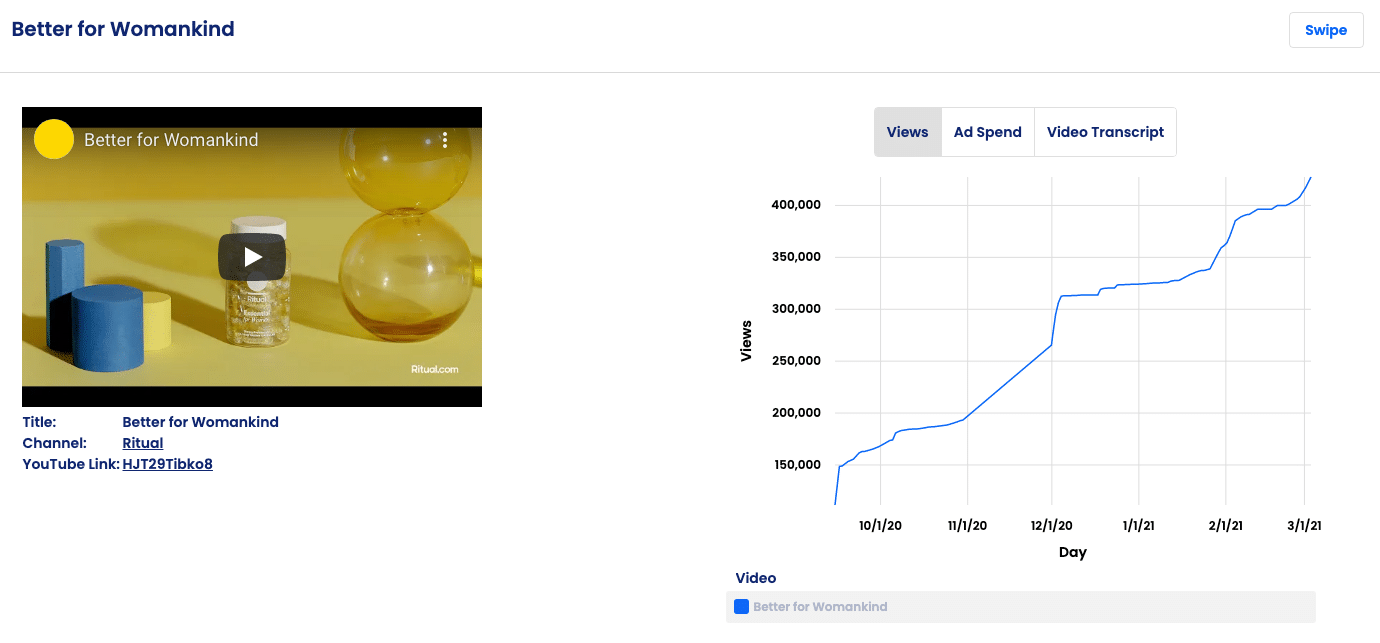

YouTube Video Ads

Ritual is spending about $2,800 a month on YouTube Ads, which brings 3640 visitors to their website.

That’s a drop in the bucket compared to what they’re spending on the other campaigns types. So my guess is that they are still in the early stages of getting this channel to work.

Now let’s take a look at what they are currently running!

When it comes to analyzing YouTube Ads, it’s always a challenge because most of the ads are unlisted. That means that you can’t see them when you visit their YouTube channel. So if you’re not being targeted, you wouldn’t know that there are ads running.

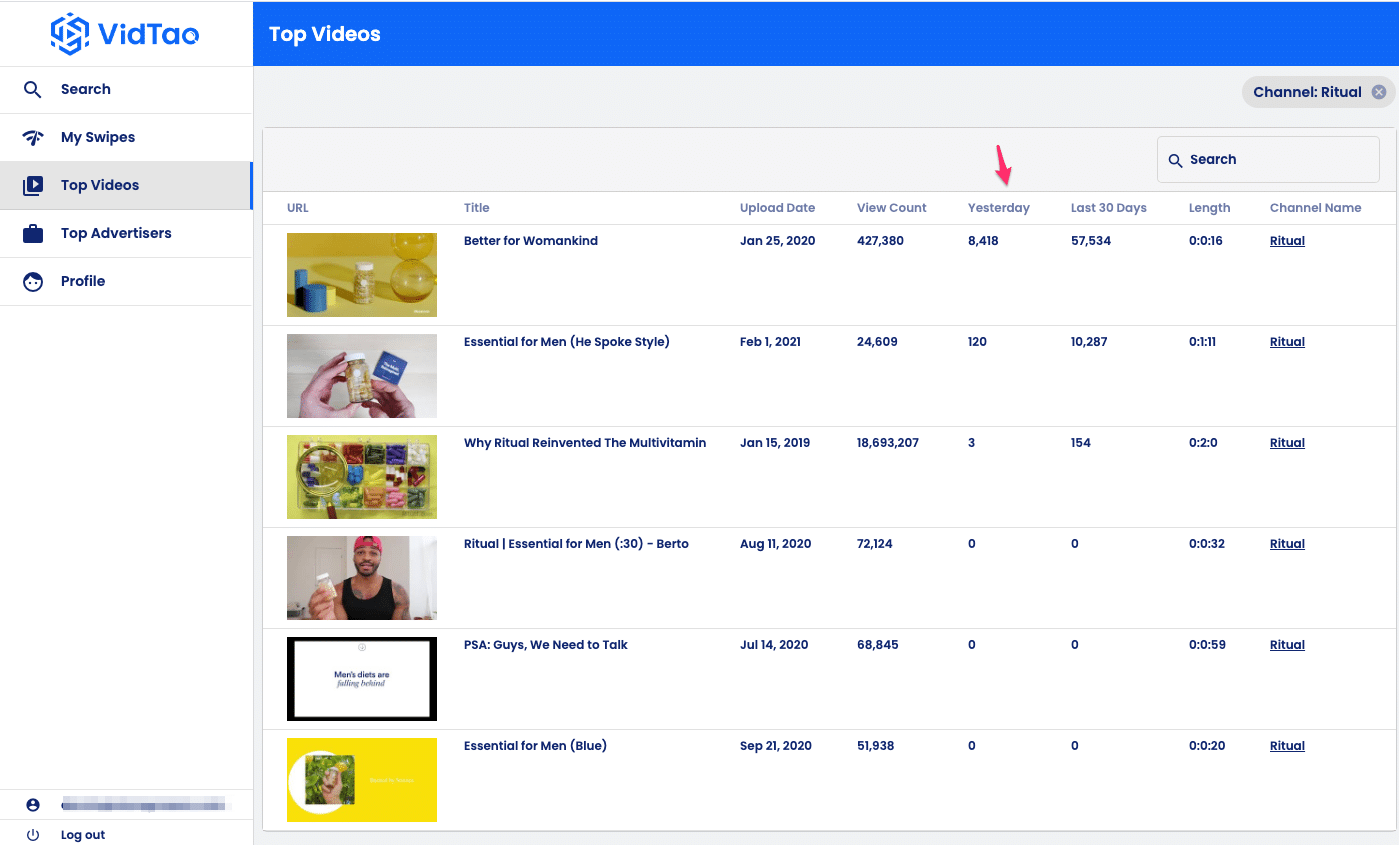

But I have a new tool! It’s called Vidtao and allows you to get around the unlisted video problem.

Here are the ads from Ritual they have in their system:

Not only does it show you all the ads, you can also see when they were uploaded and a daily view count for each of them.

That allows you to filter which ads were reactive yesterday, or in the last 30 days.

So looking at the screenshot above, it appears they’re currently only using 2-3 ads in their campaigns.

Note that this just covers the videos that are being used, not which campaigns are using them. There could be 20 campaigns each with slightly different targeting that re-use those same videos.

So let’s take a look at their main YouTube Ad:

At 15 seconds, Ritual is probably using the video in an In-stream campaign, appearing before or in the middle of a video.

The cool thing about Vidtao is that it also gives you the video titles.

That might not sound impressive, but with a YouTube Ad, you can’t see the actual title of that ad.

So from these titles, we can discover different things they are testing or different angles they are taking.

From the titles of these videos 4 out of 7 are aimed at men.

They only launched their men’s line in summer 2020, and had until that time focused exclusively on women.

This required a change in branding/positioning to reach this new demographic.

Let’s look at the evolution.

In July 2020, they ran this ad:

A good intro, but it probably didn’t really click.

So they started to collaborate with influencers. Here is a video they did with a small Youtube called What’s Good, Berto?

The goal of this kind of collaboration allows them to leverage the authority or image of the influencer. In the case of What’s Good, Berto, he’s a pretty strong dude with tattoos, very manly. But still refined 🙂

Ritual didn’t put a lot of money behind that and so I think again this didn’t really click.

In February 2021, they collaborated with He Spoke Style, a fashion influencer:

This is the ad they’re currently focused on so the future will tell how well this will go.

Google Display Ads

It appears that Ritual currently isn’t running any Display ads.

I can see a few campaigns that they’ve run in the past, but it all appears to be pretty basic.

Like this ad:

It could be that they only use Display ads for new product launches or special promotions.

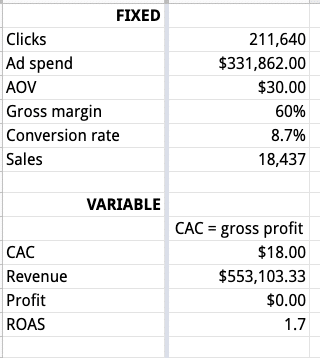

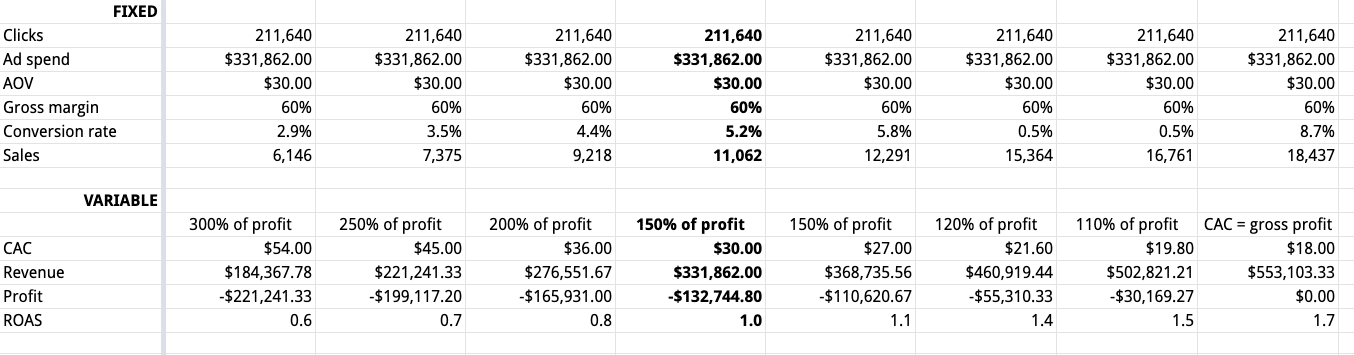

Ritual Scoreboard

Money time!

The Scoreboard is the part where we pull together all the research to look at how much money Ritual is making (or losing) with their Google Ads campaigns.

Gross margin

Most supplement brands have very healthy margins. A modest average gross margin is 40-60%.

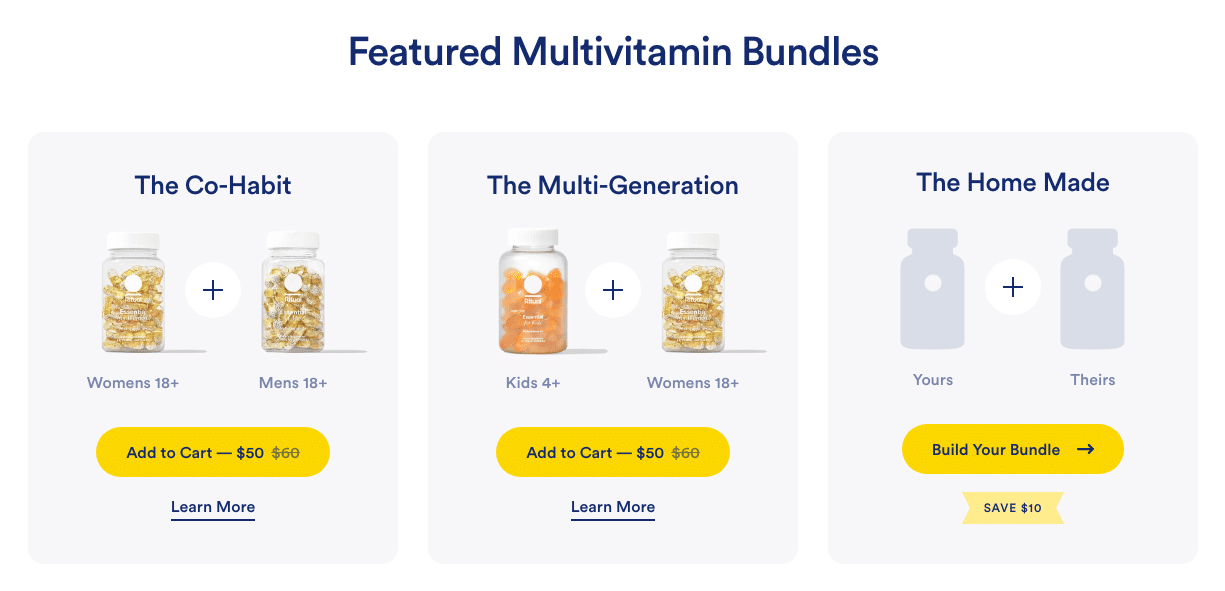

Average order value

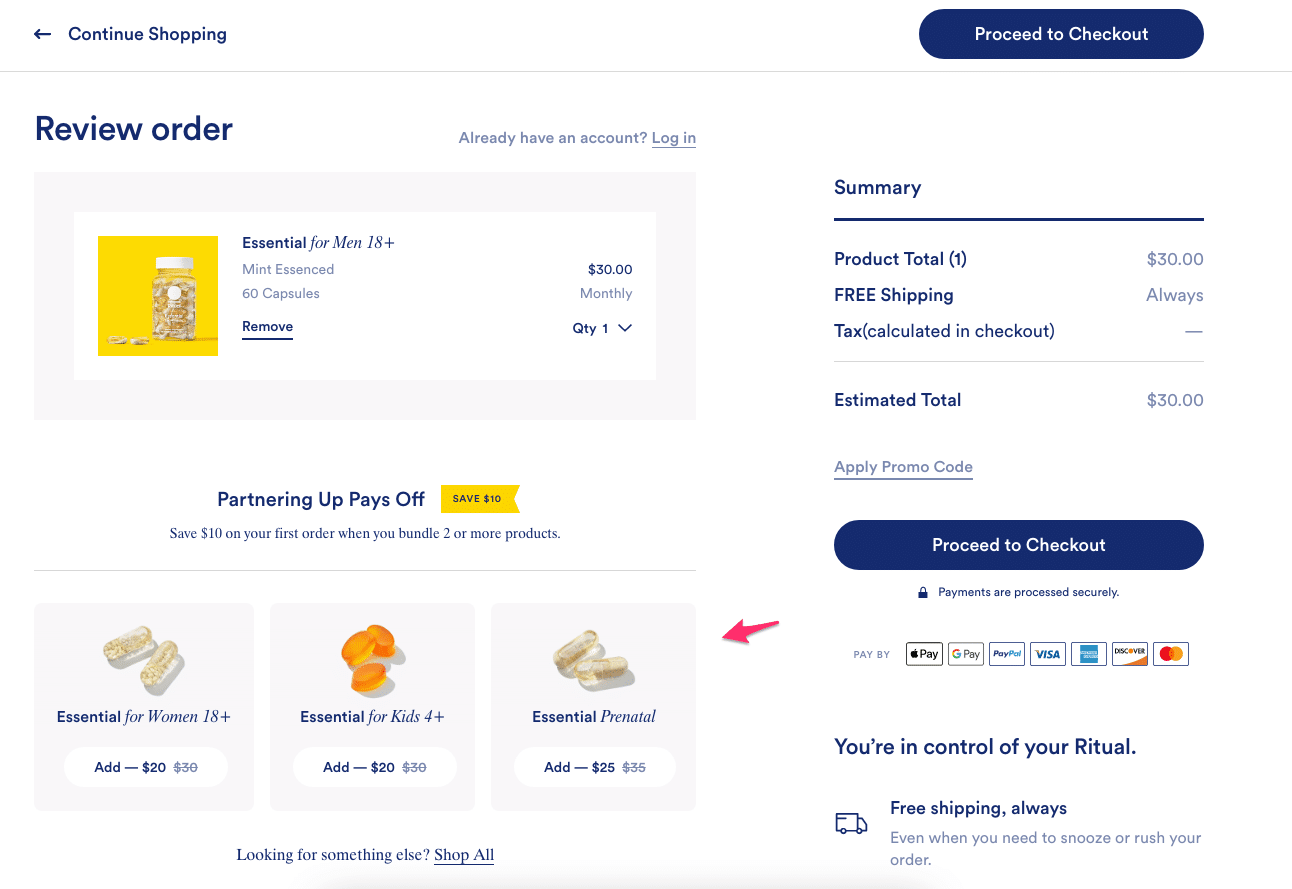

Here is where a lot of supplement brands stumble.

Ritual’s products cost between $30-35. Even with a 60% gross margin, that only leaves $21 in profit to spend on ads.

If we’re paying $4/click, that gives you 5 clicks. Which would require a conversion rate of 20% just to break even! (And in this calculation I’m not even including the free shipping)

This obviously is impossible, which is why our Google Ads Test advises to aim for an average order value of at least $50.

Ritual is actively trying to increase the average order value by offering upsells in the cart:

They’ve also got a dedicated page for bundles:

Bringing the AOV up from $30 to $50 means the gross profit is now $30 instead of $21, which gives a little extra room.

But for the sake of simplicity, let’s assume their AOV is $30.

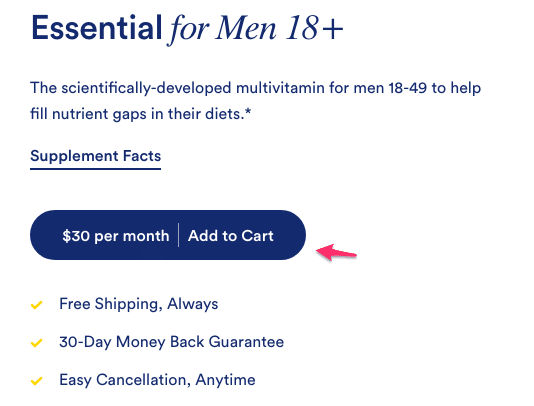

Repeat purchase rate

It’s clear from the example above that we are missing something. No business could operate in that environment for very long (even with very deep pockets).

The missing part obviously is the subscription part of the business.

If you look at their products pages, notice how you can’t actually place a one-off order:

You always have to get a subscription.

Some people will cancel after a first purchase, but many will keep on purchasing for a few months.

Mastering the customer lifetime value is the most essential part of a supplement business.

Most successful companies have this down to an exact science.

They’ll know the exact lifetime value for each of the different variables of their business:

- First product

- Marketing channel

- Promotion

- Etc.

(These are the upper echelons of what I call Product IQ)

With that in mind, let’s create the ideal customer for Ritual in terms of LTV.

Ideally an expecting mother, taking prenatal vitamins during her pregnancy.

After having the baby, she might transition into other vitamin products.

That gives Ritual also the opportunity to get other members of the family hooked on vitamins.

So instead of a looking at a single $30 purchase, we’re now looking at:

- 9 months of prenatal vitamins @ $35/mo = $315

- 12 months of regular vitamin @ $30 = $360

- 2 months of her husband on regular vitamin = $60

= $735

This higher LTV means that Ritual doesn’t need to turn a profit on the first order, in fact.

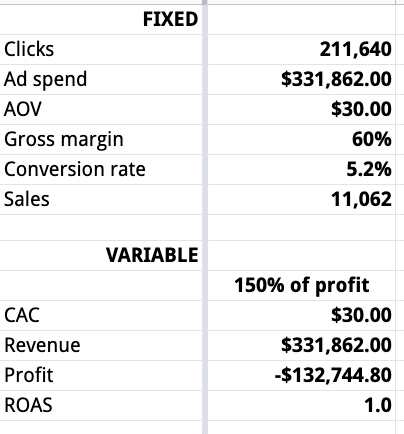

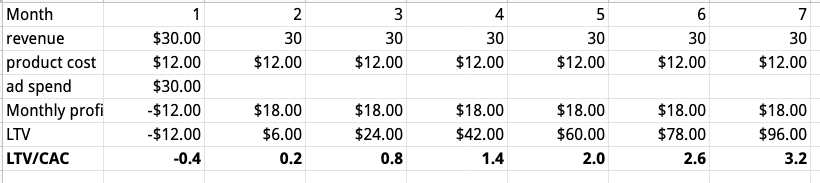

So let’s take a look the numbers if we assume that the customer acquisition cost is equal to the gross profit:

From this overview, you notice the 8.7% conversion rate, which is probably a bit too optimistic.

So if we increase the customer acquisition cost we can see the following:

So on the right hand side, Ritual is breaking even. And everything to the left that means that they are losing money.

I’ve worked with a few supplement brands, and I’ve often worked with a ROAS target of around 1.

So let’s assume that also corresponds to the strategy of Ritual.

To achieve a ROAS (return on ad spend) of 1, they lose -$132,744 /mo on a revenue of $$331,862.

It’s obvious that they’ll need customers to stick around in order to make this money back at some point.

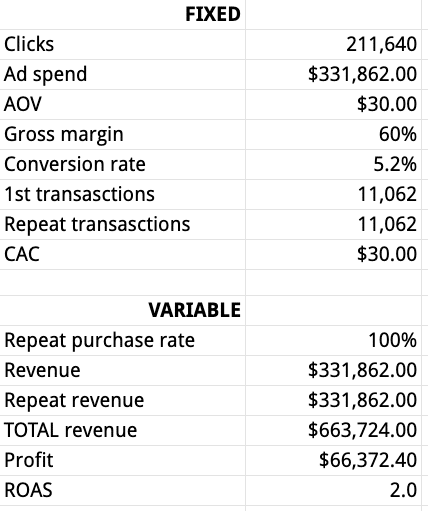

So let’s see at what happens if all customers on average purchase once again:

Month 1:

- Revenue: $331,862

- Loss: -$132,744

Month 2:

- Revenue: $331,862

- Profit: $199,116.8

Total profit: $66,372

Any purchases afterwards are pure profit (assuming they don’t need to spend anything to get customers to buy again).

Ritual could choose to forgo profit for longer, allowing them to spend more for that initial sale.

So the exact details of how long that takes really depends on the business needs, the cash flow position, expectations, etc.

A number that’s often mentioned in VC circles is an LTV/CAC ratio of 3.

That means that your customer lifetime value is 3 times what you spend to acquire a customer.

In what follows, let’s assume that this is Ritual’s benchmark:

In order to hit that LTV/CAC ratio, customers would need to stick around on average for 7 months.

As an average, that feels very high, but it’s hard to be on the outside looking in and guessing these numbers 🙂

Summary

I hope this gave you a good view into how Ritual runs their Google Ads campaigns.

Their approach is dominated by very aggressive Shopping campaigns.

Google Search Ads capture some additional searches and tries to leverage content promotion to convert more visitors compared to a product focused approach.

It’s still early, but it seems they are slowly upping their YouTube Ads game.

The subscription focused business model also means that they can run their campaigns a lot more aggressively compared to companies that want to turn a profit on the first sale.

What’s Next?

Did this article show you a few things you are missing in your own campaigns? Take a look at our courses to learn how to bridge that gap!

What did you think about this breakdown? Let me know in the comments!

Read our other breakdowns: Purple – MVMT – Judy – Away – Allbirds – Glossier – Caraway – FIGS

t

Dennis, this is pretty impressive. This scary-detailed detective deconstruction would make the Pink Panther.proud How did you obtain their google ads campaign names ?

Haha, thanks Andrey! A good spy doesn’t reveal all of his secrets 😉

Hey Dennis,

Such a good breakdown, thanks for sharing! I have a subscription vitamin business in Australia and haven’t been able to run Shopping ads (because the product is subscription only). How do you think Ritual gets around this?

Thanks!!

Abby

Could they run Google Smart Shopping and still remarket effectively since Google technically doesnt allow health products to be dynamically remarketed?

Hi Dylan,

Dynamic remarketing would be severely limited (non-existant) for those campaigns. So the campaigns would mainly be focused on acquisition.

Oh so no remarketing really, just finding new customers. Do you think its smarter to go the standard-shopping route as opposed to Smart Shopping for a company like Ritual? Since the AVG Cart Value is probably <$40. Or do you think the Smart Shopping could outpace standard-shopping acquisition at a substantial amount of conversion data/time to learn (3+ months w/ considerable adspend) even though Smart Shopping clicks are roughly $1 per? Maybe once tROAS is on and balance with adspend is determined?