How to Use and Accept Resale Certificates in Your Online Business

One of the more common ecommerce business models is to buy products at wholesale or retail and then turn around and resell those items for a profit online.

But sales tax can throw a monkey wrench in those works.

You will generally be required to pay sales tax on these purchases, even if you just intend to enter them into inventory in your online store.

And then you’ll be required to turn around and charge sales tax on those same items when you sell them to your customers.

Fortunately, online sellers can bypass paying sales tax when buying inventory by using a resale certificate.

What is a Resale Certificate?

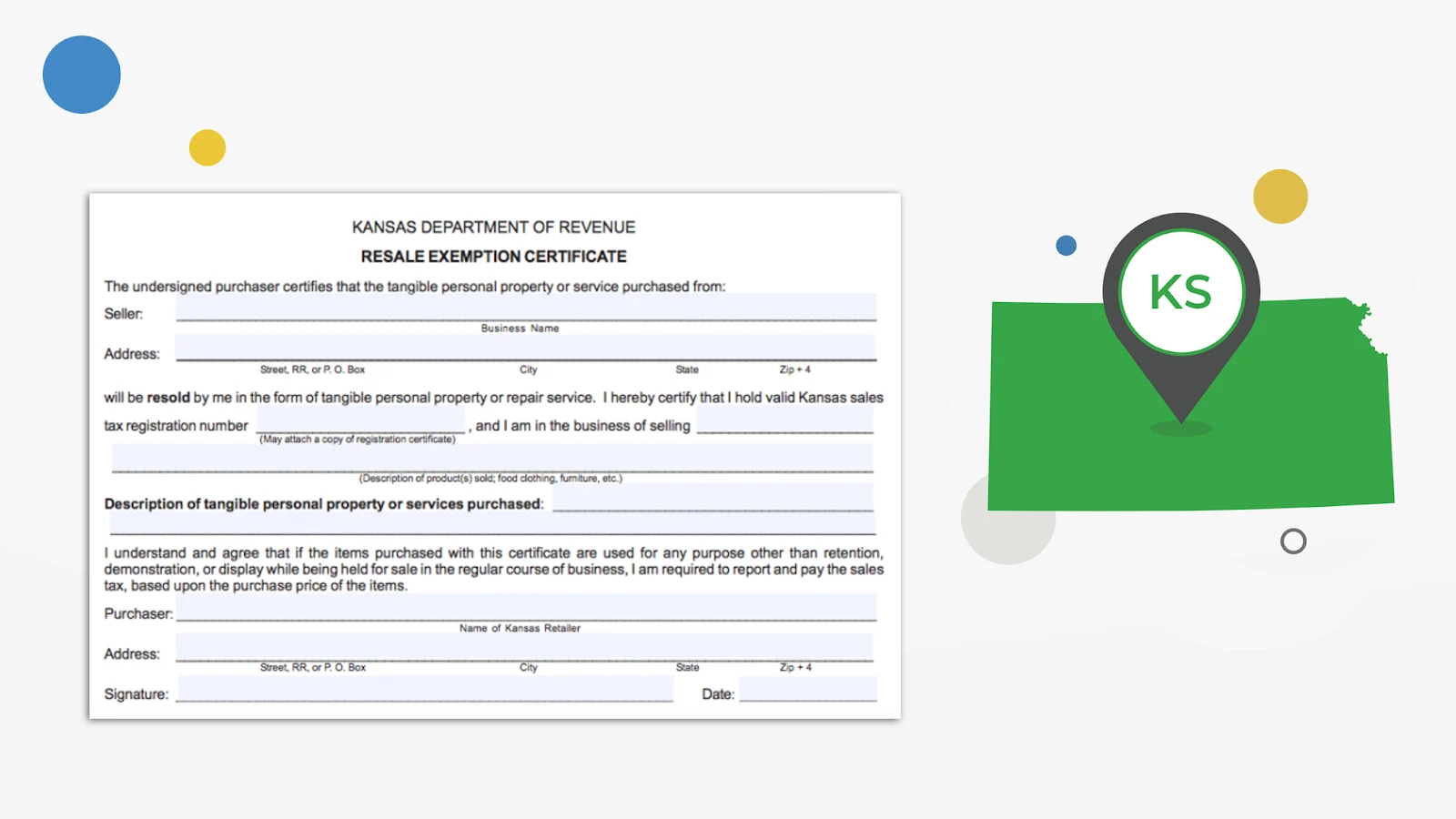

A resale certificate is a document proving that you are a legitimate retailer or purchaser and are buying products to either resell or use as component parts of products you plan to resell.

To use a resale certificate, you generally need to be registered to collect sales tax in at least one US state.

Resale certificates are also sometimes called “reseller’s permits” or sometimes just the blanket term “exemption certificates.”

Your resale certificate is generally the same thing as your sales tax permit (sometimes called sales tax license.)

However, in some cases, a state may issue a reseller a separate “resale certificate” number.

Though it has the word “certificate” in the name, a resale certificate these days isn’t always a specific piece of paper.

While some states do issue retailers a specific resale certificate to present to their vendors, most just require that you fill out certain information.

The Typical Information You Need For a Reseller Certificate:

Your business identifying details

Your personal identifying details.

The type of business you operate.

What types of items you are buying tax-free.

A signature verifying that you are making the purchase in good faith and truly intend to resell the items you are purchasing.

Here’s an example of a Kansas resale certificate:

Resale Certificate Pro Tips

Forty-five US states and Washington DC all have their own sales tax rules and laws.

We always recommend you read your state’s rules of resale certificates.

In general, though, retailers can use resale certificates to buy products they either intend to resell or rent, or components of products they intend to resell.

However, it is unlawful to use a retail certificate to purchase items you do not intend to sell.

For example, office paper or printer ink purchased with a resale certificate (unless, of course, you own an office supply store and intend for those items to be resold) is not valid.

To avoid a hassle, always fill out the resale certificate completely before presenting it to your vendor.

Vendors are often the ones on the hook for unpaid sales tax should they accept a faulty or fraudulent resale certificate from a buyer.

This is why some retailers may refuse to accept a resale certificate.

Target, for example, is known for attempting to curb online competition by refusing resale certificates from any suspected reseller.

If you use a resale certificate to purchase an item, but do not end up selling it, your state requires that you pay “consumer use tax” on the taxable item.

This is generally paid at the time you file your state income tax return. This may be a separate filing if your state does not have an income tax.

It’s also important to note that ten US states will not allow vendors to accept resale certificates that were issued out of state.

The 10 US States That Do Not Accept Out of State Resale Certificates:

Alabama

California.

Florida.

Hawaii.

Illinois.

Louisiana.

Maryland.

Massachusetts.

Washington.

Washington D.C.

For example, if you have a North Carolina resale certificate but try to buy an item tax-free in Maryland, your Maryland vendor will be unable to accept your North Carolina-issued resale certificate.

To buy an item tax-free from a vendor in Maryland or any of the other states on the above list, you will be required to register for a sales tax permit in that state.

Note that if you hold a sales tax permit from a state, not only can you buy items tax-free from vendors in that state, but you are also required to charge sales tax to your own buyers in that state.

Weigh the pros and cons before registering for a new sales tax permit/resale certificate.

How to Accept a Resale Certificate from a Buyer

As an online seller, sooner or later you will potentially run into another reseller or purchaser who would like to buy from you.

In this case, it’s time to take your duties as a vendor seriously and meticulously review the purchase order.

In most cases, if you erroneously fail to charge sales tax, you will be on the hook to pay the sales tax you didn’t collect out of your pocket.

Here are a few pro tips for accepting a resale certificate from a buyer without finding yourself in sales tax hot water.

Ensure the resale certificate is filled out accurately and completely – In the event of an audit, auditors will scrutinize resale certificates. Be sure each resale certificate you accept is completely filled out, including the signature.

Verify that the resale certificate is legitimate – Most states allow vendors to verify a resale certificate online. This allows you to double check that your customer provided you with a valid resale certificate number and that the certificate is not expired.

Make a good faith effort to ensure the purchase is valid – Let’s say someone presents you with a resale certificate. They say that they own a store that sells pet supplies, but they are purchasing a new suite of bedroom furniture for “resale.” It’s likely that this purchase is invalid, and you can refuse the resale certificate. If you do not refuse the resale certificate, you can find yourself on the hook to pay the sales tax you did not collect. The good news is that states don’t require you to become a private detective, so if the customer falsifies the document, you can claim innocence as long as you made a good faith effort to verify the certificate.

Keep the resale certificate on file – How often you should keep the documents vary, but most states require that you keep resale certificates on file for 5 years. In case of a sales tax audit, they will help you prove why you did not collect sales tax from a specific customer.

I hope this post has helped explain when and how to use and accept resale certificates in your online business.

Jennifer Dunn is Chief of Content at TaxJar, a service that makes sales tax reporting and filing simple for more than 7,000 online sellers. Try a 30-day free trial of TaxJar today and eliminate sales tax compliance headaches from your life.