When and How to Charge Sales Tax on Shipping

As an online seller, chances are good that you charge your customers for shipping or delivery fees at least some of the time.

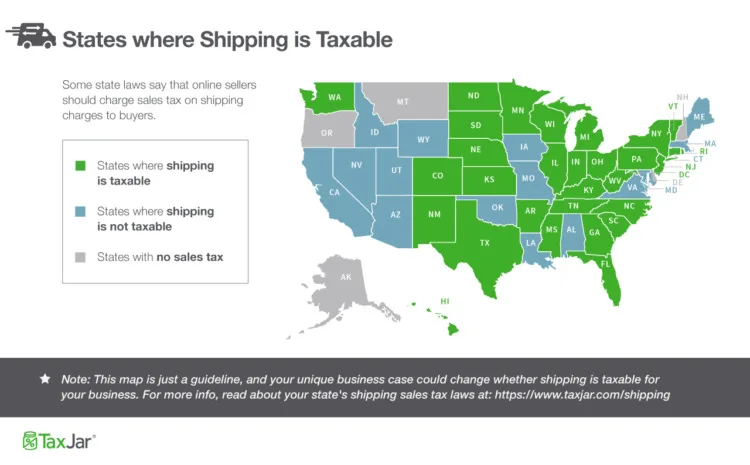

In the US, this can present a challenge because some US states require that retailers charge sales tax on shipping charges, while other states do not.

And each state’s regulation on sales tax and shipping charges is not always clear and concise.

Let’s dig into how sales tax on shipping works and how you can ensure that your sales tax policies are compliant with state tax laws.

Sales Tax and Shipping: Laws and Regulations

Forty-five US states and Washington DC all have a sales tax, and each state is allowed to make their own sales tax rules and laws.

For this reason, you’ll need to look to the state level to determine if you should charge sales tax to buyers in a particular state.

If you dig in and read each state’s law on taxing delivery charges, you’ll probably also notice that they can be a little confusing.

This is because many state sales tax laws were passed before the rise of ecommerce.

The letter of the law is often more focused on mail order purchases or delivery by company truck or freight.

The good news is that many states have more recently provided guidance to online sellers, whether in a letter ruling from the state’s taxing authority or in a website FAQ.

Sales tax and nexus within a state note

In the US, you are only required to collect sales tax from buyers in states where you have sales tax nexus.

If you do not have sales tax nexus in a state, then you are not required to collect sales tax (including sales tax on shipping charges) from buyers in that state.

When Should You Charge Sales Tax on Shipping?

You should charge sales tax on shipping charges when making a sale to a buyer in one of your nexus states if that state’s tax law declares that shipping charges are taxable.

The Connecticut Department of Revenue, for example, makes it clear on their website that shipping charges to Connecticut buyers are taxable:

Conversely, the state of Massachusetts does not require online sellers to collect sales tax on shipping charges in many cases.

The Massachusetts Department of Revenue addresses that here:

It’s not the most user-friendly read in the world, but in other words, if you as an online seller ship an item to a customer in Massachusetts, and do not include the shipping charges as part of the price of the item, then you are not required to collect sales tax from that customer.

As an online seller, it’s your job to check with the state(s) where you have sales tax nexus and determine if that state requires you to collect sales tax on shipping charges.

You can see a shipping taxability resources for each US state here:

Shipping Taxability

Let’s look at an example of the same transaction in a state where shipping is taxable and a state where it is not:

1. States where shipping is taxable.

Theo sells a $100 lamp to a buyer in a state where shipping is taxable, and charges $10 for shipping, for a total transaction amount of $110.

The sales tax rate for the sale is 6%.

Since shipping is taxable, Theo would charge the 6% sales tax rate on the entire $110 transaction amount.

He would collect a total of $116.60 from the customer.

2. States where shipping is not taxable.

Now Theo sells the same $100 lamp and charges the same $10 for shipping to a customer in a state where shipping is not taxable.

The sales tax rate is still 6%.

In this case, Theo is only required to charge sales tax on the $100 price of the lamp, and not the entire transaction amount.

In this case he would collect a total of just $116.00 from the customer, because he was not required to collect sales tax on the $10 shipping charge.

Common Exceptions to Sales Tax on Shipping

I recommend reading each state’s sales tax law or FAQ on shipping, because many states have exceptions to their normal rules. Here are a few:

You are delivering products in your own vehicle – State laws on shipping taxability generally refer to “common carriers.” A common carrier in this case is a service that anyone can use – such as the USPS, UPS or FedEx. But in some cases, if you deliver items in your own vehicle rather than using a common carrier, different shipping taxability laws apply.

You allow customers to pick up the item – Some states are adamant that shipping in an ecommerce transaction is taxable because the delivery of the item is an inextricable part of the ecommerce process. However, if you have a storefront, or otherwise give the customer even the option to come to your location and pick up the item (in some cases, no matter how far away the customer may be), then the state considers shipping charges non-taxable.

“Handling” is included – In Virginia and Maryland, “shipping” charges are not taxable, but combined “shipping and handling” charges are taxable. Be sure to thoroughly read your state’s sales tax laws on shipping to ensure that your business process doesn’t inadvertently run afoul of a detail in the law.

The shipment contains a mix of taxable and non-taxable items – Some items, like groceries, clothing and medication, are not taxable in some states. For the most part, if you ship taxable items, then all shipping charges are taxable. And if you ship all non-taxable items in a parcel, then the shipping charges for that parcel are non-taxable. But if you ship a mixed shipment (i.e. some items are taxable and some are non-taxable), then some states say that you should only charge sales tax on the shipping charges used to deliver the taxable item. You may do this by dividing the weight of the items or the prices of the items and then assigning a shipping charge to each item.

Sales Tax on a Mixed Shipment

You sell a $50 taxable coffee table book and a $50 non-taxable pair of blue jeans to a customer and ship them in the same shipment, charging $10 for shipping.

In this case, you could weigh both items and figure out how much of that $10 was used to ship the weight of each.

Or you could simply consider the price of each item and only charge sales tax on the $5 you charged to ship the taxable coffee table book.

Fortunately, BigCommerce and other online shopping carts and marketplaces allow you to elect whether to collect sales tax on shipping charges in an individual state.

I hope this post has demystified when online sellers are required to charge sales tax on shipping charges.

If you have questions or something to say, start the conversation in the comments.

Jennifer Dunn is Chief of Content at TaxJar, a service that makes sales tax reporting and filing simple for more than 7,000 online sellers. Try a 30-day free trial of TaxJar today and eliminate sales tax compliance headaches from your life.