I have two millennial sons. They (and their girlfriends 🙂 ) represent the radically changed customer base faced by specialty retailers. They buy with vastly more info available to them from their mobile phones, tablets or smart watches than perhaps even the most diligent of customers ten years ago. From on-line price comparisons to global visibility on consumer comments or Facebook / Twitter mentions: it’s all there just a few clicks away. In this highly transparent and competitive marketplace, millennial consumers follow rapidly changing trends, fully aware of the buying choices they have.

View from the specialty retailer

While the consumer discretionary sector in the US has grown at over 21% over

the last few years, mass retailers captured much of that growth, leaving specialty retailers to trail 10 basis points behind over the same period. Today, to compete, specialty retailers need to invest in;

(i) brand equity

(ii) product differentiation while matching their assortment to changing trends

(iii) reducing non-performing stock

(iv) providing consumers an excellent on-line/off-line buying experience

(v) maintaining quality-to-price ratios. A tough order indeed.

So where should a retailer start?

I strongly believe that part of the solution lies buried in all the data that they currently have lying in their ERP, POS, SCM tools and/or spreadsheets. Leveraging this vast data with the right analytics can help specialty retailers achieve the supply chain performance necessary to succeed and grow in this challenging environment.

Big data and supply chain analytics capabilities for success

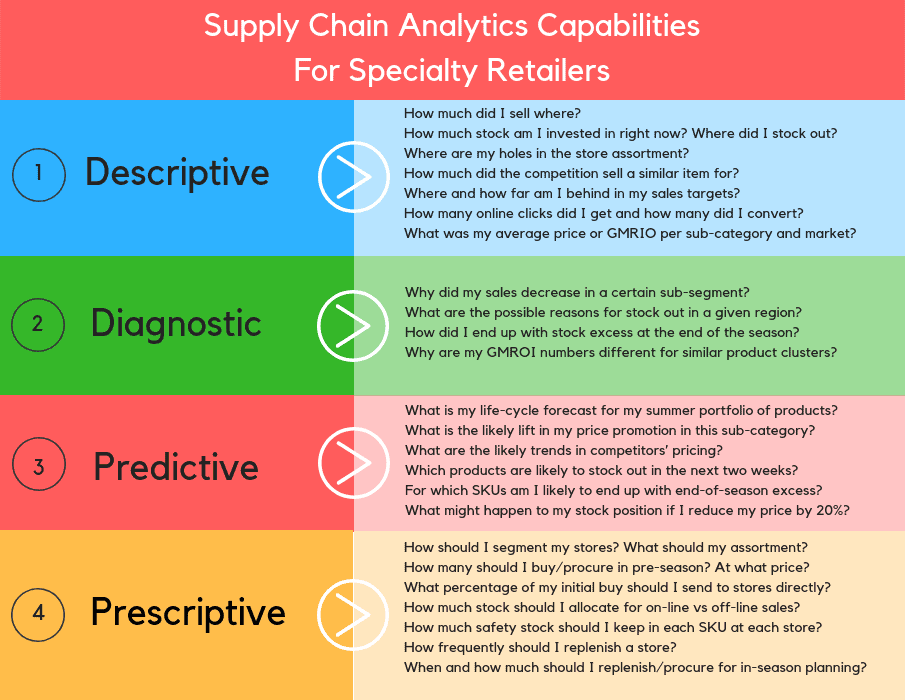

At its essence, supply chain analytics is about making smarter supply chain decisions – whether about product assortment, procurement, inventory mix or promotions:

-

Descriptive Analytics:

This is basic KPI tracking and internal reporting based on historical data: How much did I sell where? How much stock am I invested in right now? Where did I stock out? Where are my holes in the store assortment? What was my average price or GMRIO per sub-category and market segment? How much did the competition sell a similar item for? Where and how far am I behind in my sales targets? I leave how much in my OTB budget? How many on-line clicks did I get and how many did I convert?

-

Diagnostic Analytics:

This is relatively new analytics that can point you to the root-cause of your issues based on patterns in your historical data: Why did my sales decrease in a certain sub-segment? What are the possible reasons for stock out in a given region? How did I end up with stock excess at the end of the season? Why are my GMROI numbers different for similar product clusters?

-

Predictive Analytics:

This category uses statistical techniques to estimate the likelihood of future events as alerts, and includes demand forecasting. However, relatively new data-driven techniques now can answer many other important questions: What is my life-cycle forecast for my summer portfolio of products? How will my short-term demand change based on social media chatter? What is the likely lift in my price promotion in this sub-category? What are the likely trends in competitors’ pricing based on comparison engines and crawlers in the internet? Which products are likely to stock out in the next two weeks? For which SKUs am I likely to end up with end-of-season excess? What might happen to my stock position if I reduce my price by 20%

-

Prescriptive Analytics:

This category of analytics uses sophisticated supply chain optimization techniques to recommend specific actions: How should I segment my stores? What should my assortment be in each store? How many should I buy/procure in pre-season? At what price? What percentage of my initial buy should I send to stores directly at the beginning of the season? How much stock should I allocate for on-line vs off-line sales? How much safety stock should I keep in each SKU at each store? How frequently should I replenish a store? When and how much should I replenish/procure for in-season planning? What should I reduce my price to if I want to maximize my margins and minimize my end-of-season inventory? What is a profitable store-to-store transfer plan?

Each analytic component serves a larger purpose:

- Descriptive Analytics is the bedrock of the specialty retailer’s house, as improvements first and only come with measurements.

- Diagnostic Analytics points a specialty retailer to the right direction based on pattern recognition in its vast historical data, enabling faster reaction to start the fix.

- Predictive Analytics provide the foresight for focused decision making that avoids likely problems in the future.

- Prescriptive Analytics creates value by allowing decision automation for proactive actions and exception-based planning that improve bottom line results.

Starting the journey:

The contemporary shopping behavior and the tough market dynamics require innovative supply chain planning at specialty retailers. The need of the hour is to empower planning teams with the right analytics tools and insights so that they can effectively compete on price, efficiency, and growth with mass retailers and etailers.

At Solvoyo, we provide a broad set of supply chain analytics on a single platform and create value for our clients by leveraging big-data. Reach out to us today, and explore ways you can better use your data to make smarter supply chain plans tomorrow.