As an agency managing hundreds of sellers, we know that Amazon Sponsored Products is and will continue to be one of the most powerful tools for driving discoverability and incremental sales for Amazon sellers.

Before we dive into our Amazon Advertising Q3 Benchmark Report for 2017 vs 2018, let’s discuss the building blocks of Sponsored Products and how it impacts sellers.

The Value of Amazon Sponsored Products:

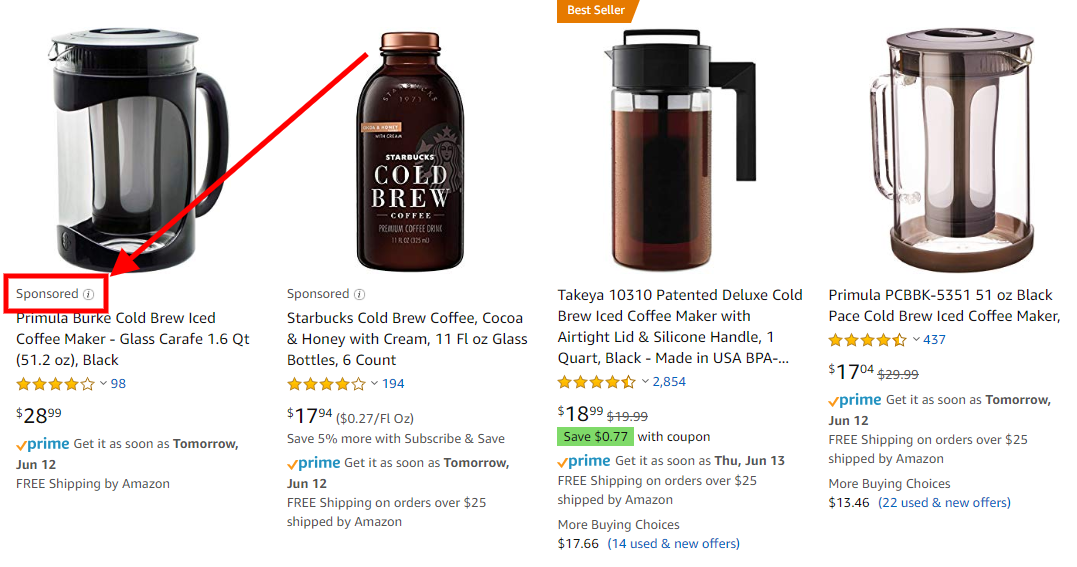

Sponsored Products is a PPC platform, which exists within the Amazon Marketplace and drives traffic to an Amazon detail page.

These ads exist on the right rail of the Amazon SERP, at the top and bottom of the SERP, and on the carousel on product detail pages.

Sponsored Products also impact a seller’s overall Marketplace presence by providing an acceleration program for newer or low-exposure ASINs, increasing Discoverability for your top Buy Box offers and acting as an incremental revenue driver.

Last year, Amazon tightened up their standards for sellers on the platform–and the marketplace is only going to get more competitive in 2018 and beyond.

We anticipate the “cost to play” will increase as more Amazon sellers flood the Marketplace increasing demand in the bidding auction.

In response, sellers will have to rely on sophisticated paid marketing campaigns and strategies to outsmart their competitors.

“We expect click volume and click-through rates to increase for Sponsored Product ads as they become less discernible from organic listings, meaning winning these auctions will be more important than ever.”

– Pat Petriello, Head of Marketplace at CPC Strategy

About the Analysis:

To better understand the trends occurring within Amazon’s Sponsored Products program, CPC Strategy conducted an analysis of our Sponsored Products data for all same store clients from Q3 2017 to Q3 2018.

The data we gathered is from Vendors & Third Party Sellers leveraging Sponsored Products.

CPC Strategy collected the following metrics* including:

- Spend

- Revenue

- Clicks

- Average CPC

- CTR

*Please note all data (with the exception of CPC) is normalized for confidentiality. The baseline marker for Q3 2017 is represented by 100 on each graph below.

CPC Strategy’s 3P Sponsored Products Analysis

The analysis below includes data from 59 same-stores U.S. Amazon sellers.

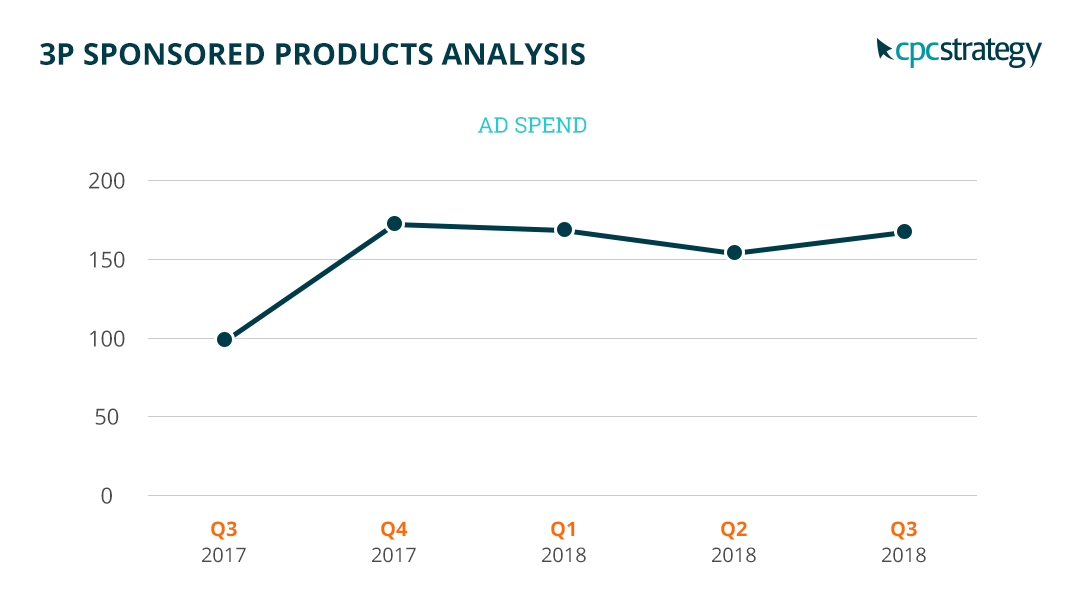

Ad Spend:

We saw a +66.51% increase in spend from Q3 2017 to Q3 2018.

This increase indicates that sellers are investing more marketing dollars into Amazon advertising than ever before.

It also indicates that sellers view Amazon Sponsored Products as an effective use of their budget to help drive sales and increase revenue.

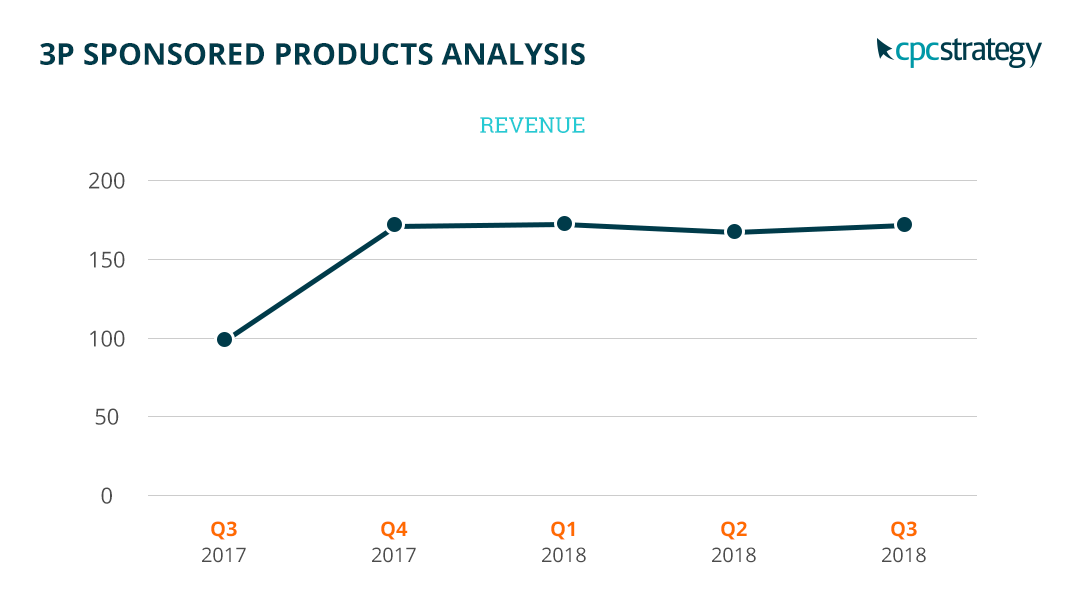

Revenue:

We also saw a lift of +68.26% in ad revenue from Q3 2017 to Q3 2018.

The data above indicates revenue lift is outpacing spend lift which means:

1) Ads are performing better in terms of efficiency, which is likely due to sophisticated targeting techniques and implementation.

2) Sellers are willing to spend more because they are seeing a strong return on their incremental investment in Sponsored Products.

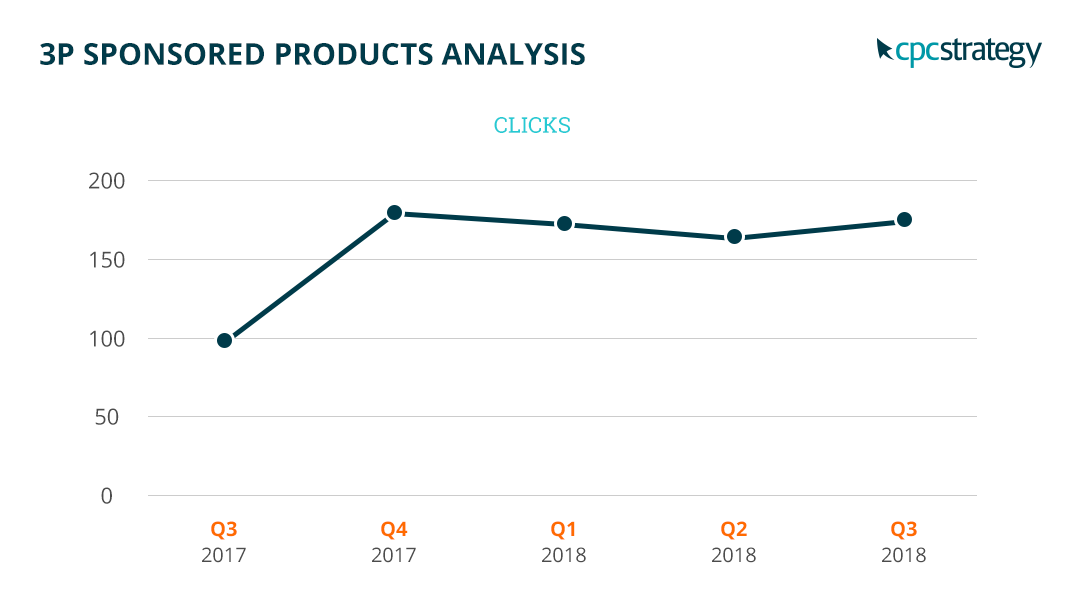

Clicks:

In Q3, we also saw a +68.29% increase in clicks. This indicates that the increase in spend is also driving a similar increase in clicks and traffic to seller detail page(s).

Note: Typically, when we significantly increase ad spend (coinciding with a lift in traffic) there is an expected decrease on return. Why? Because you are expanding your reach and targeting shoppers located much higher up the sales funnel, who typically have a lower purchase intent.

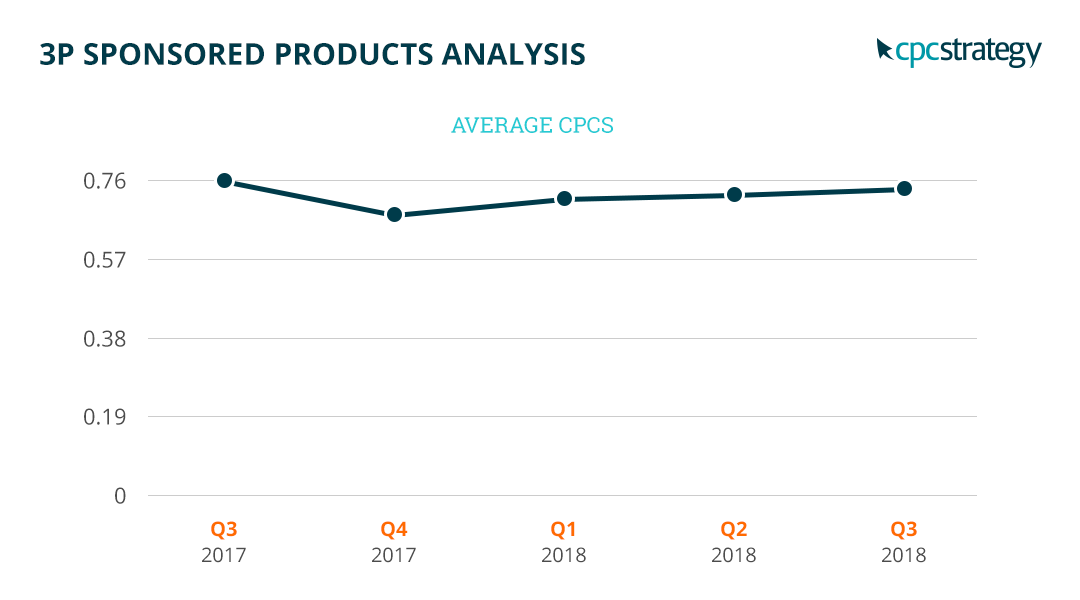

Average CPC:

We also saw a very slight decrease in CPCs from .76 in Q3 2017 to .75 in Q3 2018.

As more sellers continue to join Amazon and adopt the Sponsored Products platform – there is inevitable going to be more competition and higher ad costs within the ad auction.

Although according to this data, the CPCs stayed fairly steady Q3 2017 vs Q3 2018.

CPC Strategy’s 1P AMS Sponsored Products Analysis

This analysis includes data from 75 same-store US Amazon Vendors (within our CAPx AMS platform).

Keep in mind, this analysis is focused on large brands that typically have higher budgets than 3P sellers.

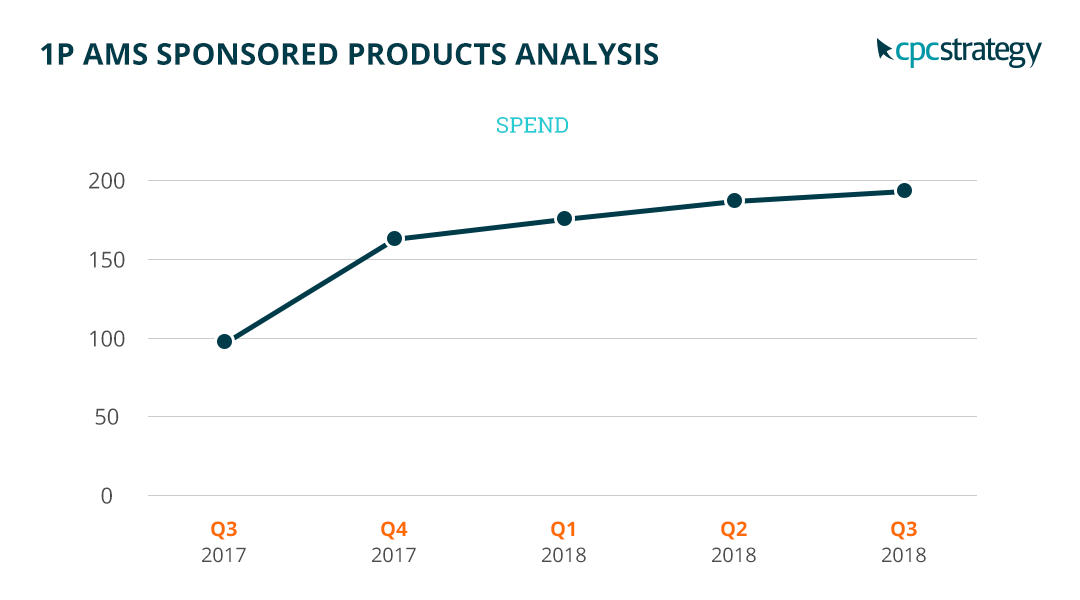

Spend:

We saw a +96.79% increase in spend from Q3 2017 to Q3 2018 – this indicates a slightly more aggressive but similar trend to the 3P data mentioned above. This may also indicate a growing interest in promotion, as the busy Q4 season approaches (and the Marketplace continues to gain traction among shoppers year-over-year).

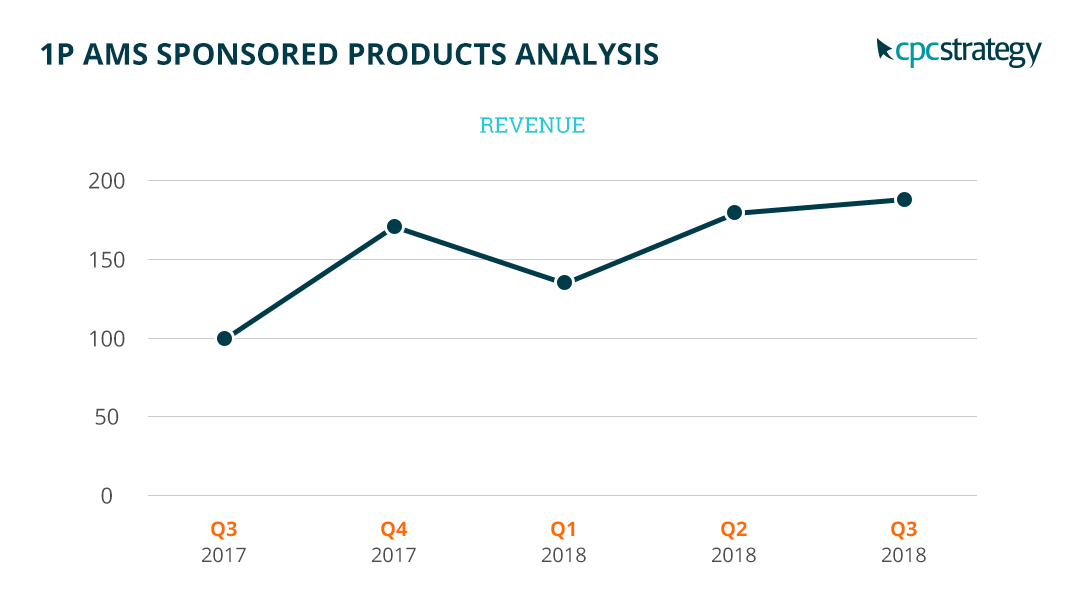

Revenue:

We also saw a +88.01% increase in revenue from Q3 2017 to Q3 2018. Although this is a positive growth, with the rising CPCs (indicated in the graph below “Clicks”), the data confirms that we see a spend increase slightly outpacing the revenue (or return).

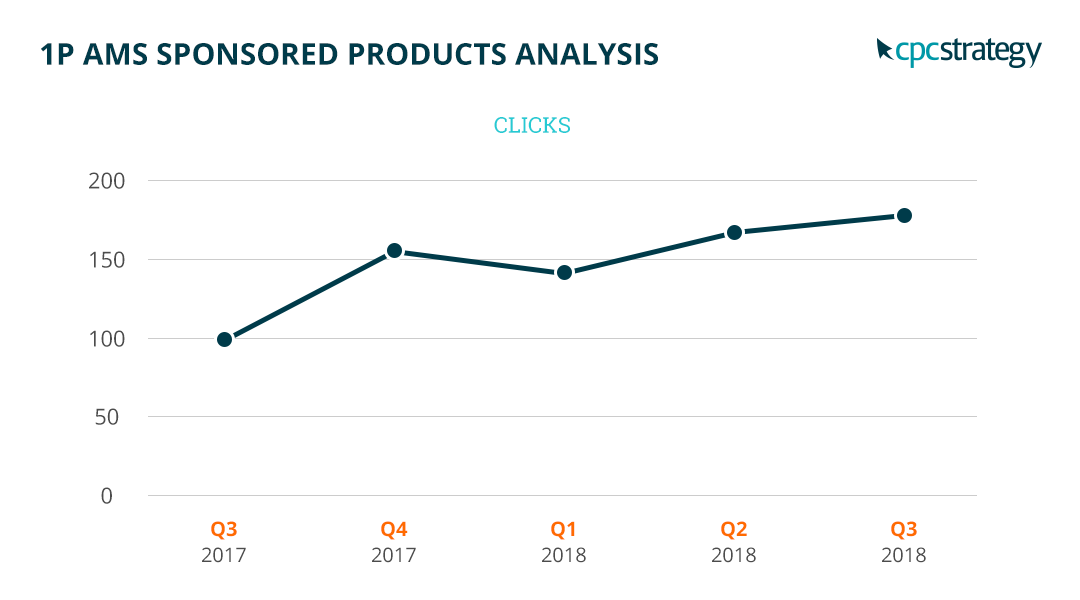

Clicks:

We also saw a +72.64% increase in clicks from Q3 2017 to Q3 2018 – once again similar to the 3P data trend mentioned above.

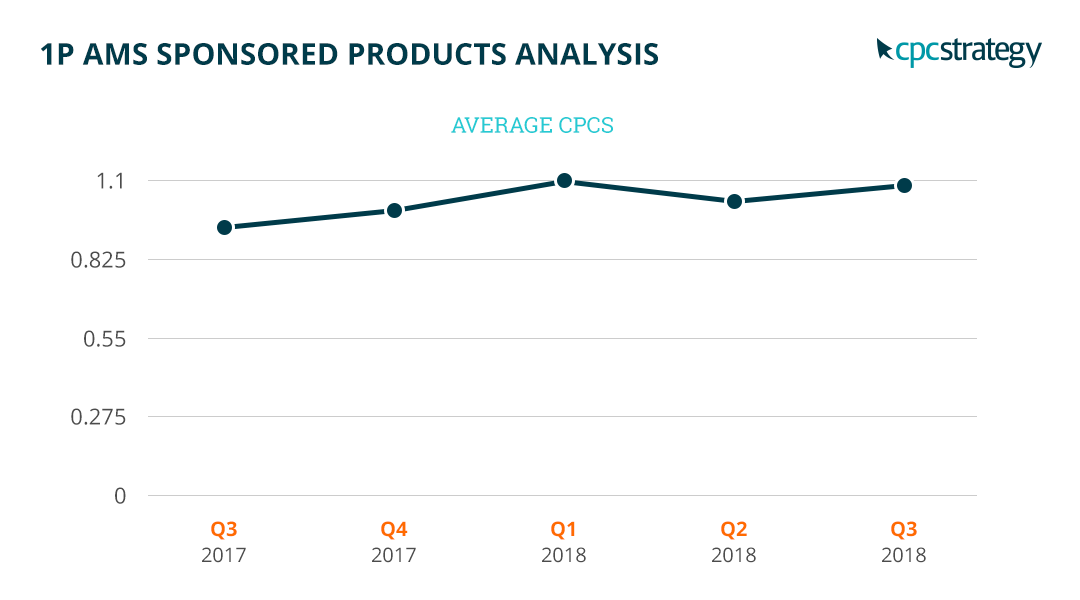

Average CPC:

CPCs also increased from $0.95 in Q3 2017 to $1.09 in Q3 2018, a +13.99% increase.

As more sellers continue to join Amazon and adopt the Sponsored Products platform – there is inevitable going to be more competition and higher ad costs within the ad auction.

Average CTR:

We also saw an increase in click-through rate by +33.42% from Q3 2017 to Q3 2018.

How To Succeed on Amazon in Q4 2018:

Utilizing advanced advertising strategies on Amazon will be pivotal for a strong finish in 2018.

Although some of the biggest shopping days like Black Friday and Cyber Monday are months away, retailers should already be testing, gathering data about their audience, and building out creative.

“We want to make sure you are prepared to get the most out of the increased traffic that we’re going to see in Q4, specifically as it relates to your Sponsored Products advertising efforts.”

– Pat Petriello, Head of Marketplace at CPC Strategy

To help sellers prepare, we gathered the top performing Amazon advertisers together for an exclusive panel at AdDiego 2018.

If you missed the conference, here’s a recap (straight from our LIVE panel) on how you can capitalize on the channel throughout the holiday shopping season.

We’re also providing sellers with a BONUS to up their game this Q4: CPC Strategy’s Amazon Holiday Calendar is full of important deadlines and helpful tips to keep on hand during the peak shopping season.

You Might Be Interested In