How Amazon Product Ads Stacked Up Against the Competition in Q4 2012

Our 2012 Q4 CSE Rankings was an exciting one for us at CPC Strategy. Not only did we get to dive into the numbers from the holiday season, but we also got to see how Google’s shift to a paid model affected the rest of the CSE landscape during Q4.

Amazon Product Ads performed well in some areas but dropped off in others. Some of the changes can most certainly be attributed to the new paid Google Shopping.

**It’s important to note that Amazon Product Ads and the Amazon Marketplaces are two distinct entities. Amazon Product Ads aim is to send buyers directly to the merchant’s website whereas the marketplace keeps the buyer within the Amazon domain.**

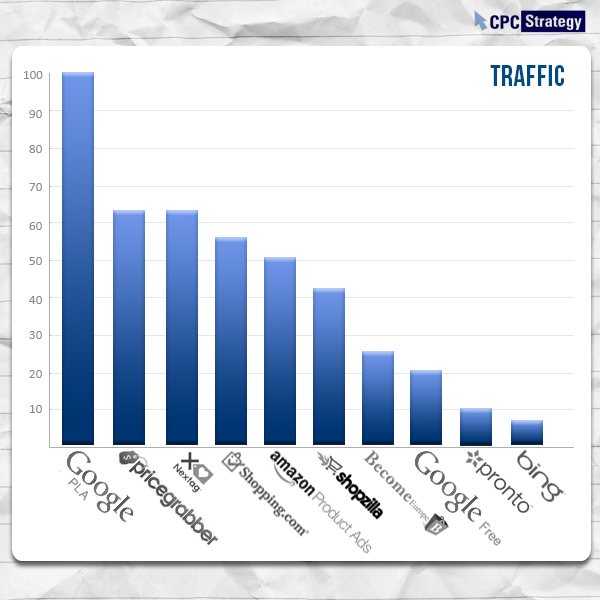

Amazon Products Ads ranked number one in traffic for our 2011 Q4 CSE Rankings. This year, Google Shopping’s traffic skyrocketed past its competitors. Pricegrabber, Nextag, and Shopping.com were next in line leaving Amazon Products Ads in 4th place.

The change in traffic rank can be credited to Pricegrabber, Nextag, and Shopping.com listing products on Google PLAs. Since Amazon Product Ads does not list any products on Google Shopping, their rank in traffic stayed consistent from Q3. But, as any seasoned online retailer will tell you, traffic isn’t everything.

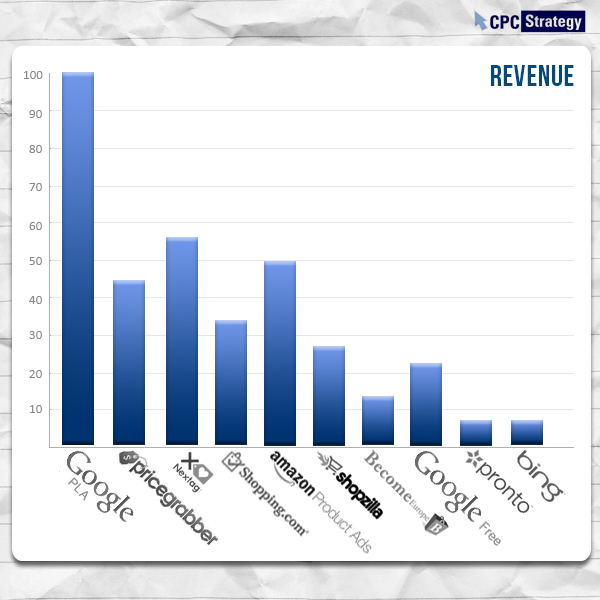

Amazon Product Ads held on to its third place spot this quarter. There are no real changes here besides the increasing gap between Google Shopping and Amazon Product Ads.

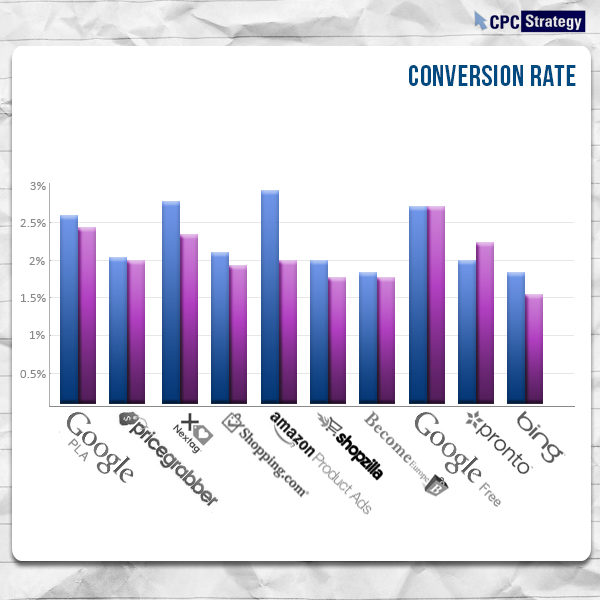

Amazon really surpassed its competitors in the conversion rate category. Amazon Product Ads ranked number one in conversion rate paying testament to the amount of qualified traffic they bring in.

Not only did they have the highest conversion rate, they also had the biggest increase in conversion rate from Q3 to Q4 making it evident the holidays mean serious business for Amazon Product Ads.

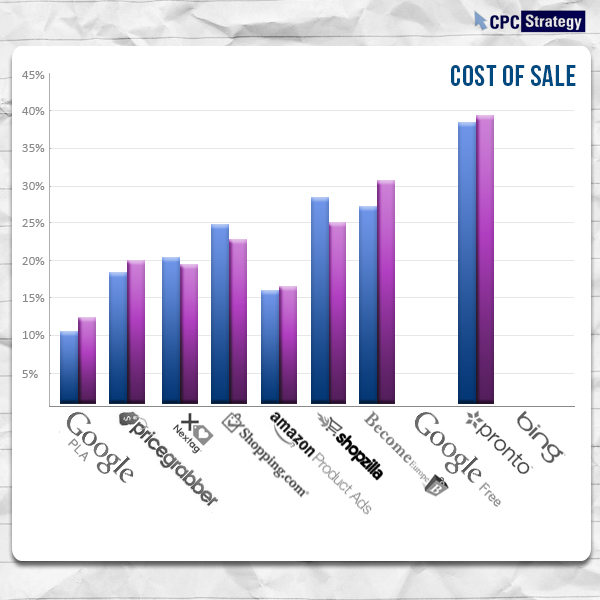

Not much has changed for Amazon’s COS (cost/revenue) in Q4. Amazon’s COS remained just over 15% this year ranking second just behind Paid Google Shopping with a 10% COS.

Although it is notable that Amazon’s COS did drop down to 15% from 25% back in Q2.

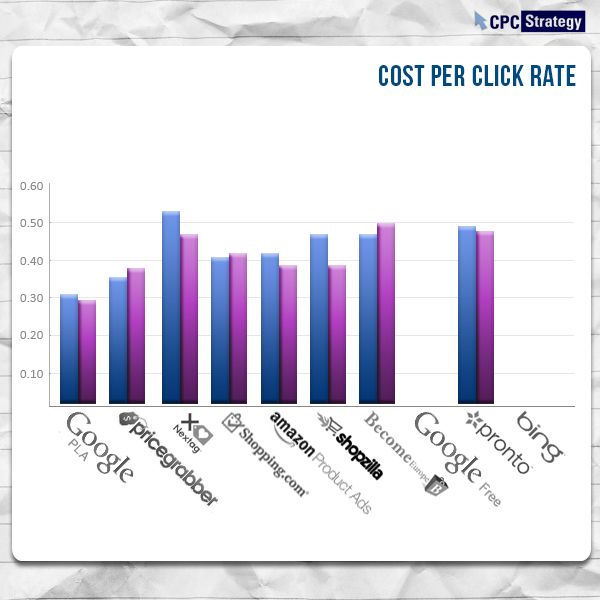

Amazon’s average cost-per-click slightly increased this quarter to just over $0.40. Google, Pricegrabber, and Shopping.com have lower average CPCs leaving Amazon as number 4 in Average CPC.

With Google Shopping posturing to be the new one-stop destination for online shoppers, Amazon certainly has its work cut out for them.