Brand Energy 2023: Here Are The Brands That Are Salient, Relevant, And Loved

BRAND ENERGY REBOOT

In 2017, we introduced a seminal approach to understanding a brand’s performance: Forrester’s Brand Energy Framework. Based on a survey of 4,436 US online adults, we combined iterative data-mining techniques and structured equation modeling to test millions (yes, millions!) of models that mapped perception of brand strength to business outcomes. This year, we’ve upped the game to include 51 brands and 79,100 respondents in the US.

Our latest report covers eight verticals and discusses how brands such as Amazon, BMW, Bose, Chase, Ford, Tesla, TikTok, Trader Joe’s, and dozens of others stack up.

A QUICK RECAP

A QUICK RECAP

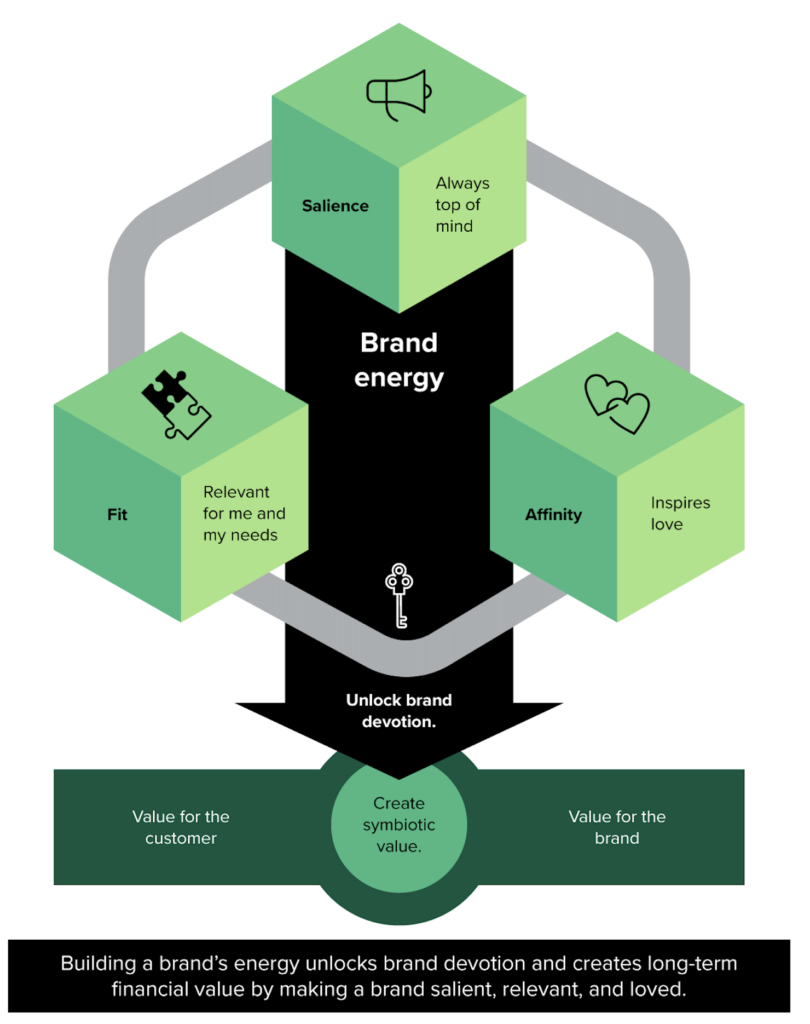

The brand econometrics revealed that three factors made for a strong brand that influenced consumer choice and created tangible financial value:

- Salience. To make the consideration set, a brand has to be top of mind.

- Fit. Consumers gravitate toward brands that fit their needs and align with their identities.

- Affinity. Emotionally engaging brands that consumers love outperform others.

SOME OF OUR FINDINGS

- While often maligned for their lack of differentiation, financial brands rise to the top of our list on the backs of energetic brands such as Chime and Lemonade (plus the consistently top-notch USAA).

- Among consumer banks, some, like Chase, score well with prospects but not so with customers (CX problem?), while others, like Bank of America, do very well with customers but falter with prospects (messaging issue?).

- At a time when brands struggle for relevance across generations, some transcend these boundaries and score extremely well with all. One, in particular, makes it to the top-five list for all generations — from Gen Z to Boomers. That brand is Bose.

- Even in categories that flounder in the sea of brand equity sameness, there are breakout brands that dazzle. In grocery retail, those are Trader Joe’s and Costco.

- We can’t live without it, yet we all seem to hate it. That’s social media for you, and brands such as Facebook, Twitter, and Instagram perform the poorest of all brands across all categories. WhatsApp does a bit better, as does TikTok, especially with Gen Z.

- For auto brands, love is in the air. Affinity scores for this category were 11% higher than the average for all other brands. But love can be polarizing: Gen Z’s favorite auto brand is Tesla. Boomers’ least favorite brand? You guessed it: Tesla! But some brands, like Honda, are consistently loved across generations.

INTERESTED IN MORE?

Forrester clients: The detailed data underlying the insights described are in my new report, Brand Energy Fuels Your Brand’s Growth.

To learn more about how brands create energy and grow, please request a guidance session with me. And if you’re attending CX North America in Nashville this year and want to hear about how brands grow, pencil in my session on Tuesday, June 13.