The Beauty & Skincare categories have certainly seen their share of ups and downs during the COVID pandemic. Initially, lockdowns and work-from-home mandates put a dent in the Beauty — specifically, Cosmetics — category. Since people were no longer “out in the public eye,” makeup use plummeted. Yet other products, such as skincare and haircare, got a boost. During COVID, consumers were suddenly put in charge of their own health and self care routines. And they turned online — to Amazon and other retailer websites, as well as social media — to not only buy products, but gather information on beauty and self care routines.

The shift from in-store to online shopping during the pandemic is well documented. But with the resurgence of in-store shopping the past year or so, there is evidence that shopping online for Beauty & Skincare may have some staying power. About half of consumers (49%) say they’re buying more beauty products online than they did prior to the pandemic, according to an April 2022 PowerReviews survey of 11,000+ U.S. consumers. PowerReviews research also suggests an uptick in the Skincare category, with nearly two-thirds (63%) of consumers saying they’re focusing more on skincare than they did pre-COVID.

So, using Profitero’s digital shelf data, we did a deeper dive into the Skincare category online, highlighting three key trends below.

1. The ‘hyaluronic acid’ hack for healthy skin

Working “hyaluronic acid” into beauty & skincare (even haircare) routines became a viral sensation among beauty enthusiasts and “skinfluencers” on TikTok late last year and into 2022. Turns out hyaluronic acid is a common skincare ingredient known for its hydrating properties, which helps preserve the skin’s moisture and firmness. Smart skincare brands jumped all over this trending keyword and started using it in their product titles.

‘Hyaluronic acid’ becomes a viral sensation on TikTok

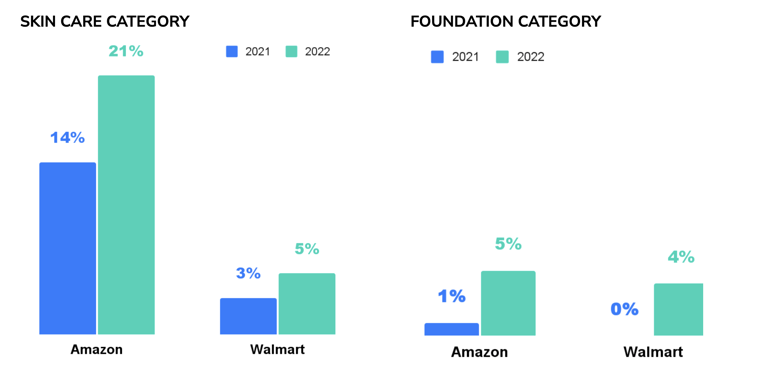

During a recent 30-day period from May 14 - June 13, 2022, 21% of products on Page 1 of Amazon included the term “hyaluronic acid” in their product title, compared with 14% a year ago. What’s more, brands are extending the term usually reserved for skincare products to additional products as well, such as foundation. During the May 14 - June 13, 2022 time period, 5% of products appearing on Page 1 of Amazon search results for “foundation” included the term “hyaluronic acid” in their product titles, up from 1% in 2021. A similar uptick in the use of the term “hyaluronic acid” was found on Walmart’s website.

% of products on Page 1 of search results using the term ‘hyaluronic acid’ in the product title

Source: Profitero; Time period analyzed: May 14 - Jun 13 2022 vs. 2021

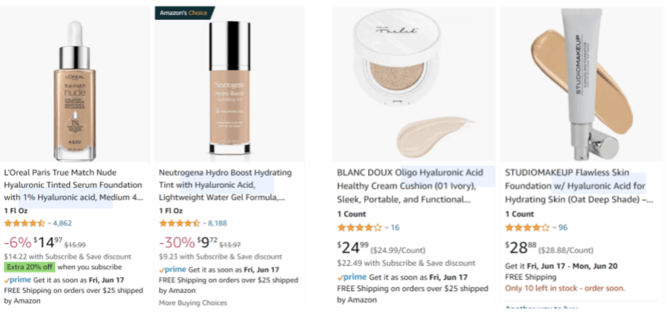

Foundation products on Amazon using ‘hyaluronic acid’ in their title

2. Hot. Hot. Hot. Tis the season for ‘sunscreen’

As summer heats up and the pandemic subsides, it’s no surprise that searches for “sunscreen” are trending on Amazon. Profitero found searches for “sunscreen” during the first week of June 2022 were up 77% from 2021 levels, and a whopping 188% higher than the same period in 2020 (at the height of lockdown).

The story, however, seems to be more than just about a return to normal. Searches for “sunscreen” on Amazon in 2022 are also outpacing pre-pandemic 2019 levels by 126%. This perhaps suggests the stickiness of Amazon for common routine skincare purchases, such as sunscreen. Amazon’s also likely gaining sunscreen sales at the expense of other competitors.

Search Rank Index — Keyword ‘sunscreen’ on Amazon U.S.

(Base year index of 100 in 2019)

Source: Profitero; Time period: First week of June in each of the years shown

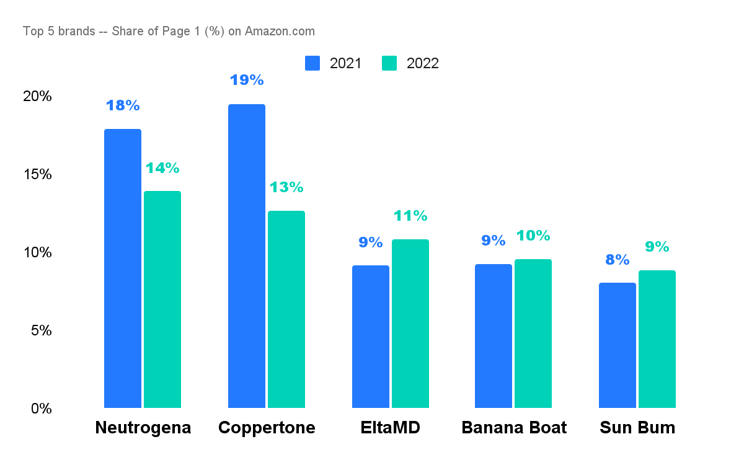

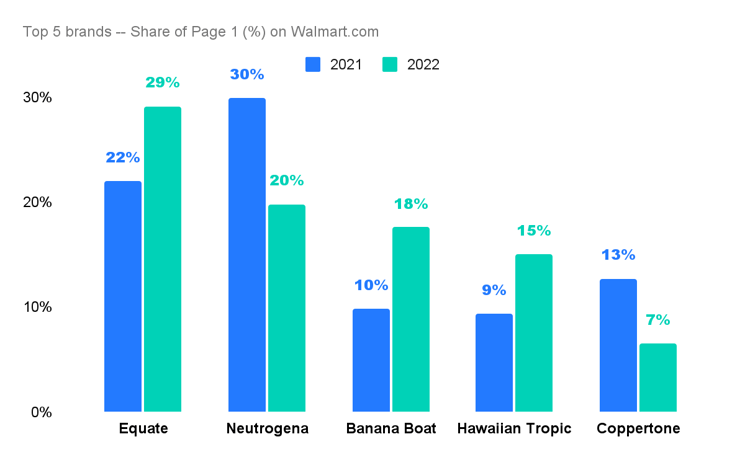

Below is a look at the top 5 brands ranked by share of Page 1 on Amazon.com and Walmart.com from May 10 - June 10, 2022 compared with the same time period in 2021.

Top 5 brands — Share of Page 1 (%) on Amazon.com

Source: Profitero; Notes: Includes both organic & sponsored search; Time period: May 10 - June 10, 2022 vs. May 10 - June 10, 2021

Top 5 brands — Share of Page 1 (%) on Walmart.com

Source: Profitero; Notes: Includes both organic & sponsored search; Time period: May 10 - June 10, 2022 vs. May 10 - June 10, 2021

A few notes of interest:

-

In general, brands capture a much lower share of Page 1 on Amazon than Walmart. This is likely because of the high level of endless aisle competition on Amazon. Search results for “sunscreen” on Amazon turn up 10,000+ products versus 1,000+ products on Walmart.

-

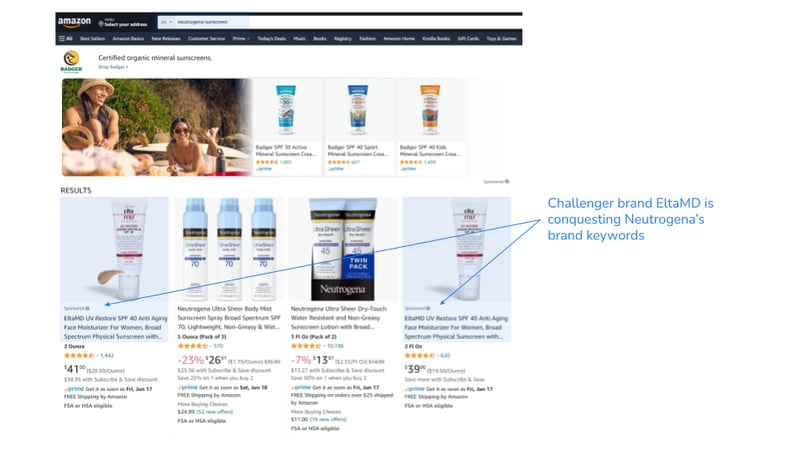

Leading brands Neutrogena and Coppertone are losing ground to some small challenger brands (e.g., EltaMD and Sun Bum) on Amazon.com this year versus last year. In fact, we found EltaMD conquesting Neutrogena’s brand keyword by sponsoring products in search results for the term “neutrogena sunscreen.” Amazon is one of only a handful of sites where you can conquer another brand’s keyword in search results, so having a strong defensive strategy on Amazon is critical.

Walmart’s private label Equate has taken over as the leading brand on Page 1, with 29% share of Page 1 in 2022 versus 22% in 2021. Other brands gaining share of Page 1 include Banana Boat and Hawaiian Tropic, while Neutrogena and Coppertone’s share of Page 1 has dropped.

3. Rising prices of beauty online

We are living through a perfect storm of cost pressures facing the industry. Cost inflation is hitting us from all sides — rising raw material costs, labor costs, oil / gasoline and transportation costs. It doesn’t appear to be slowing down any time soon either. But what’s hidden behind the Labor Department’s monthly-reported inflation numbers is just how hard inflation is hitting consumers when they shop online.

Every month, Profitero’s eCommerce Price Index tracks online prices for thousands of products sold on retailer eCommerce sites. Our latest data shows that as of May 2022, online prices for beauty products in the U.S. are up 6.3 ppts year-over-year.

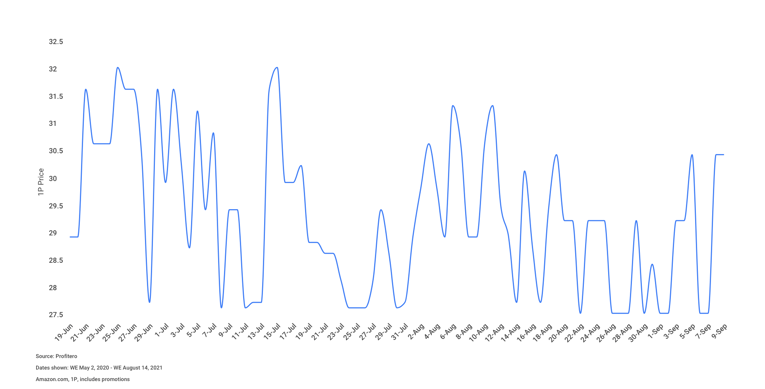

Further complicating things, eCommerce is the most volatile and fast changing channel when it comes to price and cost management. As the chart below shows, eCommerce experiences extreme volatility in daily price movement. Something that would never happen in brick & mortar. This makes it all the more important to take a “hands on keyboard” approach to tracking online price data.

Example of daily price changes for a beauty product on Amazon.com (2021)

Source: keepa data, June 19 - Sept 9, 2021

So what, now what? What can brands do?

With consumers shopping online for beauty & skincare products more than ever, it’s important that your products are discoverable and visible in retailer search results. In fact, our research shows that moving from Page 2 to Page 1 organically in search results can increase a brand’s sales by 50%, on average. Some tips:

-

Identify and prioritize your target and relevant trending keywords. While it may seem intuitive, this is a critical step for brands just starting to operationalize paid search capabilities as well as veterans who’ve been at it for a while. Ask yourself: Are we winning all the keywords that matter in our category? This is important because our research shows that optimizing for relevant, high-frequency keywords gets you 2x the sales lift as low-frequency keywords. Thus, you should regularly monitor search frequency and volumes to align your keywords — for both organic and paid sponsorship — with the most frequently searched terms.

-

Track keyword search trends to pinpoint upward trajectories and spikes in a timely manner. This can be crucial in helping brands quickly identify and anticipate consumer demand, giving you time to ensure adequate stock is on hand to meet consumer needs. And keep a watchful eye on social media trends so you’re ready to pivot as needed to leverage opportunities to promote relevant products, and optimize content for trending keywords (e.g., “hyaluronic acid” or “sunscreen”).

-

Use a digital shelf tool like Profitero to monitor your share of Page 1 versus your top competitors. More importantly, take action immediately (e.g., adding relevant keywords to your product content; using paid search and retail media) when you find your search rank dropping or you’re losing share of Page 1.

-

Use daily online price data and competitive insights to help mitigate the impact of cost inflation and to defend your profits. Some things to think about, which Profitero can support: rationalizing your product portfolio to reduce unnecessary costs; understanding which products are the most / least price sensitive so you can confidently consider price increases; and renovating your assortment to improve unit economics.

For more eCommerce insights & reports:

Follow us on LinkedIn

Follow us on Twitter

Stay informed with Profitero’s latest newsletter

Contact us for business or press inquiries

———

Follow us on LinkedIn

Follow us on Twitter

Stay informed with Publicis Commerce Insights

Contact us for business or press inquiries