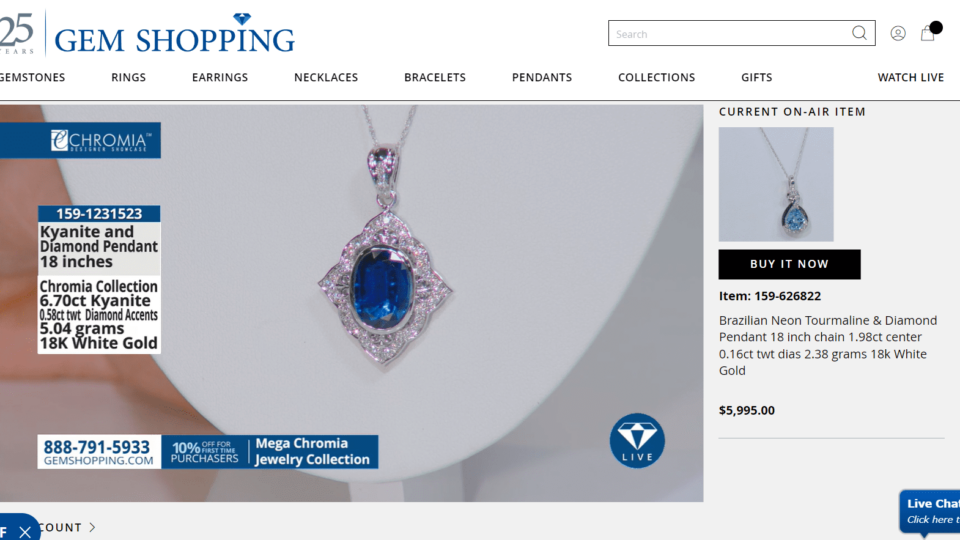

Gem Shopping Network (GSN) has carved a unique space in the shoppable media market: Its primary business is still conducted via linear television, akin to the Home Shopping Network and QVC, but it also is growing significantly through connected TV (CTV) and streaming platforms like Apple TV, Roku and YouTube. And thanks to a seamless payment experience powered by SplitIt, GSN is creating inspiring content about its fine jewelry and is then translating it into bottom-line results.

“If you know the world of jewelry home shopping, you have a few companies like HSN or QVC that do jewelry part-time, but we only do fine jewelry — and we do it 24/7,” said Eduardo Hauser, CEO of Gem Shopping Network in an interview with Retail TouchPoints. Because of this niche focus, GSN’s target customer, who is aged about 40 years and older, tunes in largely for the education and entertainment value. But as the business expands across media channels and touch points, the company’s biggest goal is to make purchasing from that content as seamless as possible.

“In the end, what we’re trying to do is remove friction and to provide customers with great flexibility when it’s time to transact with us,” Hauser explained.

For fashion and even semi-fine jewelry, paying with a credit card isn’t such a hassle. But GSN’s minimum average order value of $3,000 means some purchases far exceed most credit card limits.

SplitIt’s fractional payment solution makes buying these high-ticket items easier and more fiscally responsible, which has helped GSN increase basket size and average order value. Since launching the partnership in 2021, GSN has processed about 9,000 transactions using SplitIt, totaling more than $30 million in sales.

Advertisement

‘With Flexibility Comes Growth’

When it comes to the payment experience, “removing barriers at the time of transaction is very important,” according to Hauser. That’s why the company has assessed “every single way” to eliminate friction and provide flexibility — from accepting credit cards and ACH to allowing wire transfers. “With flexibility comes growth,” Hauser said. “The jewelry industry is growing at a healthy clip and it’s a massive industry. Anything that you can do to facilitate payments inside of the industry goes a long way.”

Looking to expand this payment experience even further, GSN implemented SplitIt. Although fractional payments and financing are certainly not new in the jewelry industry, GSN wanted to make purchasing high-ticket items as easy as possible for customers. That finding a solution alternative to traditional BNPL services that have credit approval processes built into them.

Hauser expanded upon why this nuance was critical to the GSN business and its core customers: “We tend to deal with individuals who spend a lot of money on jewelry, and we didn’t want it to come across as an intermediate layer between us and their credit approval,” he said. “We also learned that some of our customers are retired, and they don’t have any income anymore, so they could fail the credit score test and wouldn’t get approved. We did not want that to reflect on our business.”

Encouraging Responsible Purchases

SplitIt leverages already approved credit lines rather than applying for new credit. Consumers also can select whether they want to pay for an item in full or split the fee up over a series of months.

Hauser noted that some of GSN’s highest-spending customers use SplitIt because they feel more comfortable using their approved credit lines over time. It gives them confidence and peace of mind that goes beyond simply providing the ability to buy something they couldn’t afford otherwise.

As a result, GSN doesn’t have to worry about being caught between customers and the credit bureaus. It also addresses the main concern of BNPL, which is that it can give consumers access to products they can’t actually afford. “That’s something we did not want to be a part of,” Hauser explained. “We didn’t want people taking on more credit in order to buy items that we were selling. Working with a spread between approved credit and unused credit seemed to be a more conservative approach than inviting people to try to seek new credit approvals to buy something that perhaps they shouldn’t.”

Embedding Payment into the ‘Dual-Screen Experience’

Because GSN is so immersed in both new and established media channels, its payment experiences needed to scale across multiple platforms. GSN has a traditional ecommerce experience and checkout flow with SplitIt embedded into the journey, but the technology also can be used via phone and chat.

“Many of the emerging payment options, at least at the time we were weighing options, were integrated online, but they were not able to conduct transactions over the phone,” Hauser said. “We like to keep consistency, so if you’re a customer, you have the same payment options across all platforms.”

The GSN live show workflow is entirely different. Consumers have three different activation opportunities: One is the ability to call a differentiated phone number that is specific to the channel; for example, the phone number for the YouTube livestream is different than the website’s live feed. The second is a distinct URL and the third is a QR code that is “the key that opens the door to a dual-screen experience,” said Hauser.

Accelerating the Conversion Funnel

As GSN embeds payment into its omnichannel experience, it is very disciplined about separating the engagement platform, which represents the channel being used to share content that engages shoppers, and the transaction platform, which encompasses the payment types used to complete a purchase.

For example, at the top of the funnel, GSN considers how its viewership is growing and how it’s engaging with the audience to retain them long-term.

“The biggest value that we bring to our consumers is entertainment and education,” Hauser explained. “We are not always pushing for the sale. Often, there’s a very informative conversation that takes place between the caller and the sales rep, where the customer just wants to learn about what they’re watching [on the show].”

For the transaction or conversion funnel, GSN assesses how viewers ultimately buy across channels. That is why SplitIt and GSN’s friction-busting payment strategy is ultimately a conversion tool, not an audience development tool. “You will rarely see us advertising the fractional payments offering on TV,” Hauser explained. “Not that we won’t do it ever, because we will for high-priced items. But for us, it’s all about giving the customer transactional flexibility.”

Fractional payments also aren’t included in the ecommerce experience until consumers reach the product description page. “This is where you have the price and discount, the trust statements and information on the payment flexibility,” Hauser said, “because we want to present it as a way to convert the transaction, not as a way to entice somebody.”