Decoding China’s Central Bank Digital Currency

Forrester eCommerce

JULY 13, 2021

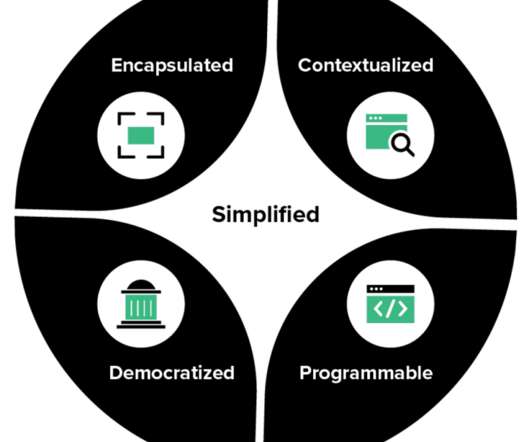

The digital yuan, the central bank digital currency (CBDC) of China, has already been tested in several major cities across the country. With further rollouts in 2021/2022, we expect to see this digital currency significantly impact a variety of B2C and B2B industries across financial services, retail, transportation, and entertainment.

Let's personalize your content