Myths And Realities Of Channel Conflict: Evolving Partnership Dynamics Will Dissolve Channel Conflict Concerns

When discussing brands’ direct-to-consumer (DTC) digital strategies, I am often asked how brands are handling issues of channel conflict with retail partners. There are a few forerunners to my response:

- A brand’s DTC digital strategy is not just about direct transactional sales to consumers. All brands need a DTC digital strategy, which derives value beyond sales. All brands need to be driving direct engagement with consumers.

- Indirect digital sales (via partners) will still be the main revenue stream for ubiquitous brands. Not all DTC brand strategies have to be at odds with retail partnerships. More ubiquitous brands will continue to rely on sales through retail partnerships.

So, when it comes to channel conflict — yes, some brands are fanning the flames. More luxury, cult, or higher-exclusivity brand types, such as Nike or Dyson, have a greater revenue opportunity from DTC sales and are reducing their reliance on retail partners. As these brands work on rebalancing the ratio of direct and indirect sales in favor of their own brand’s DTC sales, it is ramping up channel conflict concerns among their existing retailer relationships.

But this is not the whole story. For many ubiquitous or lower-exclusivity brand types, like Colgate or Duracell, retail partners will remain an important part of the go-to-market strategy. There are certain products — think toothpaste, food, or lotion — that consumers will just tend to buy from retailers as part of a regular shopping pattern. And even among those higher-exclusivity brand types, there will be brands for which retail partners still play an important role in their overall go-to-market strategy alongside their own brand DTC sales efforts.

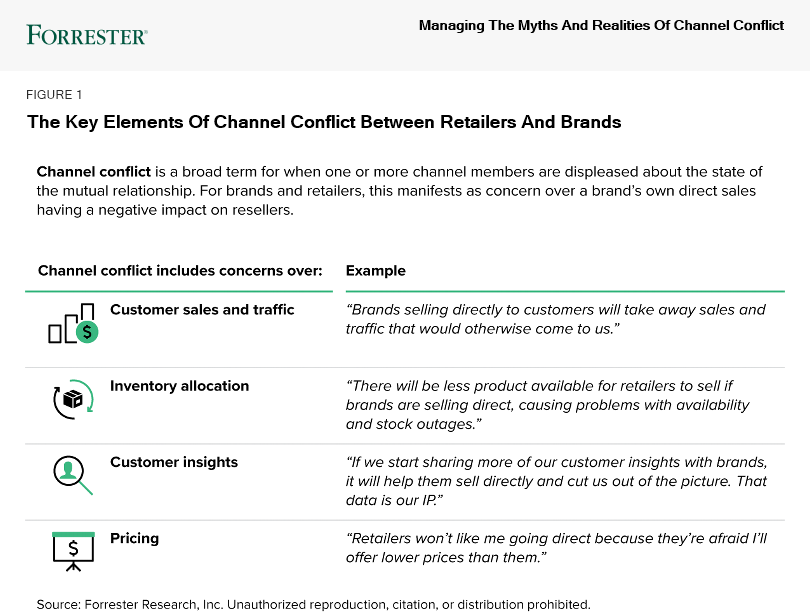

For either brand type to thrive, brands must evolve their retail partnership dynamics. By shifting from passive supplier to active and joint business partners, brands and retailers will start to address, and in some cases do away with, different channel conflict concerns as they:

- Evolve from fighting for sales and traffic to supporting a shared customer experience. Brands will increasingly own more of their digital destiny by building DTC engagement (and for some, DTC sales). From this, a key point of tension arises with retail partners around “ownership” of the customer. Brands and retailers must align on the brand’s promise and agree to collaborate to support a shared customer experience and connect the end-to-end customer experience.

- Move from fearing limited product supply to managing allocation/availability in partnership. Channel conflict can relate to operational issues too, including concerns over inventory availability and allocation for retail partners as brands enable DTC sales. This is one aspect of channel conflict that won’t completely disappear, as product supply is finite. However, as partnership dynamics shift, retailers and brands can manage and mitigate this tension.

- Shift from dreading price wars to upholding overall brand value. Pricing is another aspect of channel conflict, deriving from retailers’ concern that brands will undercut sales by making products less expensive when consumers purchase them directly from the brand. However, this concern is largely misplaced. Successful brands will look to drive value from partnerships rather than engaging in price wars.

To find out more about how brands and retailers are working to make these shifts and mitigate channel conflict concerns, check out my latest report, Managing The Myths And Realities Of Channel Conflict.