When it comes to online shopping, the German ecommerce market remains strong. And while German shoppers are similar to those in other Western retail markets, there are a few differences that brands should be mindful of when entering the market.

To identify and evaluate consumer preferences, ESW conducts an annual, large-scale survey of global ecommerce consumers. The Global Voices survey aims to draw out what really matters to global shoppers so that brands can meet and exceed their expectations.

German Population Demographics

When selling in an international market, it is essential to know basic demographics.

Germany’s population is currently 84.6 million people with women making up just slightly more than half (42.8 million women vs. 41.7 million men).

The population grew by 1.3% in 2022, with most of that growth due to immigration and an inflow of refugees from Ukraine.

While the median age of the German population (44.9 years old) is lower today than 10 years ago, it is still higher than the global median (30.3 years old). In Europe, Germany has the third highest median age. Italy’s median age is 46.8 while Portugal comes in second with a median age of 45.

Income and Internet Access

More than knowing basic demographics, brands with ecommerce channels also need to understand a market’s spending power.

Germany’s wages are on the rise with an average annual income of €49,200 ($53,550). The country has a higher average income than France, Italy and Spain.

When it comes to internet access, nearly 92% of the population has it with nearly 89% of the country having access to broadband. In 2022, German shoppers increased their online spending over 2021 for a total of $141.2 billion.

German Customer Expectations and Ecommerce Trends

To have a successful ecommerce presence in Germany, it is essential to understand what is important to German shoppers and what motivates them. To gain that understanding, let’s look at how 1,025 German adults who make online purchases responded to the ESW Global Voices survey.

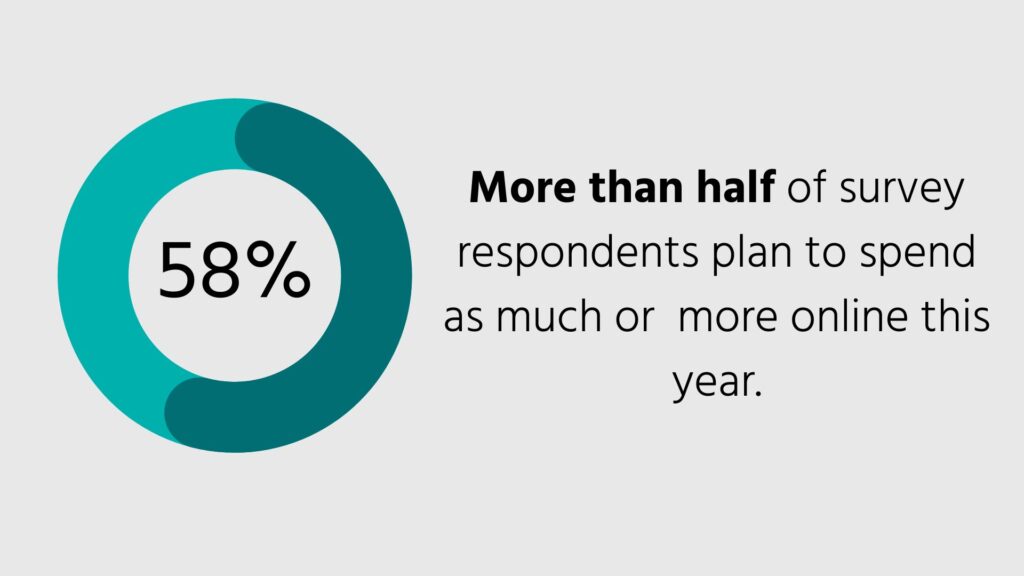

2024 Online Spending will Be Strong

More than half (58%) of respondents said they plan to maintain or increase their online spending in the coming year. What will spur that increased spending? According to the survey, 49% of those who plan to spend more say that they will be motivated by price. These shoppers will look online to get better deals than they can in brick-and-mortar stores.

Interestingly, German shoppers have relatively low expectations for what qualifies as a “good deal.” More than four in 10 respondents (43%) said that they consider a discount of only 20% or less to be a good deal. Brands do not need to resort to deep discounts in order to appeal to German shoppers.

Online Retailers Must Prioritise Security

Data security is top of mind for German shoppers. In fact, the number one reason survey respondents gave for not buying cross-border was concern about fraud. To alleviate these concerns, brands should prioritise data and purchase security. More than just prioritising security, brands should be transparent about protocols and ensure that security measures are clearly displayed throughout the purchasing process.

If a brand cannot properly deploy the security measures that German shoppers require, it is imperative to bring on a partner that can.

Clothing is the Most-Purchased Category

When it comes to what German ecommerce shoppers are buying, apparel is far and away the most popular category. Nearly 3 in 4 shoppers (74%) reported buying clothing online. Footwear follows as 58% of people said they shop for shoes online. And the third most purchased category is cosmetics with 42% reporting they had bought beauty products online.

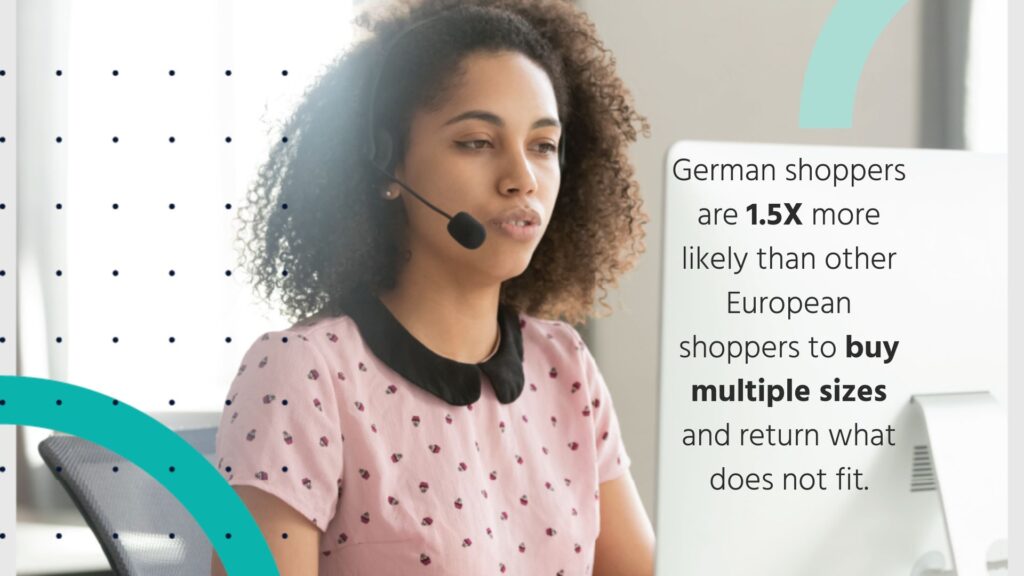

Return Rates are Higher than EMEA Average

Brands that have done business in Germany before are likely not surprised to read that German shoppers return items at higher rates than their European counterparts. This is due, in part, to local laws that allow items to be returned within 14 days for any reason or no reason at all.

On average, 9% of EMEA shoppers said they would order multiple sizes and return what they did not want. In comparison, 14% of German shoppers said they plan to bracket their orders.

Shoppers will Pay for Returns

Even though German shoppers are more likely to return purchases, they are not averse to paying for returns. In fact, 46% of respondents said they would purchase a product even if there was a nominal cost to return it.

When given the choices of paying for return shipping, paying a fixed membership fee that includes free returns or paying a restocking fee, most (37%) said they would pay for return shipping.

Local Payments and BNPL are Most Preferred

While German shoppers have access to and use credit cards, they prefer to pay with invoice methods. It makes sense, then, that out of 17 choices about intended shopping behaviour, the second most popular response (after participating in holiday shopping) was the use of BNPL options.

When asked what would make them more likely to shop cross-border, 22% of respondents said being able to use a payment method they were familiar with.

Taken together, brands need to ensure they give German shoppers secure, localised payment methods.

The Bottom Line

The German ecommerce market is an excellent market for brands looking to expand their global ecommerce footprints. The population is digitally savvy and has the disposable income to make online purchases.

But to succeed, brands must localise the customer experience. From payments to return policies to security and transparency, brands must meet German shopper expectations.

To ensure that your brand launches strong and achieves sustained growth and revenue in any market, talk to an ESW ecommerce expert.