This is the era of automation & AI!

Who would want the drag of manual accounting tasks?

After all, it’s all about being efficient with your time.

Maintaining records, storing countless documents & receipts, payment reconciliation, and keeping up with a tidy organization of contacts, bills, & invoicing. Phew!!!

It’s overwhelming and all this is a complete mess if you do it manually.

Subsequently, this raises a need for accounting software, which we have an abundance of in the market.

Essentially, the question is, how to keep it simple and try not to have a clutter of software going back and forth?

Let’s move forward.

Table of Contents

- Latest reports and key statistics about accounting.

- What is payment reconciliation?

- Best Practices for Payment Reconciliation Process.

- How to Implement Automated Payment Reconciliation?

- Xero Integration for Payment Reconciliation.

- How MakeWebBetter can help you?

- Automated Payment Reconciliation by FormPay.

- Benefits of Xero Integration with FormPay.

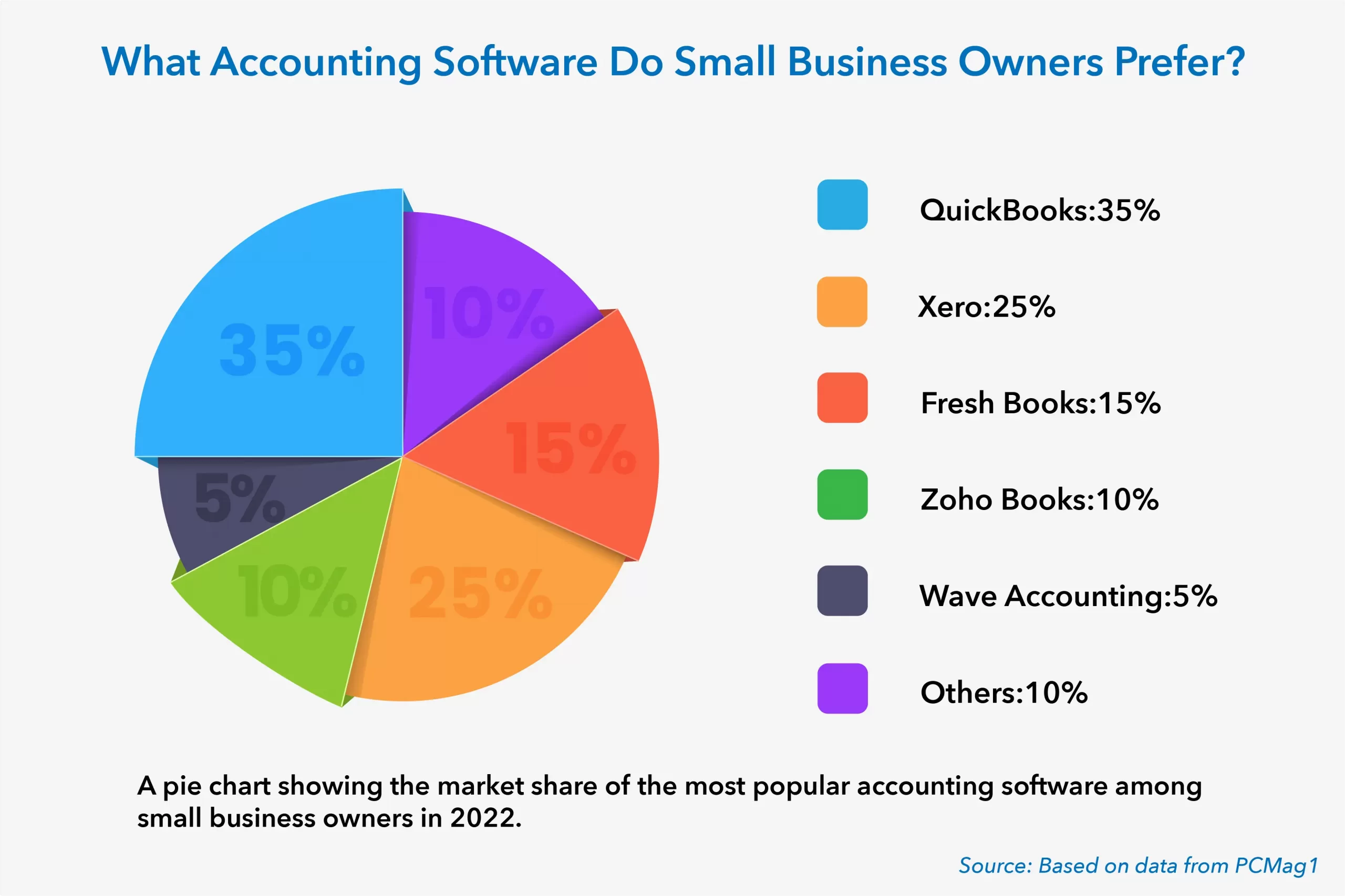

Few Accounting Statistics

- Quickbooks & Xero take the lead in top accounting software having a market share of 35% & 25% respectively.

- Companies with cloud accounting could handle five times more clients than businesses without cloud accounting.

- 77% of general accounting operations can be fully automated while 12% can be highly automated.

- 71% of CIOs expect their service delivery model to increase on account of automation activities.

- There are 3.5 million Xero subscribers worldwide, second only to Quickbook which is more popular in the US.

Payment Reconciliation Explained

Payment Reconciliation is the process of matching your General Ledger with every invoice and receipt generated. Meanwhile, this is to ensure proper bookkeeping, accuracy of the company accounts, and investigation of any differences.

The prerequisites of the Payment Reconciliation process are:

- Records on transactions – such as payment or billing.

- Access to accounting software, spreadsheet, or Record Retention System.

- Businesses may also save receipts, invoices, and billing paperwork.

What is Payment Reconciliation Process?

Essentially, the payment reconciliation process will involve four simple steps. Here, they are:

Step 1: Gathering Internal Documents

To begin – the process involves verifying your business transactions and invoices, whether stored in your payment or accounting software or offline. It is necessary to obtain these documents directly from their origin and then cross-reference them with external records.

Once, you’re done gathering data on issued receipts or invoices and other related documents. Next is finding the appropriate data through company accounting software or bank account data, to match with.

Step 2: Gathering External Documents

Now, ask your bank or finance department to provide you with the external records which show the inflow of funds. After acquiring the records, make them organized enough to be examined against your internal documents.

Finally, you will have all the data with you to begin the reconciliation process.

Step 3: Comparing and Reconciling Payments

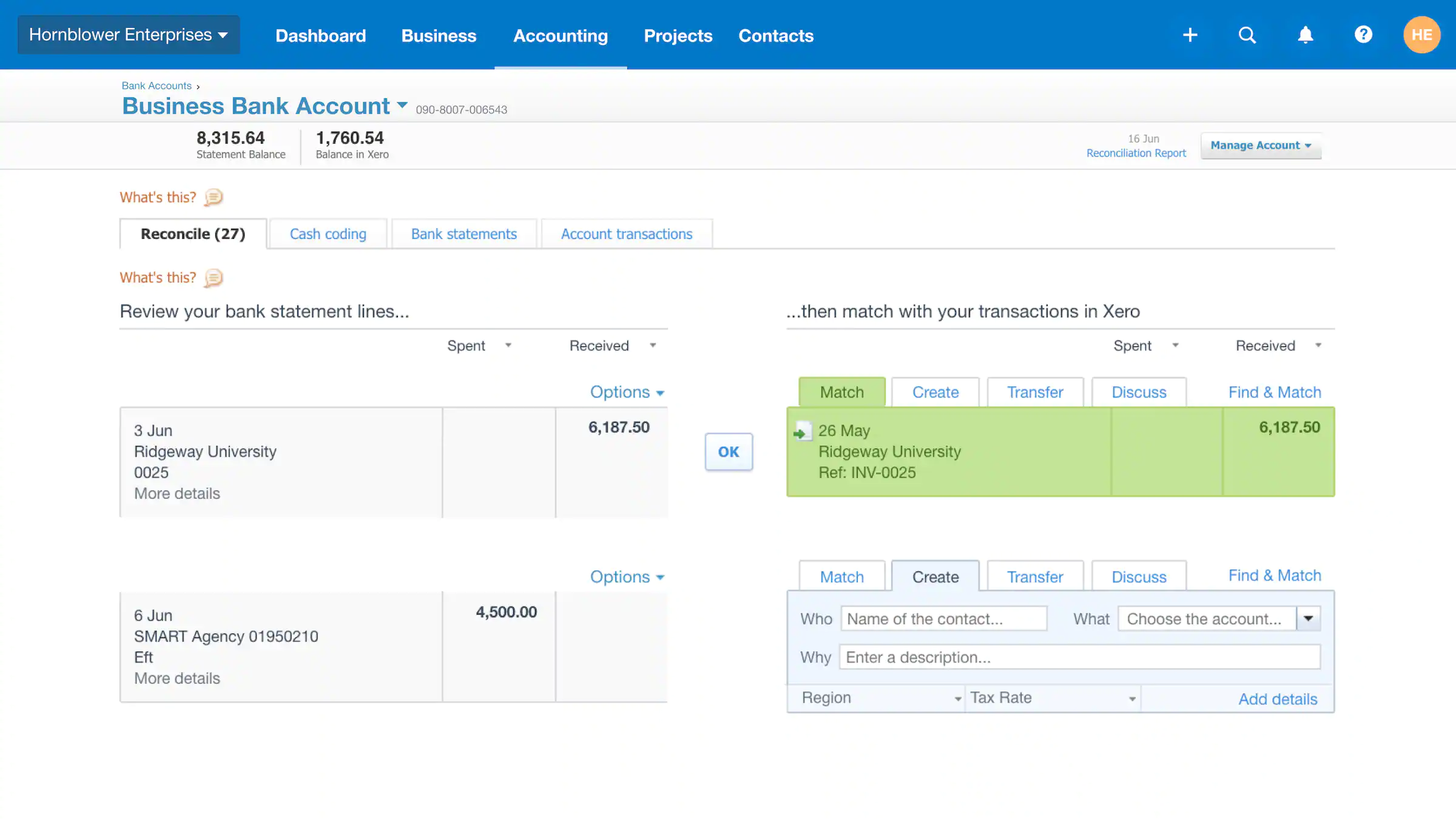

Here, be advised to use an accounting tool like Xero that facilitates automated payment reconciliation. Otherwise, the process of manually going through your records line by line could be exhausting and not reliable.

When you automate reconciliation process using payment reconciliation software, all the inconsistencies & omissions will be flagged without any further effort. Otherwise, you can do it manually.

Once you’re through the comparison stage, net you will have to investigate discrepancies that you might have found during the comparison.

Step 4: Investigate the Inconsistencies

Lastly, omissions and discrepancies should be attended to and investigated with the department accountable. And should be fixed Following in line with your internal processes, the inconsistencies you’re dealing with will need to be investigated further before you can complete reconciliation.

The moment, you’re done with the fixing the discrepancies, the reconciliation process is complete then.

Best Practices For Payment Reconciliation Process

Besides having a clear idea of the steps involved in the process, there are a few things to consider before you begin. Undeniably, there are a few best practices, following which you can perfect your reconciliation process.

Maintain Organized Records

Keep detailed and up-to-date records of all incoming and outgoing payments, including invoices, receipts, bank statements, and payment confirmations.

Reconcile Regularly

Perform payment reconciliation on a regular basis, preferably monthly or quarterly. This ensures the timely identification of any discrepancies or errors.

Match Transactions

Match each payment transaction with the corresponding invoice or customer order. Verify that the payment amount, date, and other details align with the original documentation.

Use Payment Reconciliation Software

Utilize accounting software that provides automated reconciliation features, to streamline the process and reduce manual errors.

Compare Bank Statements

Cross-reference your bank statements with your accounting records to identify any discrepancies or missing transactions.

Investigate Discrepancies

When you come across any discrepancies or unexplained differences during the reconciliation process, investigate them thoroughly. Contact relevant parties.

Segregate Duties

Implement a system of checks and balances by separating the responsibilities of handling payments, recording transactions, and reconciling payments.

Document Reconciliation Process

Document your payment reconciliation process, including the steps followed, tools used, and any specific requirements.

Seek Professional Advice

If you encounter complex reconciliation issues, consider consulting with an accounting professional or seeking advice from a financial advisor.

Make sure you follow the above practices when you’re trying to automate reconciliation process, so as to remove any flaws and errors.

How to Implement Automated Payment Reconciliation?

In the past 3 decades, the payments landscape has transformed immensely. With multiple payment gateways, different transaction fees, and multiple billing methods, it gets hard to follow payment reconciliation manually.

Consequently, in today’s era of online purchases, the manual payment reconciliation process can never suffice. The payment Reconciliation process only involves cross-checking and fixing omissions in your account balances, with respect to invoices and payment records.

Thus, to implement automated payment reconciliation, all you need is:

- A payment processing platform that helps store and keep track of transaction data effortlessly.

- With the above, An automated invoicing software to avail error-free documents, for the payment reconciliation process to begin with.

- An accounting software to maintain your ledgers and store information regarding customers and transactions made under names.

- Besides every requisite, you must have a payment reconciliation facility with software that reads stored invoices and matches them with your ledger. Also, tell you about missing data or discrepancies.

Thanks to the 21st century, you don’t need to manage everything separately and it’s easy to automate reconciliation process. Consequently, putting together your payment processing platform and integrating it with accounting software will suffice.

Xero Integration for Payment Reconciliation

Xero is an accounting software and is entirely cloud-based. This means you can access your financial data anywhere through a computer system with an internet connection.

Xero is a celebrated tool. For instance, it is esteemed for its user-friendly interface and real-time reporting capabilities. The features and its quality interface makes it a valuable tool for businesses of all sizes.

Moreover, its integration capabilities with various financial, business and payments apps, allow improved efficiency.

In brief, the key functions of this cloud-based accounting software include:

- Bank reconciliation

- Invoicing and billing

- Expense tracking

- Reporting and analytics

- Mobile app and integrations

- Payroll management

- Time tracking

How MakeWebBetter Can Help You?

MakeWebBetter is a HubSpot Elite solutions partner. The HubSpot eCommerce agency focuses on alleviating the eCommerce experience worldwide, helping businesses grow and become scalable.

Amongst the eCommerce solutions offered by MakeWebBetter, HubSpot eCommerce integration services, website development & migration, inbound marketing and apps like FormPay is the ultimate win.

FormPay Overview

FormPay by MakeWebBetter is a HubSpot partner app. It is designed to help you accept payment anywhere in the world. The payments are enabled by leveraging the access to data of the HubSpot forms you have with the free HubSpot version.

The payment tool is home to many payment gateways — PayPal, Stripe, Amazon Pay, Authprize.net, PayU, Razorpay, and Adyen. With this, FormPay enables the most popular payment modes for 100% secure online transactions worldwide.

In addition, FormPay also has Xero integration for payment reconciliation and invoicing, which makes it a fabulous payment reconciliation software. Moreover, it also has reporting and analytics capabilities with its collaboration with Google Analytics and Microsoft Clarity.

FormPay Features That Stand Out

FormPay lets you accept payments using the free HubSpot version. It collaborates with multiple payment gateway providers to facilitate payment processing. These gateways use top-tier encryption to store customer information and payment data.

Besides this, you have in-app management access for payment forms, transactions, data, and features that augments your payment infrastructure. So, you get everything to revamp your payment service with FormPay.

- Global Reach – Accept Payments anywhere in the world.

- Contact Sync – Sync all your payment data in HubSpot as properties and lists.

- Multiple Gateways – PayPal, Stripe, Amazon Pay, Authorize.net, PayU & more.

- Customizable Payment Forms – Suits branding & versatility.

- Discount Coupons – Coupon functionality with payment forms.

- Product-specific Forms – Create products and sync them with HubSpot.

- XERO Integration – Sync contacts & invoices with Xero.

- Online Payment Reconciliation – Xero enabled payment reconciliation.

- Handy Management – Monitor or repurpose forms, coupons & products.

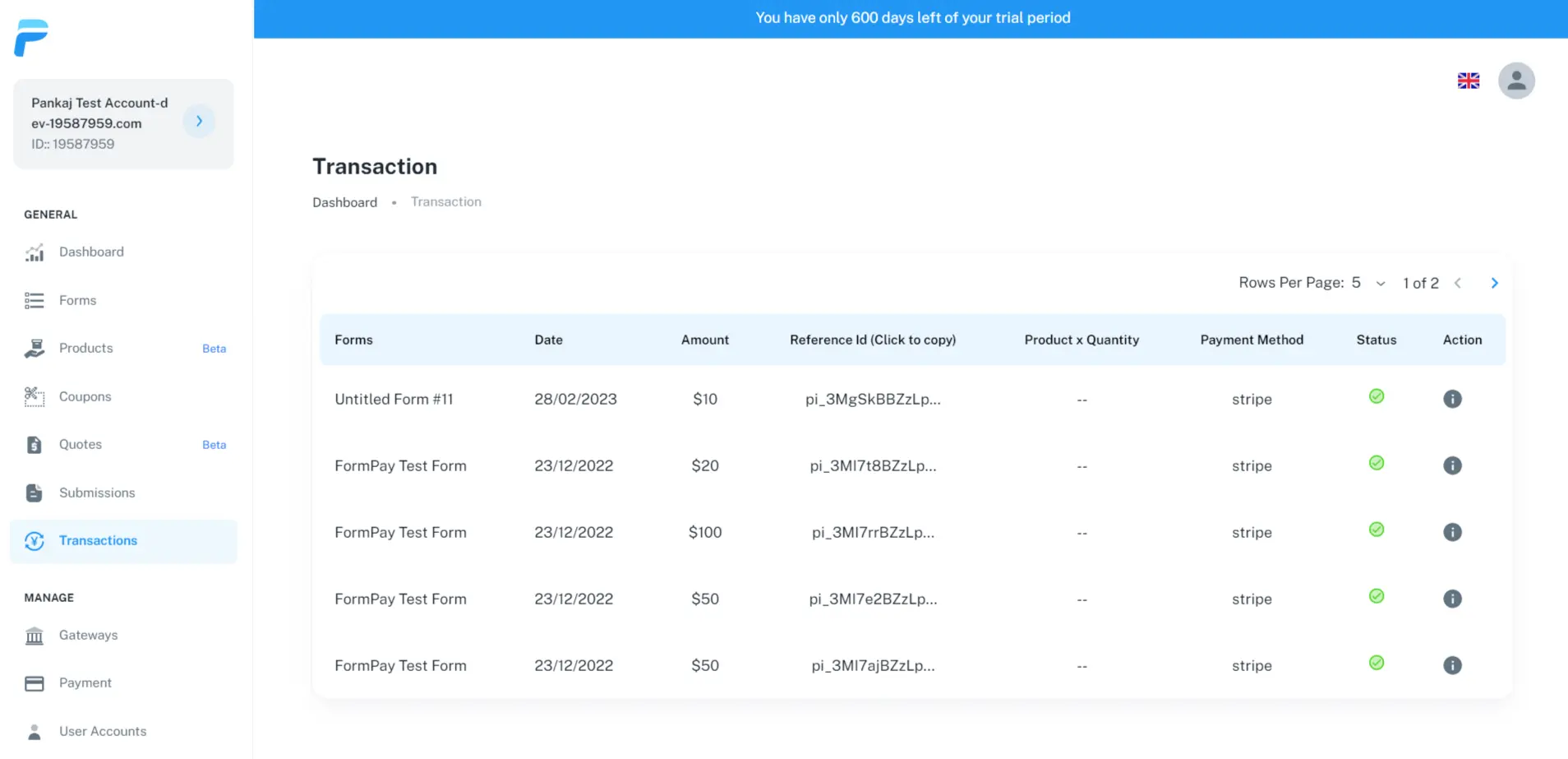

- Transaction Tracking – Monitor transaction data with all the details.

- Donation Form Settings – Create specialized donation forms.

- Subscription Business – Accept recurring payments.

Need a better HubSpot Payments alternative?

With Formpay you can collect payments in HubSpot CRM. Anywhere in the world with any gateway.

Automated Payment Reconciliation by FormPay

A payment reconciliation software will save you a lot (time, effort & money of course). A part of the payment reconciliation process i.e. collecting and organizing data, is already done by FormPay.

In fact, your responsibility is just a few clicks to set up the integration for XERO & FormPay. And you can leave it to automation.

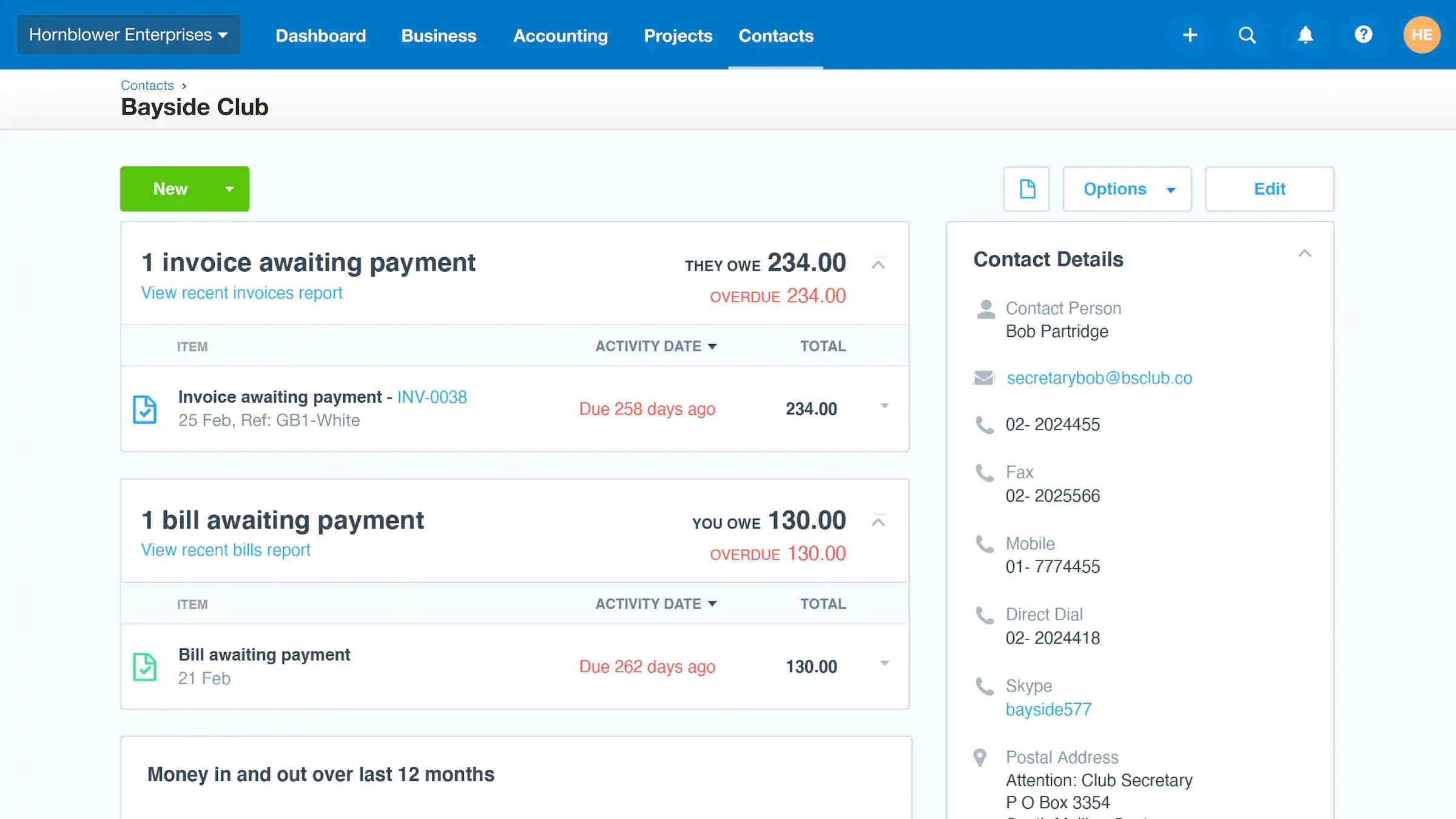

Contact Management

Without a doubt, the customer who just bought from you is the prospect for the next purchase or potential source of reference.

It’s essential to maintain proper records and enlist the activities & purchases performed by your customers. Evidently, this empowers you to communicate, share information, and perform quality marketing campaigns.

All this data synced in Xero,

- Gives you an overview of the contact transaction history.

- Manage contact details and store respective documents for them.

- Creates Lists and Groups to organize your contacts.

Following this, view details of a customer’s or supplier’s sales, invoices, and payments in Xero Contacts.

Payment Invoices

On the other hand, FormPay keeps transaction records with it. This includes all the information regarding – the payment gateway used, total spend amount, reference id, date, status, and everything.

Furthermore, this data is also synced into HubSpot and is added to contacts as timeline events. Once you set up Xero integration all this data will be synced to your Xero account.

Online Payment Reconciliation

FormPay enables online payment reconciliation with Xero. Evidently, all the contacts & payment invoices synced in your Xero account make the payment reconciliation process painless and quick.

Unquestionably, the more reliable data you have in place the smoother process when it comes to online payment reconciliation. It’s so much easier and has other perks like:

- Easy to organize and manage data.

- Frictionless comparison through automated payment reconciliation.

- Quick identification and easy allocation of discrepancies and omissions.

- Marvelous interface to perform online payment reconciliation.

Got Questions?

Find more help understanding the FormPay app through these links.

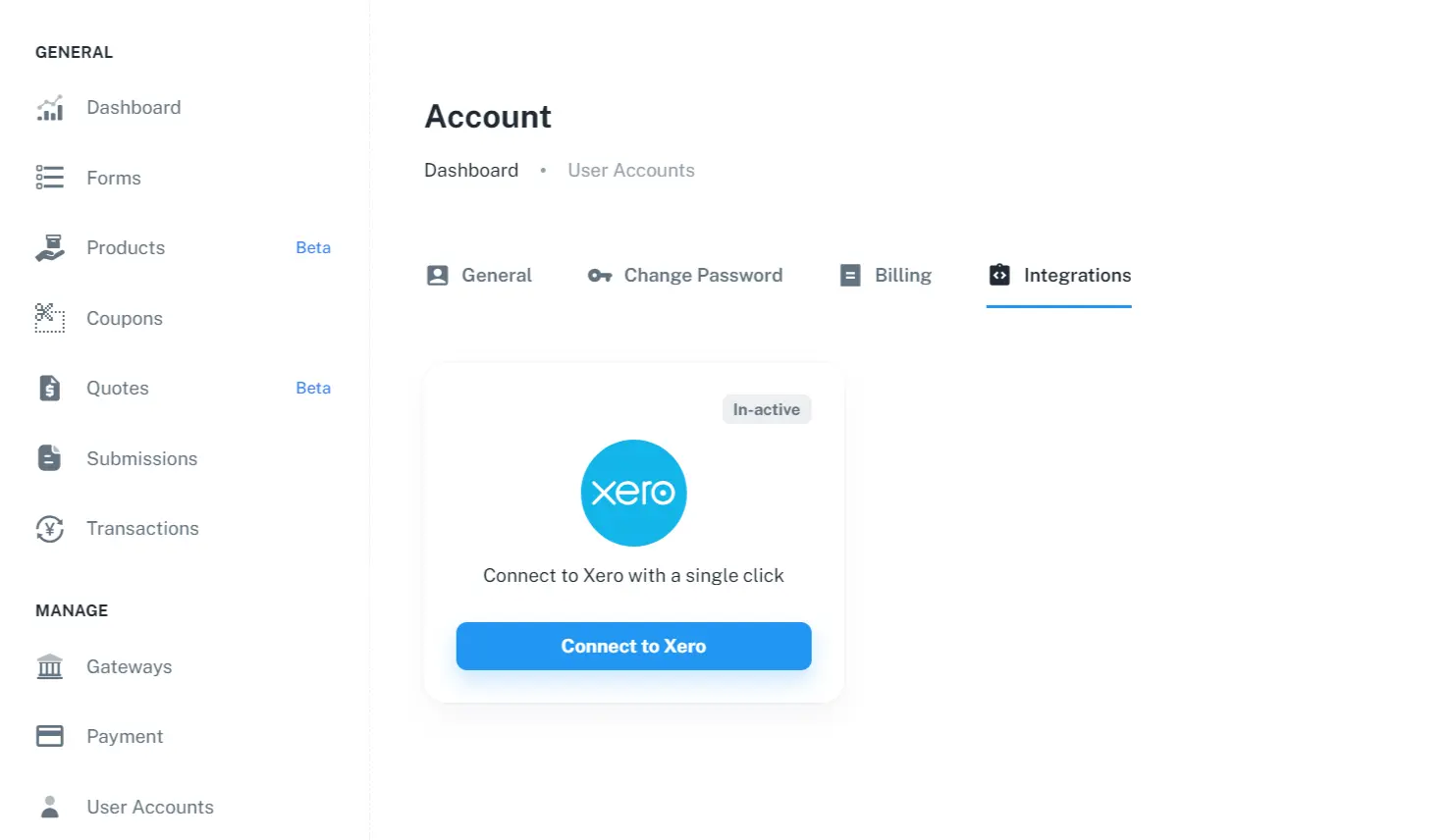

How to enable Xero Integration For Payments?

Take out 2 minutes and follow these simple steps to set up FormPay Xero Integration:

- First, visit the FormPay app.

- Begin by scrolling down and then click on User Accounts from the sidebar on the left.

- Then, go to Integrations.

- Next, click Connect to Xero button. Then, you’ll be redirected to Xero’s webpage.

- On the next page, enter your Xero credentials and click Log In.

- That’s it! Your Xero account will now be successfully integrated into FormPay.

Benefits of Xero Integration with FormPay

Integrate Xero For Free

The Xero Integration is aree. If you have a XERO account, then it becomes supremely handy to keep a record of all your transactions.

Although, these records are primarily used to generate invoices. But, it has other purposes too – for instance, creating RFM-based segmentation.

Maintain Real-Time Payment Records

For instance, say you need purchase records and contact information to create a personalized experience, communicate, recover abandoned carts, or to run email marketing campaigns.

Yet, would you be willing to create an RFM-based list before you begin? Of course not. Most payment processing software such as FormPay allows you to sync records in real-time. (FormPay integrates with HubSpot & Xero accounts).

Effortless Payment Data Syncing

Apart from transaction tracking, this integration will provide your Xero account the data including customer details, encrypted card information, and transaction details.

Automated Invoice Generation

Integrating Xero with FormPay will give you everything you need to streamline the invoicing process. As all payment data & transaction details are synced to your Xero account, you can use this information to generate invoices.

The Gist of it…

Automation is the key to simplifying complex operations and capitalizing on the time saved. As part of accounting, payment reconciliation is compulsory and should be a recurring process.

Although, doing it annually will result in human errors, discrepancies, and time wastage. Most certain way to accomplish a flawless payment reconciliation process is to integrate the source of your payment data and invoices with your accounting software.

It’s amazing how a small thing can play a big role in the overall success of the business. Cheers on taking a step towards one such thing.