E-commerce Shipping: Everything That Is In Control And That Isn't

As an e-commerce merchant, you put in a lot of effort to meticulously curate the stage of the customer journey that is under your control to motivate them to click that “BUY” button, make a successful sale, and bring in profits.

However, at this critical juncture, the reins of control slip from your grasp.

This part of the customer journey that follows: from dispatch to delivery or, in some cases, returns — known as “the post-purchase phase”, is filled with uncertainties and challenges.

To make things worse, these challenges have the potential to hurt your business and undo all your efforts till that point.

Inevitable Post-purchase Issues and Their Impact on Your Business

The post-purchase phase is highly error-prone. Once shipped, your customers’ packages inevitably encounter unforeseen issues such as getting lost and damaged while in transit.

- 32% of customers say that they have not received at least one package they ordered in the past six months because their packages were lost in the mail.

- 7% to 11% of customers’ online orders arrive broken or damaged

- $500K is the estimated loss for e-commerce businesses just from lost and damaged packages in a year

Over time, businesses that consistently face lost and damaged package issues have a competitive disadvantage and face a negative impact when it comes to growth.

So, what is it that you can do to ensure that your bottom line stays protected, each time lost or damaged package incidents happen?

This is where shipping insurance steps in to save the day.

What is Shipping Insurance And Why Is It Important For Your Business?

Shipping insurance is a safety net that is designed to protect e-commerce shipments, particularly against loss and damage.

If an insured parcel gets lost or damaged while being shipped or the contents in the package go missing, then you are entitled to a financial compensation of the package value or the insured value from the insurance service provider.

There are multiple reasons why shipping insurance is necessary for your e-commerce business:

- Peace of mind from the assurance of financial security and thereby having reduced concerns about potential delivery incidents.

- Protection, especially against high-value goods such as jewelry and electronic items going missing and packages getting lost or damaged during transit.

In short, with parcels insured, you will no longer have to worry about losing money due to delivery issues.

Instead, you can both confidently approach customers who’ve faced delivery issues with your repeat purchase efforts, as well as direct the expenses towards growing your business and stay ahead of the competition.

If you’re unaccustomed to shipping insurance — we’ll get right to how you can get started with choosing the right service provider for your needs.

On the other hand, if you’re someone who’s been insuring your packages via old-school techniques, here’s why it may not be the best option for you in the current state of e-commerce and package deliveries.

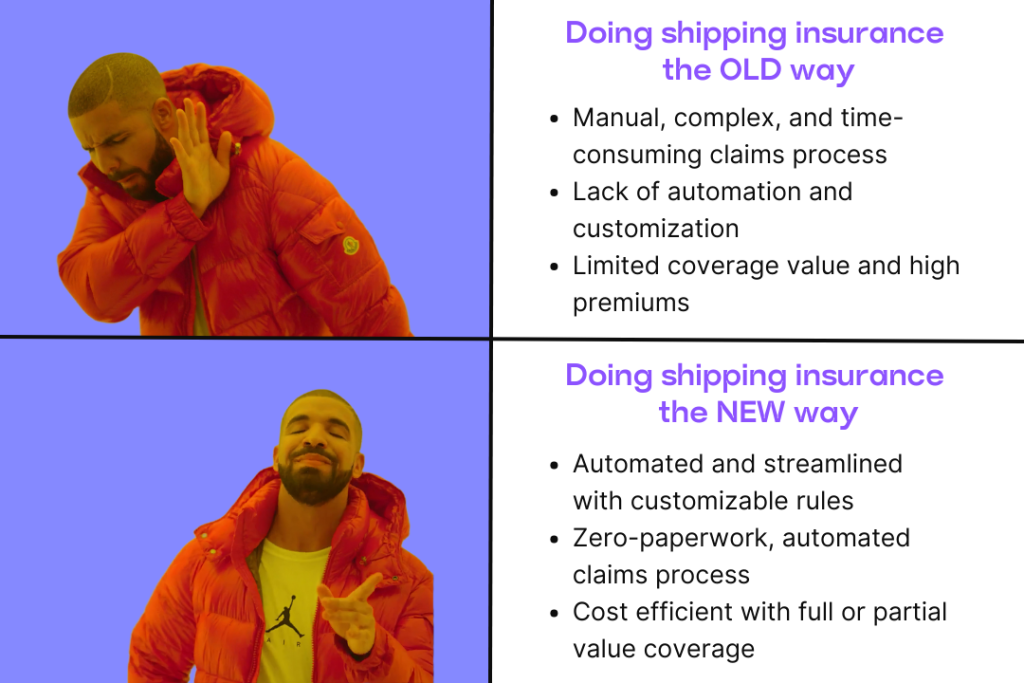

Why Old-School Shipping Insurance Techniques Might Not Make The Cut in Today’s Post-Purchase Landscape

Generic shipping insurance options can provide a certain level of protection. But in the current state, where lost, damaged, and missing package incidents are repetitive in occurrence, they may not always be sufficient for your business for several reasons:

- Limited Coverage: Generic shipping insurance options often come with limitations on what they cover. They may not fully cover the value of high-ticket items or certain types of products, leaving you exposed to dealing with potential financial losses.

- Complex Claims Process: Filing a claim for lost or damaged goods through generic options can be complex and time-consuming. Customers may need to file manual claims, provide extensive documentation, follow up regularly, navigate through a bureaucratic system, and wait for an extended period to receive their compensation. This can be too much of a hassle.

- Lack of Customization: Generic insurance options typically offer just one type of solution for all needs, thereby preventing you from tailoring rules and coverage options based on specific preferences.

This brings us to address the need for specialized shipping insurance solutions that are well-integrated into your post-purchase efforts and offer diverse benefits that make things easier for you.

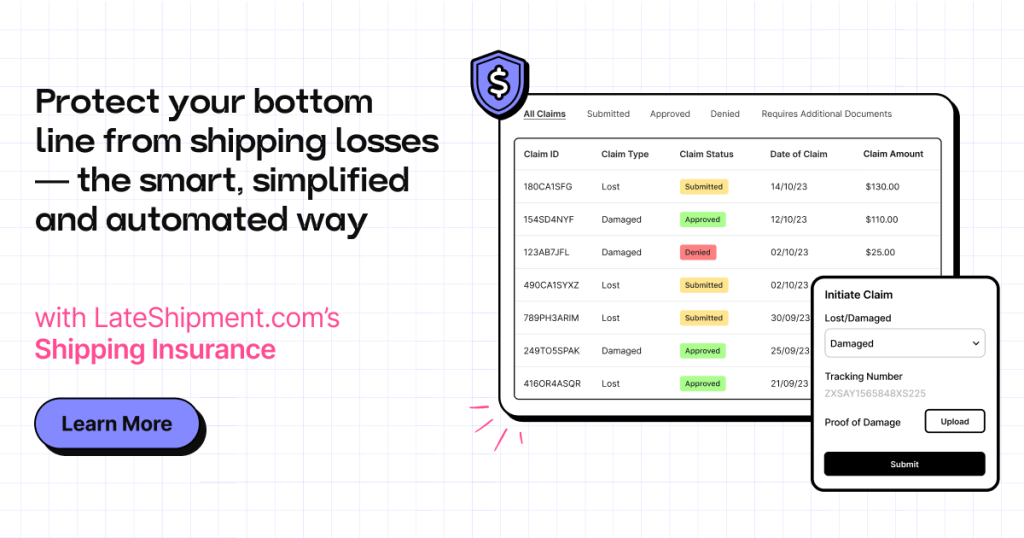

For specialized solutions that are designed to help you stay ahead of shipping losses and damages, meet LateShipment.com’s E-commerce Shipping Insurance.

Introducing LateShipment.com's E-commerce Shipping Insurance — Smart, Simplified, and Automated

Generic shipping insurance has always been rigid and unreachable for the average e-commerce merchant and we at LateShipment.com wanted to change that status quo and make things accessible and convenient.

With claims backed by “A” rated U.S. insurance company Shipsurance, we are bringing shipping insurance into our existing post-purchase suite to offer comprehensive insurance coverage that brings substantial savings compared to carrier-provided insurance and expedited claim payments.

Here are the specific ways LateShipment.com’s Shipping Insurance stands apart while being beneficial to you.

LateShipment.com: the (Revolutionary) New Way of Insuring Your Parcels

What’s Covered?

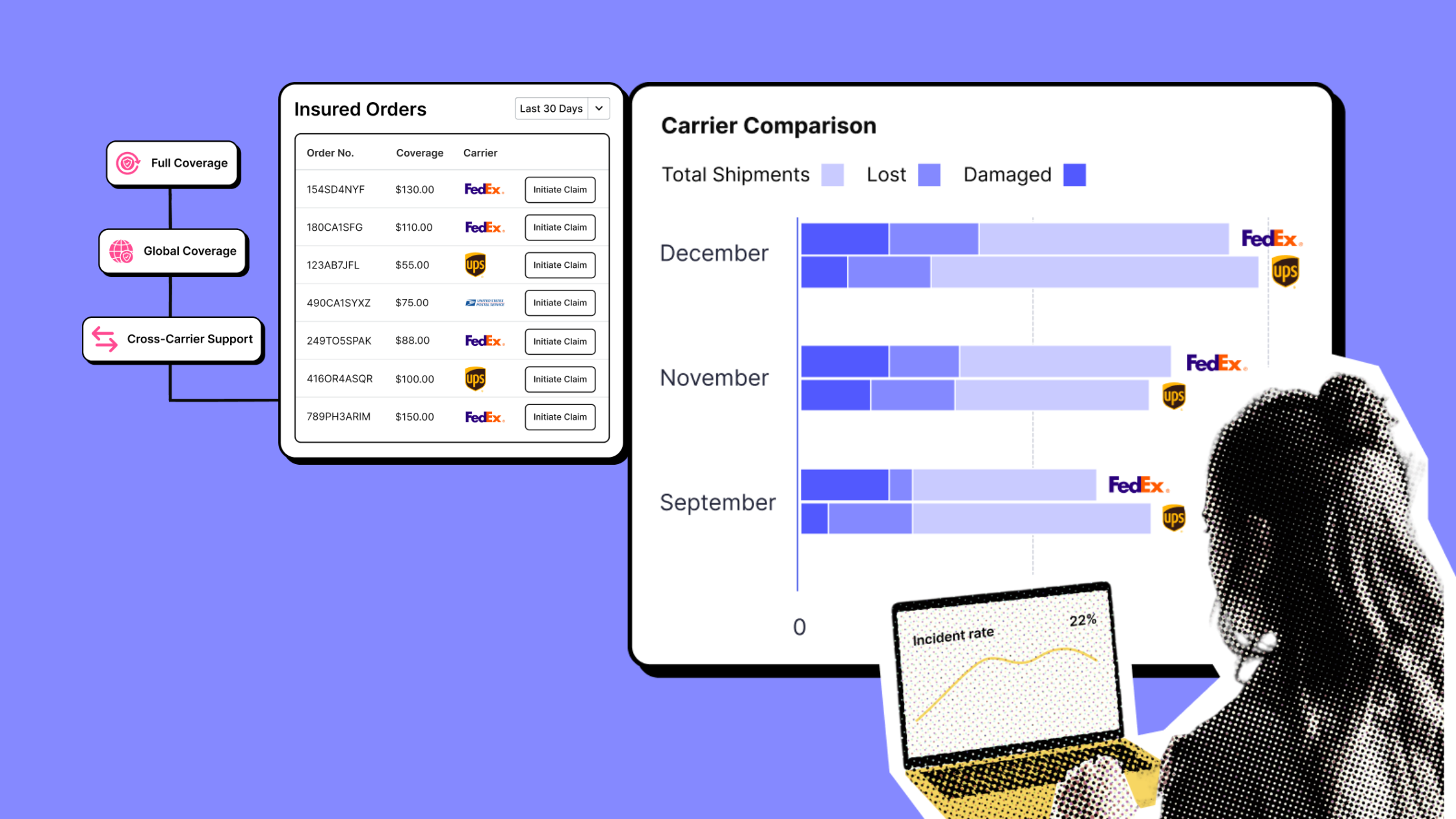

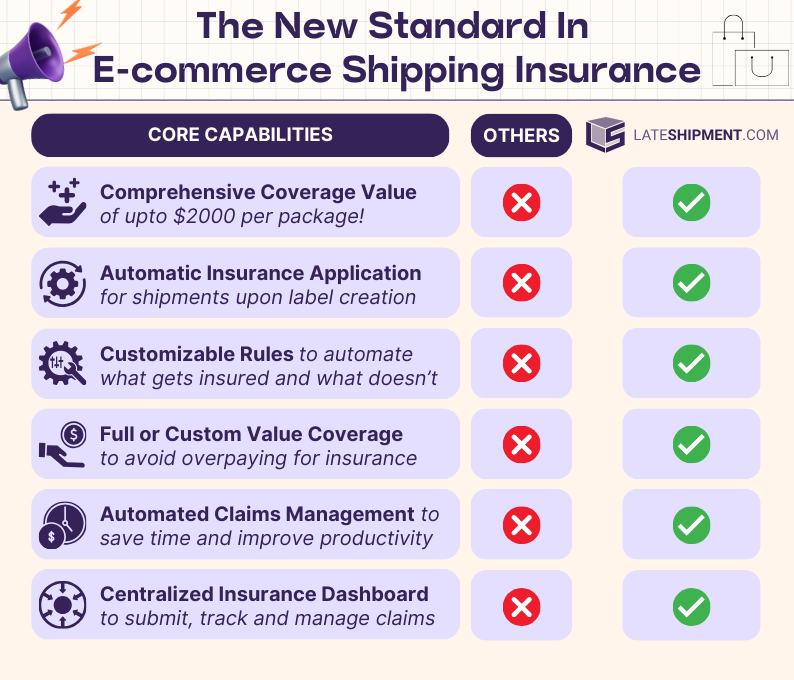

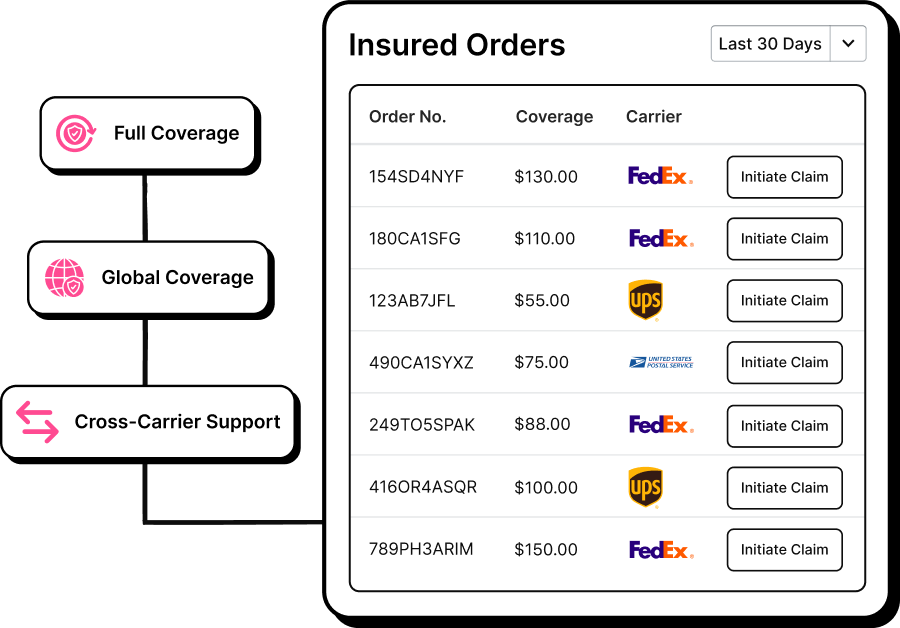

Comprehensive shipment protection – With every incident of lost, damaged, or missing items being claimed for coverage of up to $2000 per package across the globe, involving a majority of shipping carriers, LateShipment.com offers highly comprehensive shipment protection that you can ship out on every order with peace of mind.

What’s new?

- Forget the hassle of opting to insure with every order – Seamlessly include insurance into your order fulfillment workflow, with automation that begins as soon as the label is generated.

- Your insurance, your rules – Tailor your rules just to insure the shipments that align with your unique insurance needs.

- Ensure you are never over or under-insured – Flexible coverage options to help you avoid overpaying for insurance. Opt for a full shipment value cover or set your preferred rate and include shipping costs if needed.

- Add insurance on-demand – Small business or occasional shippers? We’ve got your back. Effortlessly add insurance on your own just when you need it, in one click.

- Centralized claims management – With all things insurance happening inside a unified portal, you have access to a centralized view of submitting claims, tracking statuses, and everything else.

- Quick claims from the Help desk – Enable your support agents to address lost/damaged tickets instantly with a claim portal right inside the helpdesk.

What’s better?

Following and managing claims being a hectic task is a thing of the past. With our automated claims management in place, manage Insurance claims effortlessly.

- Effortless claims handling – As our claim management is an automated process, it only takes 2-steps from your end to select the shipment and upload your proofs. Automation will handle the rest.

- Lightning-fast claims approval – The best part, your claims are resolved in a very short time of less than 5 days, so you can gladly skip the waiting period.

Discontent due to package losses and damages is a thing of the past.

With comprehensive risk coverage, intelligent automation and claims easier than ever, LateShipment.com’s Shipping Insurance is the smarter way to protect your bottom line.