Amazon and Walmart’s Fight for Online CPG Wallet Share

Amazon has long been a dominant force in US ecommerce, as it lays claim to the biggest share of total ecommerce dollars spent, has the largest retail media ad network, and enjoys strong customer loyalty through its Prime membership program. In recent years, though, Walmart is steadily fighting back, including rolling out the Walmart+ membership program on the path to building an ecommerce empire, and growing a strong retail media network along the way.

When it comes to day-to-day essential purchases like beauty, food and beverage, and over-the-counter health products, both Walmart and Amazon account for a huge share of online interactions, but the winner between the two varies significantly by product category.

Here we’ll examine how these two giants stacked up against one another when it came to consumer preferences using the results of Tinuiti surveys studying beauty, food and beverage, and over-the-counter health product customer journeys.

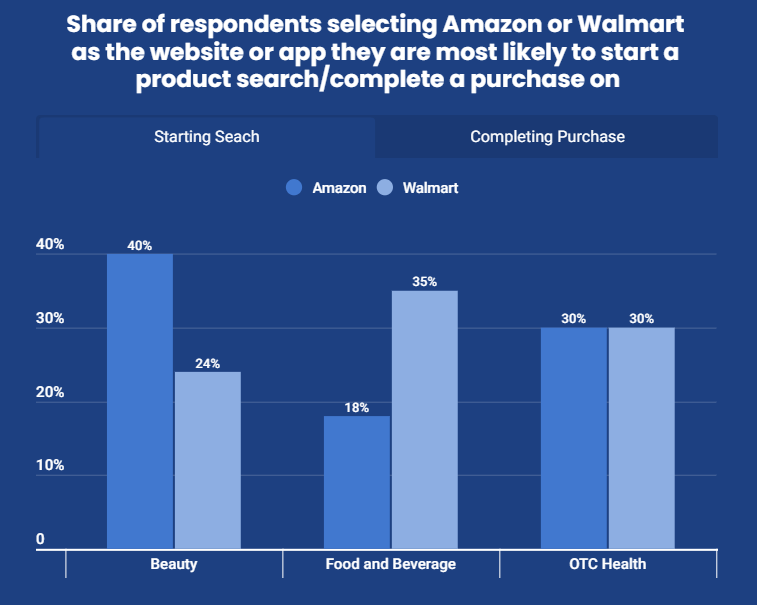

We asked more than 3,000 US shoppers across three unique surveys where they were most likely to start online product searches for beauty, food and beverage, and over-the-counter health products. For all three product categories, Amazon and Walmart were the two most popular responses.

For beauty shoppers, Amazon beat out Walmart for the top spot, with 40% saying they first turn to Amazon for these searches. In the case of food and beverage, a category where Amazon’s popularity has lagged its market share for other product types, Walmart had the highest share of shoppers select it as the place to start online searches.

When it comes to over-the-counter health products, Amazon and Walmart are in a dead heat for the number one destination for online search.

In the case of all three of these categories, more than 50% of respondents selected either Amazon or Walmart as the best place to start online searches, and both Amazon and Walmart accounted for at least 19% of responses in each category. This highlights how important both platforms are when it comes to online product search, and CPG brands should certainly be looking to maximize their presence on each.

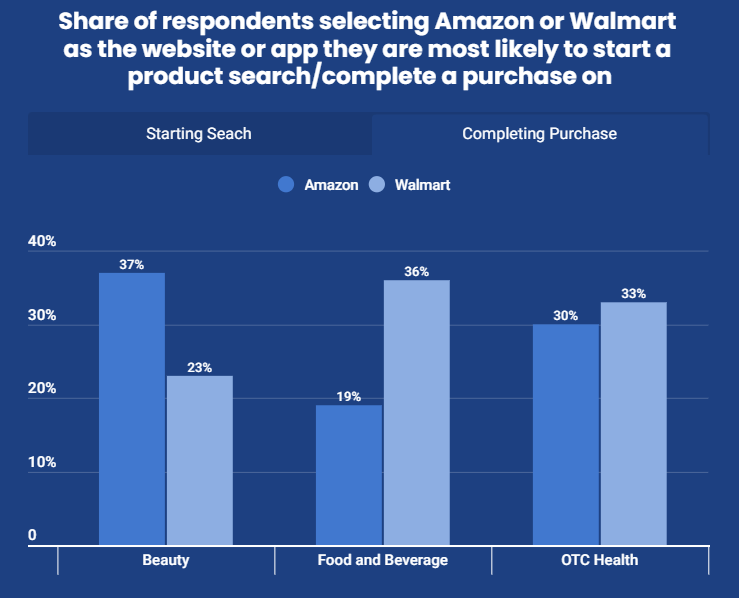

This is especially true because shoppers who start on Amazon or Walmart often finish on Amazon or Walmart. The share of shoppers who selected Amazon and Walmart as the online place they were most likely to complete CPG purchases was very similar to the share of shoppers who say they start searches on these sites across all three product categories.

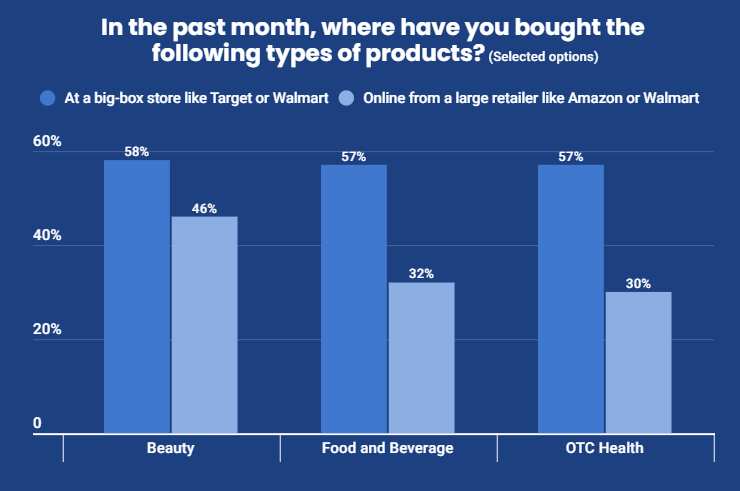

That said, marketers shouldn’t just look to Walmart and Amazon as sources of online orders.

Not surprisingly, the most popular destinations for CPG purchases remain brick-and-mortar stores. Respondents selected big-box stores like Target and Walmart as the place they most often make beauty and over-the-counter health purchases, and chose grocery stores, generally, for food and beverage purchases (followed closely by big-box stores).

Given Walmart’s dominance in the brick-and-mortar realm, marketers should be sure to account for the huge spillover effect searches on its website have when determining retail media investment. This is also increasingly becoming an important part of measuring the value of Amazon ad investment, even if its brick-and-mortar presence through Whole Foods and Amazon branded stores isn’t as robust as Walmart’s. Simple online return on ad spend doesn’t measure the full value of ad dollars spent for brands that sell in physical stores.

Based on the results of Tinuiti’s 2023 CPG Customer Journey report, Walmart and Amazon dominate the competition when it comes to searching or buying CPG products online. Marketers in any of the three product categories studied (and beyond) should be looking at both of these giants for the opportunity to get products in front of online shoppers to grow product awareness and drive sales, both online and offline.

The full report also shows how players like Target and Google fare against Amazon and Walmart, with a number of insights from a generational perspective that help to illuminate each step of the consumer path to discovering, researching, and purchasing day-to-day essentials. Access it today for an interactive look at all of the key takeaways.