The Banking Crisis Will Send New Ripples Through Tech Budgets

Three bank failures in a matter of weeks (Silicon Valley Bank, Credit Suisse, and Signature Bank) have put policymakers and regulators into action to restore enhanced prudential standards, revise liquidity coverage ratios, and tighten credit and capital market rules to restore market confidence. Regional banks will brace for stricter risk control, a lending pullback, and withdraws in deposits as depositors seek refuge in the bigger banks.

This crisis will send ripples through the tech industry, already weakened by layoffs in the first quarter of 2023:

- The crisis will exacerbate a slowdown in funding to tech startups. Constraints on capital access will raise costs for tech startups. The tech industry is still recovering from the pandemic: Tech companies that went public during the COVID-19 pandemic bull market have had a median return of -44%. Early-stage software companies looking for investments might plan early exits and deals based on 6–8x valuation multiples, a one-third discount on pre-pandemic deals. Private equity and large corporations will look to acquire high-growth tech companies, while tech startups that burn cash or are unprofitable will find it harder to borrow money.

- Fintech funding will be disproportionately impacted. Credit will be harder to find for smaller fintech companies. Seventy-one perent of fintech IPOs since 2020 were from Silicon Valley Bank (SVB) clients, with SVB making $3.8 billion in loan commitments to US fintechs. Fintech funding has already receded to 2018 levels — a phenomenon not helped by larger banks tending to be more reluctant to invest in fintechs. Fintech access to liquidity and venture capital will further tighten as investors get more choosy in their investments and investment timings, even with a significant amount of “dry powder” in markets.

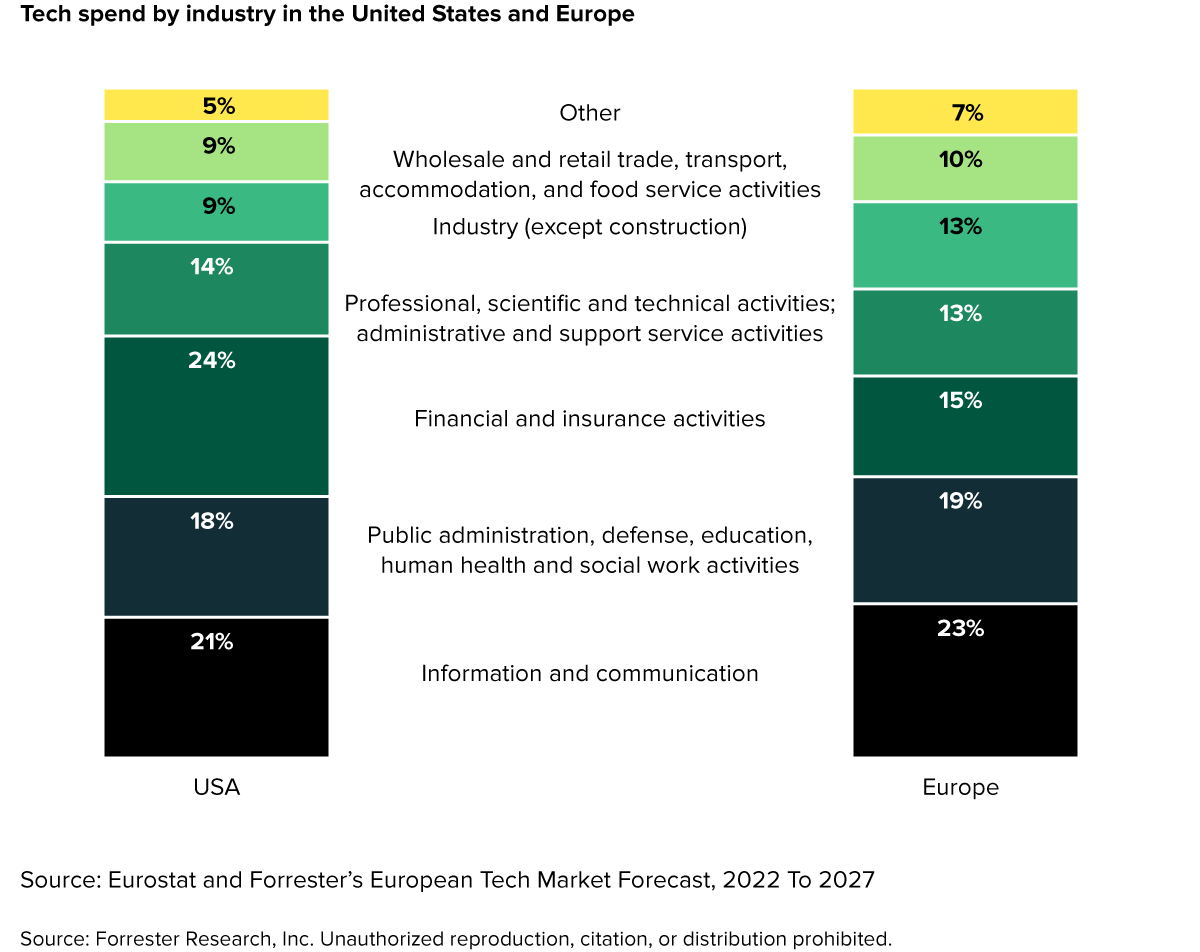

- Tech spending growth in banking, financial services, and insurance will slow. The banking, financial services, and insurance sector (BFSI) is a main contributor to tech spend, capturing approximately 24% and 15% of tech spend in the United States and Europe, respectively (see figure below). Though the movement of deposits to larger capitalized lenders could translate to a net neutral impact beyond 2023, the immediacy and tumult of bank failures may cause a short-term drop-off in tech spending for the industry.

- Tech spending growth in IT services will also slow. IT services companies have high exposure to BFSI. Indian IT service companies draw the bulk of their revenues from the financial services sector. TCS, Wipro, Infosys, and Cognizant drive more than 30% of their revenues from the BFSI sector, leaving them more exposed than Accenture. Liquidity concerns for BFSI across the US and Europe can constrain tech spend growth. A banking crisis could delay the ramp-up of critical IT projects, impacting key revenue targets and pushing back new order closures that can drag down the IT services market in 2023.

Despite these challenges, Forrester’s report, US Tech Market Forecast, 2022 To 2027, highlights that the BFSI sector is resilient with historically strong growth in tech spend. Investments in data centers, cybersecurity risk mitigation, and the migration to cloud will remain important drivers for long-term tech spend.

To learn more about the relationship between the banking crisis and tech spend, please schedule a guidance session or analyst conversation with Michael or Himank.