Search, The Next Big Category In Commerce Tech, Is Crucial To CX And Success

Our newly published Vendor Landscape for Commerce Search and Product Discovery lists the 28 most notable vendors in the space and details the 10 most important use cases they’re focusing on for clients today.

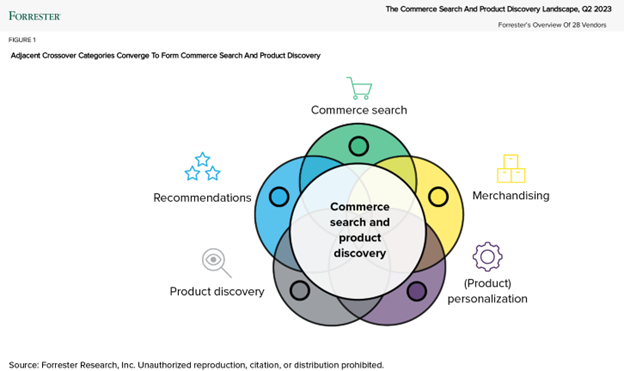

Yes, you read that right: 28 notable vendors. When I announced the new Forrester Wave™ for the Commerce Search and Product Discovery market, I described this new category as a “convergence.” Indeed, vendors that self-identified as “product discovery,” “merchandising,” or “commerce search” have acquired other solutions and built out their functionality. These expansions brought these previously separate categories into overlapping functionality. The Venn diagrams of these previously specialty groups now look more like a circle as the overlap is so extensive.

In fact, when we began researching this space, we had a handful of usual “commerce search” suspects. As we broadened our scope to include the converging markets, we uncovered a much wider landscape of products.

Product Discovery Drives Customer Experiences – And Business Goals

The core (required) functions of a solution in this category are search itself (keyword search and vector/semantic search) and tooling for non-technical practitioners. These few words represent a broad set of functionalities that serves to improve the customer experience during the crucial product discovery process.

Through a combination of human tuning and AI automation, the system presents customers with products they’re most likely to buy (or the products that meet other goals, such as profit). Customers also control their own experience by using filters to narrow results to those they’d most like to see.

However, the extended (less common) use cases represent a remarkably varied selection of functionality. Just a few extended use cases that these solutions serve include:

- Product configurator/quiz. This functionality enables businesses to collect coveted zero party data within a micro-moment – information that customers share, both proactively and intentionally. Think of a quiz that walks a consumer through their skin type, complexion, and SPF preferences and captures intimate details about a customer’s makeup preferences, provided by the customer themselves. A product configurator that captures the make, model, and year of a vehicle to serve spare parts that fit also enables the business to continue to market compatible accessories to that customer.

- Optimization for shipping cost, inventory, etc. If anyone still thinks order management systems operate “just in the back office,” this use case should set them straight. The vast majority of customers want these controls when shopping. In fact, 72% of US online adults say it’s important to filter by inventory availability, per Forrester’s April Consumer Pulse Survey. But some search solutions take this a step further and enable digital businesses to prioritize products that are in closer proximity to the customer or are overstocked. Sometimes, it’s less about what a customer wants to buy and more about what the merchant wants to sell

- Combined search for content and commerce. Often, search solutions within the commerce experience surface more than just products. Every website provides some content that customers want (think: returns instructions or user guides) and search can serve those results. Sometimes, modular content sits alongside products as well (e.g., installation instructions when customers search for a product type – or showing recipes alongside ingredients).

This Market Is Still Evolving

As is often the case in the early days of a tech market, the rapidly evolving commerce search and product discovery market is still unstable. Even long-standing search players are integrating recent acquisitions or implementing the latest AI models. Digital businesses selecting a solution in this category should keep in mind that:

- You’ll want to identify the solutions that best support your top priority. Because of the convergence, many solutions are still growing into the new shoes they want to fill. Many have recent acquisitions they’re still integrating. Most are strongest in their original area of focus (e.g., search OR merchandising OR recommendations). Some even require an additional purchase to bring in a major functional area, such as search itself. Use the Extended Use Case by Vendor graphic in the Landscape. It indicates which extended (less common) use cases each vendor told us they’re most often selected to serve.

- AI is all the rage – but don’t confuse the tried and true with the shiny and new. While new AI models are our “top disruptor” in this market, AI is also the “primary challenge” as digital businesses struggle to prove the value and benefits of automated adjustments determined by AI. Just as merchandisers might be getting over their long-standing mistrust of AI due in part to a historical lack of accurate testing against manual settings, AI has exploded on the scene via new large language models (LLMs). Many vendors are rushing to implement newer models, with exciting expectations. Look for testing, validation, and monitoring for any performance impacts when adopting these new models

- A Vendor Landscape isn’t an evaluation. It was exciting to pull together this wide selection of commerce search products for our clients to review. But bear in mind, while Landscape reports provide the analyst’s view of a market and the products in the space, the vendors provide the information about their products; the analyst doesn’t determine it. We’ll publish our Forrester Wave™ for Commerce Search And Product Discovery – a true evaluation – in very late summer this year.

Questions? Forrester clients can book time with me (inquiry or guidance session) so I can help answer your questions about this evolving landscape. I’m here for you!