Despite the state of the economy not yet officially being declared a “recession,” there are plenty of telltale signs — e.g., weakening consumer confidence, escalating inflation, more value-seeking behaviors — that we need to be operating like we’re in one.

Doing nothing is not an option.

Leading brands always need a plan to preserve sales and market share, and stanch losses during times of economic uncertainty.

Here are 10 things brands should be doing now:

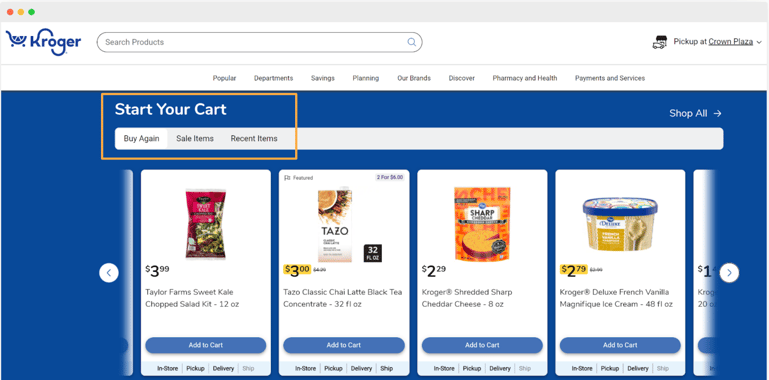

1. Win the list and lock in loyalty

As consumer behavior shifts toward more planned and less impulse or discretionary purchasing, it becomes that much more important to get in the consideration set and win re-purchase. One way to do this is by investing in subscription programs, like Amazon’s Subscribe & Save, and other lock-in mechanisms (e.g., “buy again” lists).

PRO TIP: USE AVAILABLE TOOLS TO GET IN THE CART EARLY; THEN LEVERAGE "BUY AGAIN" CAPABILITIES TO DRIVE REPEAT PATRONAGE

2. Revisit the shopper value equation

Hone your USP (unique selling proposition) to zero in on the right balance of price / convenience / quality. During recessionary times, how you communicate your price / value proposition becomes key. So, be sure to review your product content and promotional strategy to ensure the right message is being shared. If shoppers are going to trade down, you want them to trade down in your brand.

PRO TIP: PAY ATTENTION TO HOW COMPETITORS ARE REDEFINING THE VALUE EQUATION FOR CONSUMERS

3. Fend off private label threats

Implementing tactics to defend against private label advancement is crucial, especially when shoppers look to trade down during down times. This threat is magnified online because private labels typically hold a large share of Page 1 compared to national brands—something that may increase as retailers push their own store brand agenda.

PRIVATE LABELS HAVE SIGNIFICANT REPRESENTATION IN THE TOP SEARCH RESULTS FOR GROCERY CATEGORIES ON AMAZON.COM, WALMART.COM AND TESCO.COM

|

AMAZON.COM

|

WALMART.COM

|

TESCO.COM

|

|||

|

CATEGORY

|

PL SHARE OF PAGE 1 June 2022

|

CATEGORY

|

PL SHARE OF PAGE 1 June 2022

|

CATEGORY

|

PL SHARE OF PAGE 1 June 2022

|

|

crackers

|

21%

|

garbage bags

|

31%

|

chicken

|

84%

|

|

cookies

|

15%

|

sunscreen

|

28%

|

nuts

|

82%

|

|

pasta sauce

|

14%

|

bleach

|

22%

|

soup

|

70%

|

|

garbage bags

|

12%

|

dog food

|

21%

|

cookies

|

67%

|

|

toilet paper

|

11%

|

coffee

|

18%

|

pizza

|

64%

|

National brands that take a “hands-on-keyboard” approach to regularly track competitive dynamics (daily, if possible), ready to pivot and take action to minimize market share losses will be best positioned to win. Some immediate steps to consider:

- Use every pixel on your PDPs to communicate brand equities, including Ratings & Reviews

- Increase paid search or invest in content to improve organic search

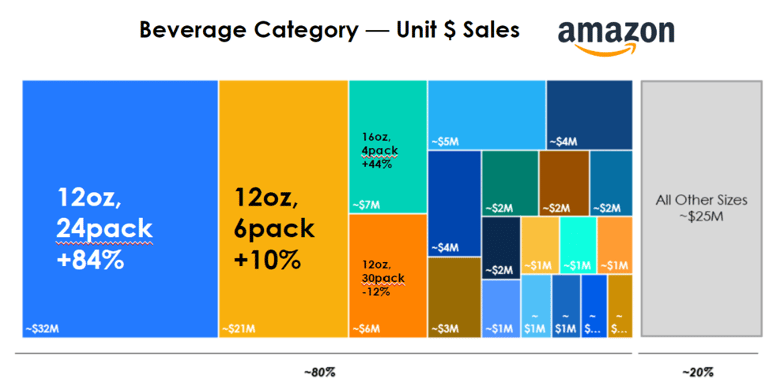

- Analyze price elasticity and review your price pack architecture to play with value dynamics as a way to keep value conscious consumers buying your brand

Read Profietro’s blog: Battle of the brands: 5 tips to fend off private label as shoppers trade down.

4. Manage and optimize the product portfolio

Some retailer sets and product offers have already changed dramatically the past few years, with longtail SKUs being eliminated as brands focused on core products to alleviate supply chain challenges. This rationalization of assortment ultimately helps retailers and brands heading into a recessionary environment. If you’re one of the lucky ones that have risen above any supply chain issues, now may be the time to review your portfolio for potential brand and SKU rationalization and any needed re-mapping or retailer reallocation.

5. Double down on revenue management

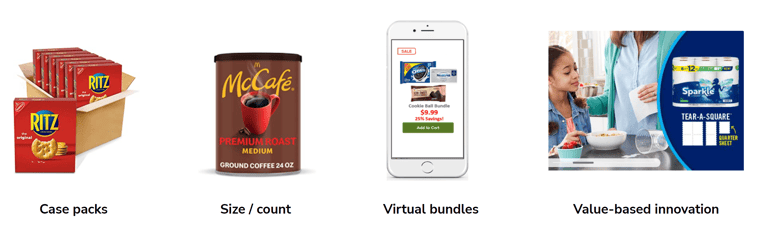

This could take multiple forms, e.g.:

- For brands with MAP policies, get tougher in terms of enforcing them

- Take a more disciplined approach to promotional execution

- Ensure you have the right price point and right price-pack configuration by retailer

Consequently, now is an excellent time to analyze your price-pack architecture. This, along with testing price elasticities and cross-elasticities, could help maintain ASPs and margin without sacrificing volume. As reported by The Wall Street Journal, Kraft Heinz intends to offer more discounts and add smaller pack sizes with lower price points to appeal to cash-strapped shoppers.

Click here to watch Profitero's John Phillips explain the benefits of a price pack analysis.

PRO TIP: TRACK PRICE PACK ARCHITECTURE (PPA) TRENDS TO IDENTIFY CATEGORY GAPS AND OPPORTUNITIES

6. Plan to do more with less

In Q4 and moving forward, retailers are likely to get a lot more aggressive with their negotiation tactics, pressuring suppliers to be as transparent as possible about costs. This means the time is right to revisit your cost structure and unit economics to remain or get on a path to profitability. It’s also a good time to automate for efficiency, scrutinizing both the demand chain (pricing, promotion, advertising) and supply chain (production, storage, logistics) for savings opportunities. Providing the right systems so teams can react quickly to the data they have is also key.

7. Readjust marketing goals and budgets

Zero-based budgeting is a reality during recessionary times. This means starting from $0 each planning cycle and making every dollar earn its keep. Prevailing wisdom is that upper funnel marketing is more likely to take the hit than the lower funnel. Thus, maintaining test & learns with lower-marketing vehicles like retail media is critical. So too is making sure retailers are capturing this activity as total investment, with ROI consistently measured to inform the go-forward strategy. More than ever, brands and retailers should be partnering to share as much attribution data as possible so budgets don’t get cut.

8. Get intentional about distribution

Not all retailers will win in recessionary times; in fact, it’s just the opposite for many. Down times typically favor larger retailers vs. smaller ones. It typically favors those focused on non-discretionary vs. discretionary goods. It typically favors discounters and value-oriented retailers (e.g., clubs and dollar stores). So choose your partners wisely. This could mean a re-segmenting of customers and channels in order to place bigger bets with anticipated winners.

9. Shift toward 'commercial' innovation

Place a more concerted focus on relevant distribution, pricing, promotion, etc. versus new product development (NPD). For example, ruggedizing the supply chain could be worth the investment. Taking steps to build a flexible supply chain will help minimize future distribution disruptions like what happened during the pandemic. Get prepared by adding third-party logistics, drop-ship capabilities, and Seller-Fulfilled Prime (SFP) on Amazon, as needed.

10. Negotiate like your life depends on it

Anticipate retailers to be ruthless during the Fall 2022 planning cycle (i.e., 4Q22 and beyond). Come prepared to defend your price / value proposition; lean on your brand equity with consumers; be transparent with costs — and negotiate, negotiate, negotiate armed with fact-based support for price adjustments.

Talk to your Account Manager or contact us to learn how Profitero can help your organization weather the recessionary headwinds, using data as the driver.