Small tweaks to your SaaS billing practices can make a huge impact on the customer experience.

For example, Jon Torres — a digital marketing consultant specializing in SaaS commerce — noticed that, for some of his clients, refund requests spiked around renewal time.

“It turned out that many refund requests happened because the company had failed to inform customers about their upcoming billing cycle,” Jon told us. “And interestingly, many of those customers resubscribed later on in the year.”

Each of the companies Jon worked with lowered customer churn by creating a better notification process, including a reminder about their renewal six weeks prior to the billing cycle.

“Small things matter,” Jon added. “Simple things like people wanting to renew during a certain month to coincide with their fiscal year. Those things make a big difference.”

In this piece, we offer seven case studies from SaaS companies — small tweaks they made to reduce churn and increase customer LTV. We also show you how to personalize your billing practices with advice from our experience working with thousands of SaaS businesses.

Note: FastSpring offers advanced subscription management services that support free trials, monthly and annual recurring billing plans, proration, discount management, and more. Learn more here.

7 growth hacks from the SaaS experts

We reached out to a variety of leaders to ask for their SaaS billing best practices. Here are seven mini case studies about how these companies manage billing to reduce churn or increase LTV.

1. How Enchant reduced churn and support requests related to account owner issues

The person using your SaaS product may not have access to the credit card used to sign up.

For example, companies will often have a manager subscribe to a SaaS tool using the company credit card and then provide the login information to lower-level employees to use.

Vinay Sahni, co-founder and CEO of Enchant, learned this lesson first hand. “You need to make it easy for someone to update their billing information without being logged in.

“We used to regularly have odd situations where people would want to temporarily change the owner on the account to their accountant so they could update their credit card details.”

Vinay solved this problem by implementing a special billing page that his customers could use without logging in. He then sent out a link to this page inside payment failure notification emails.

Vinay writes, “The benefit of this was huge! Users could now forward the payment failure email to the right person, without that person having an Enchant account. Before this change, we used to regularly get support requests related to account ownership changes for billing purposes. After this change, these requests completely disappeared.”

2. How Ruler Analytics tracks expected churn

“When a new customer is onboarded, we’ll look at their own business — the complexity of their requirements and tech stack; how our solution fits in with the specific problem they are looking to solve; and our key contact’s understanding, technical expertise, and communication levels — all to derive a score,” explains Dave Smithbury, Head of Marketing and Sales at Ruler Analytics.

“This score then determines how we’ll manage the relationship through onboarding and customer success, including whether they need further education on the benefits of marketing attribution or more advanced advice on how else our product can bring operational and strategic improvements across their business.”

Use the wealth of data you have on your customers to analyze your churn metrics. If you’re finding that churn most often happens when auto-renewal occurs, you can offer a discount or other reason for that person to stick around.

Note: See how FastSpring can help you reduce churn.

3. How My Marketing Concepts upsells annual payments during trial

Cem Er at My Marketing Concepts mentions that “providing a quick win during the freemium trial period excites customers and helps reduce or even eliminate SaaS churn.”

After users achieve this quick win during the trial, the SaaS company sends out an annual payment upsell offer. Cem mentions, “In our experience, 80% of our customers take advantage of this offer.”

4. How Castos upsells subscription tiers

Craig Hewitt, founder and CEO of Castos, has a different approach to upsells and cross-sells. His podcast hosting company uses data analytics that looks at which users are most likely to grow out of their current subscriptions. He also looks for users whose plans might be too large for their current needs.

Craig says, “We then contact our users to give them suggestions about which subscriptions might be best for them based on past trends and future projections.”

Personalizing your upsell and cross-sell offers can make a huge difference to your win rates.

5. How Dubb uses videos to increase trial conversions

Many SaaS companies offer free trial periods where users can test out their products partially or in full, but there are countless schools of thought on how to run a free trial offer.

For example, many SaaS executives think requiring a credit card number upfront will decrease the conversion rate. However, if you do ask for a credit card number, those who provide one are more qualified prospects.

Ruben Dua, CEO and founder of Dubb, found a unique way of improving free trial conversions. “One of the best ways we’ve found to reduce your churn rate is by using videos to communicate value to our customers efficiently.”

Ruben continues, “On the payment page, they’ll get to watch a short video that reiterates the value they’ll get from taking action. And in cases where our customers get stuck, our support team responds in a timely manner with personalized video. As a result, we’ve reduced cancellation rates and gotten clients who are happy to renew their subscription.”

6. How SoStocked increases retention through grandfathering existing customers into lower prices

The founders at SoStocked, an Amazon inventory management platform, make sure that when they’re trying out pricing changes, those changes work in their existing customer’s favor: “To keep the churn rate low, any time you lower your prices, lower it for existing customers. When you raise your prices, don’t raise them on your existing customers,” co-founder Chelsea Cohen explains.

Chelsea also encourages SaaS companies to experiment with pricing to increase customer demand. It’s not always a bad thing to be priced higher than your competitors — it can signal to prospects that yours is a premium service. On the other hand, if your win ratio is low, it might be time to lower your prices.

7. How FastSpring simplified the signup process

Little things matter in the signup process, so take the time to test and optimize every part of the process.

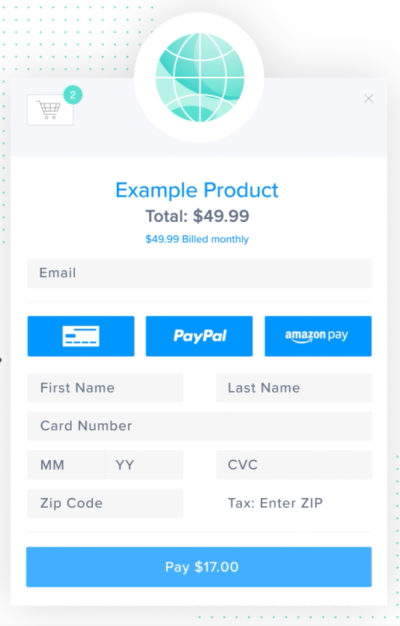

Here’s an example: Years ago, FastSpring was one of the first checkout providers to offer a simple popup checkout that appeared over an order page at the click of a button.

In the past, the standard payment collection method was to open a new page with all the appropriate checkout fields.

It’s such a simple thing, but when we compared conversion data for our popup checkout vs. a traditional checkout page, we saw that on average, the popup checkout converted better than a traditional checkout page for most of our sellers.

Note: Our SaaS billing software can support all common SaaS subscription billing models. Learn more here.

8 ways to increase revenue with your specific pricing model

Strategies to optimize your subscription plans vary by pricing model. In this section, we offer conversion-optimizing tips specific to the most common SaaS pricing strategies.

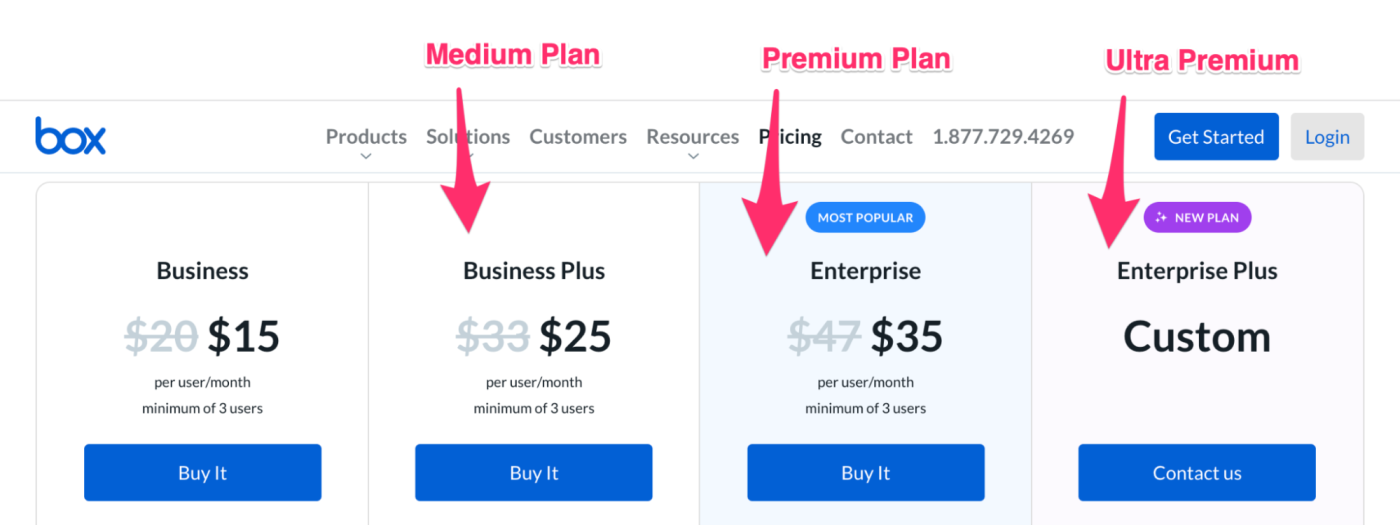

1. Optimize a tiered subscription model through “anchoring”

If you’re using a tiered subscription model, do you have a premium tier? The premium tier serves as a pricing anchor, making your medium-tier (or tiers) more attractive to the average user. This is a psychological strategy called “anchoring,” and it can be extremely effective.

Some SaaS companies, like Box, even create a very highly-priced ultra-premium tier simply to make their other plan options feel less expensive.

2. Make it easy for prospects to see which tier works best for them

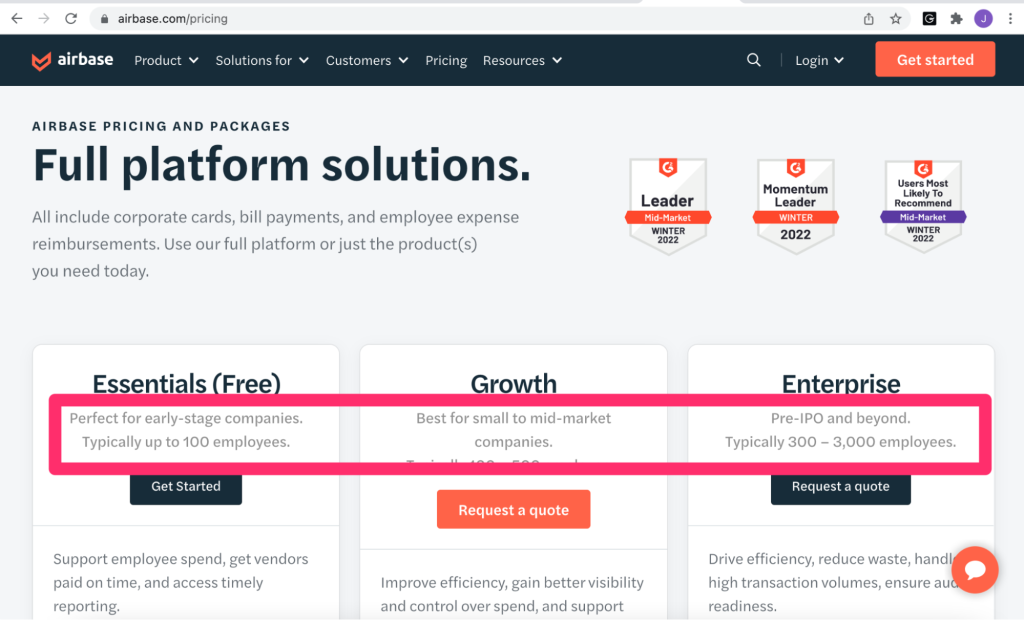

Check out the language that Airbase uses on their pricing pages, which gives prospects a clear idea of which tier they should try.

The language you use should align with your ideal customer profile (ICP). In other words, if you want to attract SMBs, make sure you have SMB language on your site.

If a customer sees language that describes them, they’ll know you’re a good fit for them (and vice versa).

Bonus Tip: If you have an API, include it in every tier to make it easier for customers to get the most value out of your services and scale with your product.

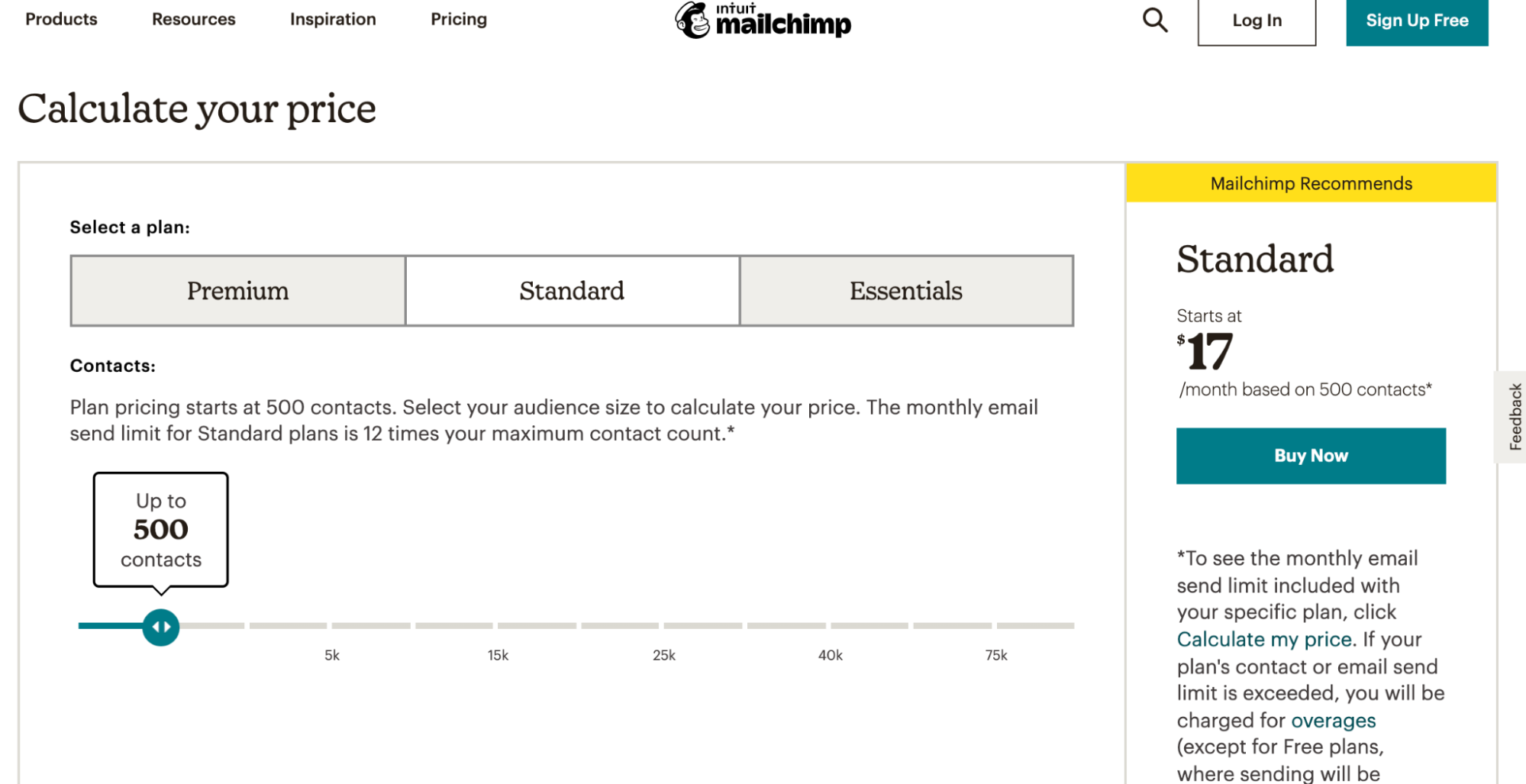

3. Usage-based subscription plans: Calculators for the win

When you’re using a usage-based subscription model, pricing calculators make it easy to see whether your product fits into a user’s or company’s budget.

Mailchimp became a well-known brand through its freemium model in which companies scale up to higher plans with increased usage. On their pricing page, their calculators give prospects more confidence about which pricing plan will best suit their needs.

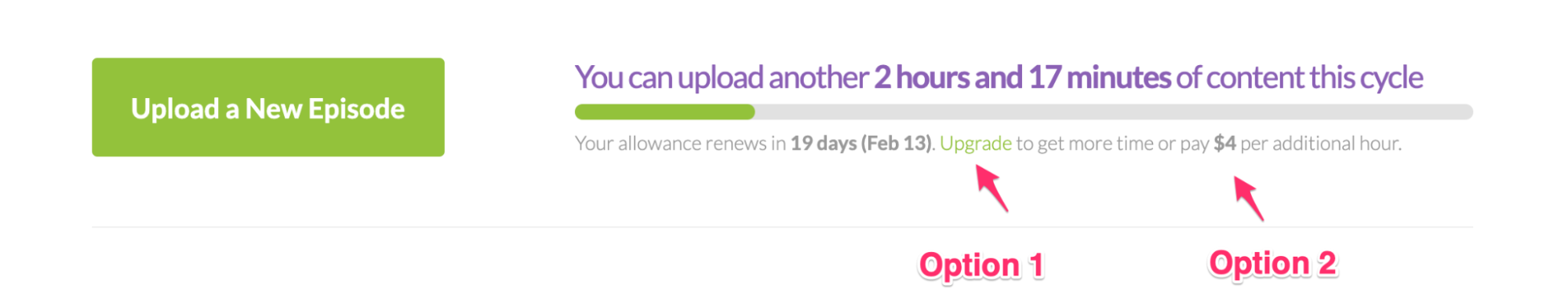

4. Offer custom upsells based on usage within the product

Buzzsprout, a podcast hosting platform, informs users how many more minutes they can upload on their current plan and offers two options for increased usage. For customers who aren’t ready to upgrade to the next tier, Buzzsprout gives them the option of buying more minutes.

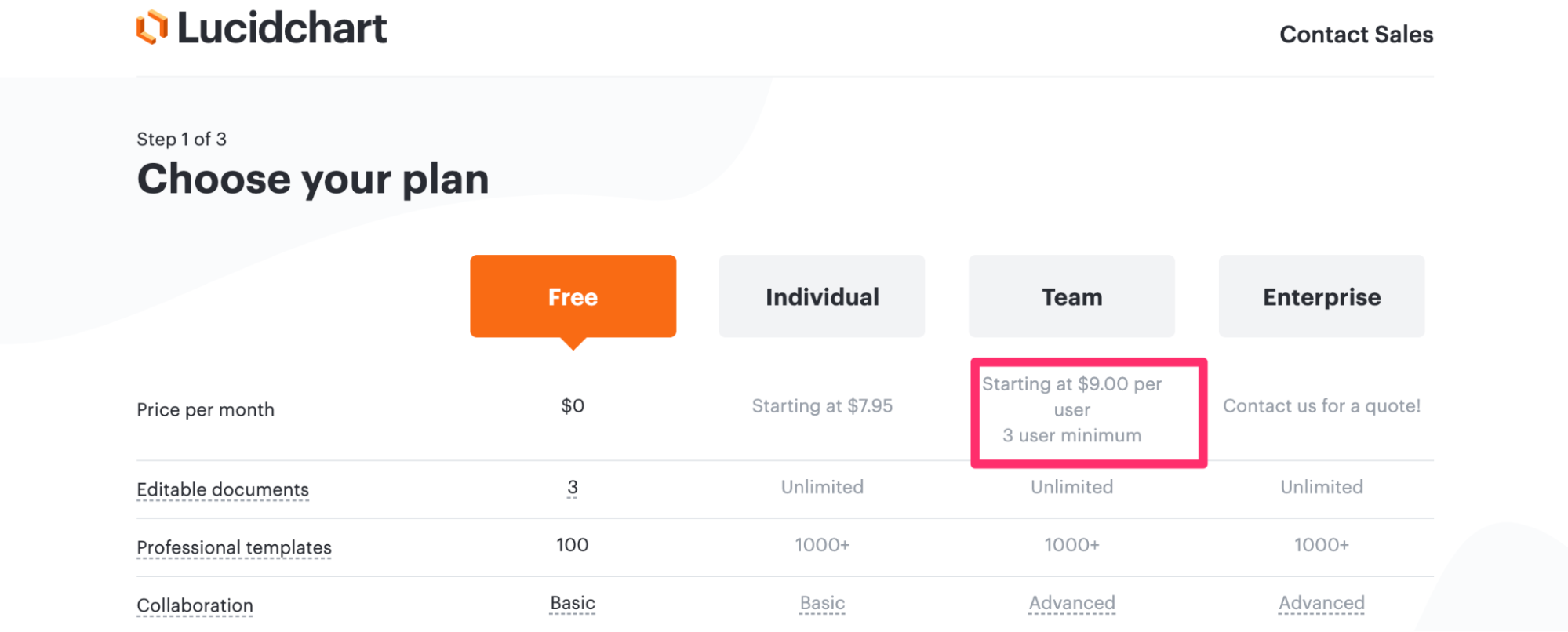

5. User-based pricing tip: set a minimum number of users

Enforcing a minimum number of users — as we see with Lucidchart — sets a floor for user-based subscription pricing. Just make sure your monthly cost is reasonable for small teams.

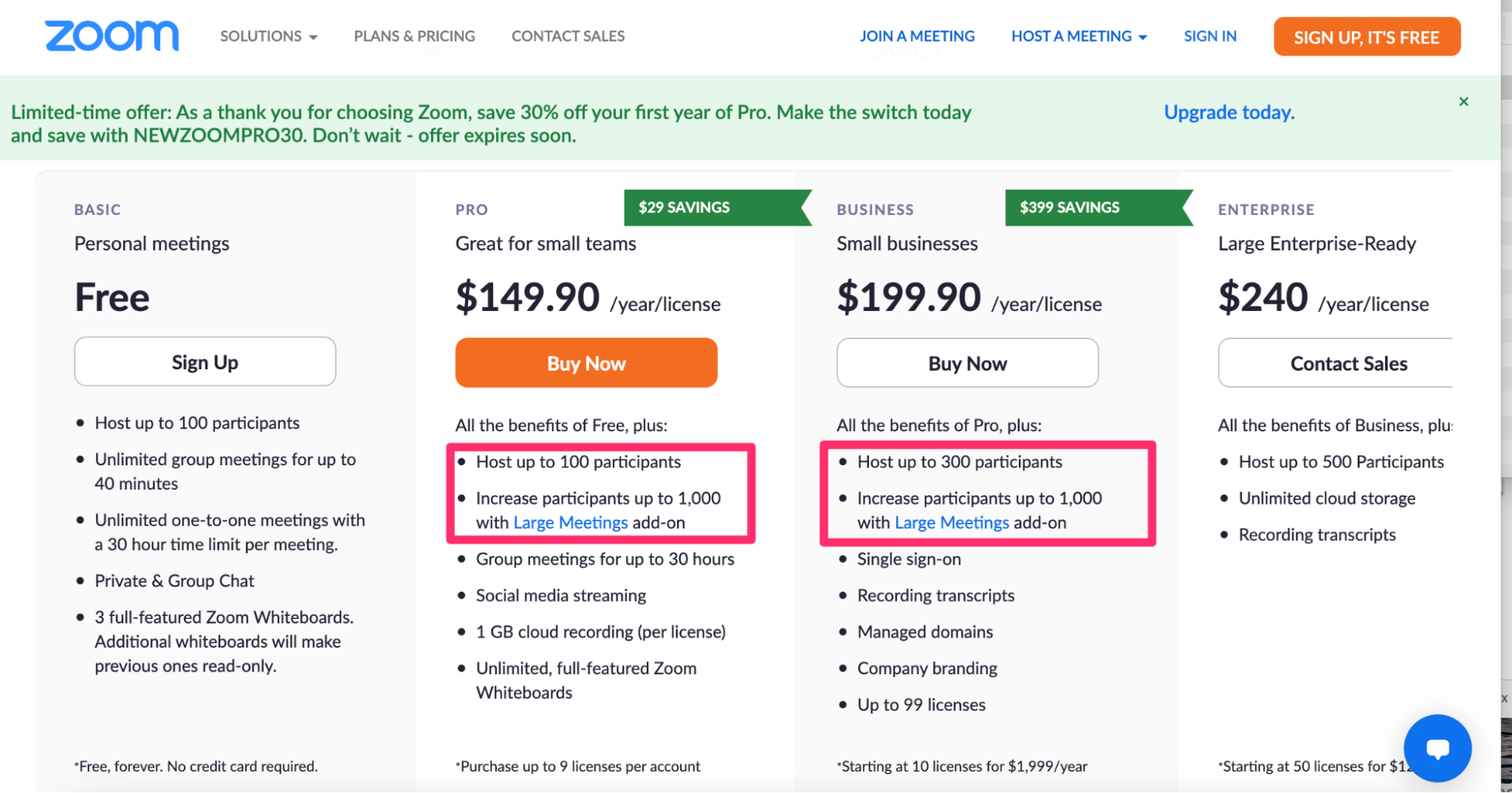

6. Use add-ons when user-based tiers aren’t complex enough

Typically, user-based plans are related to the number of users in a company. However, Zoom has two types of users to consider: the users in an organization, and participants in a meeting or call.

While their tiers, which are priced per license, allow teams to include more participants in a meeting, they also plug their “Large Meeting Add On” in their two medium tiers.

Notice how the top tier allows for unlimited participants? This is a subtle selling point to upgrade to the enterprise plan.

7. Enterprise sales: look for opportunities to automate

If you’re new to enterprise sales, be aware that enterprise deals sometimes take significantly more work to close than people think. To streamline the enterprise sales process, we recommend using an integrated quoting, invoicing, and billing system to keep you from getting buried in PDF quotes, back-and-forth emails, and signature chasing.

Note: FastSpring’s interactive quote tool makes it easy for you to create custom quotes for your prospects.

8. Allow enterprise customers to research your company before requesting a demo or quote

When B2B buyers are considering a purchase, less than 20% of their time will be spent talking to a potential supplier, according to Gartner research. If they’re comparing multiple suppliers, they may only spend 5% of their time talking to a sales rep. The majority of their time is spent researching independently.

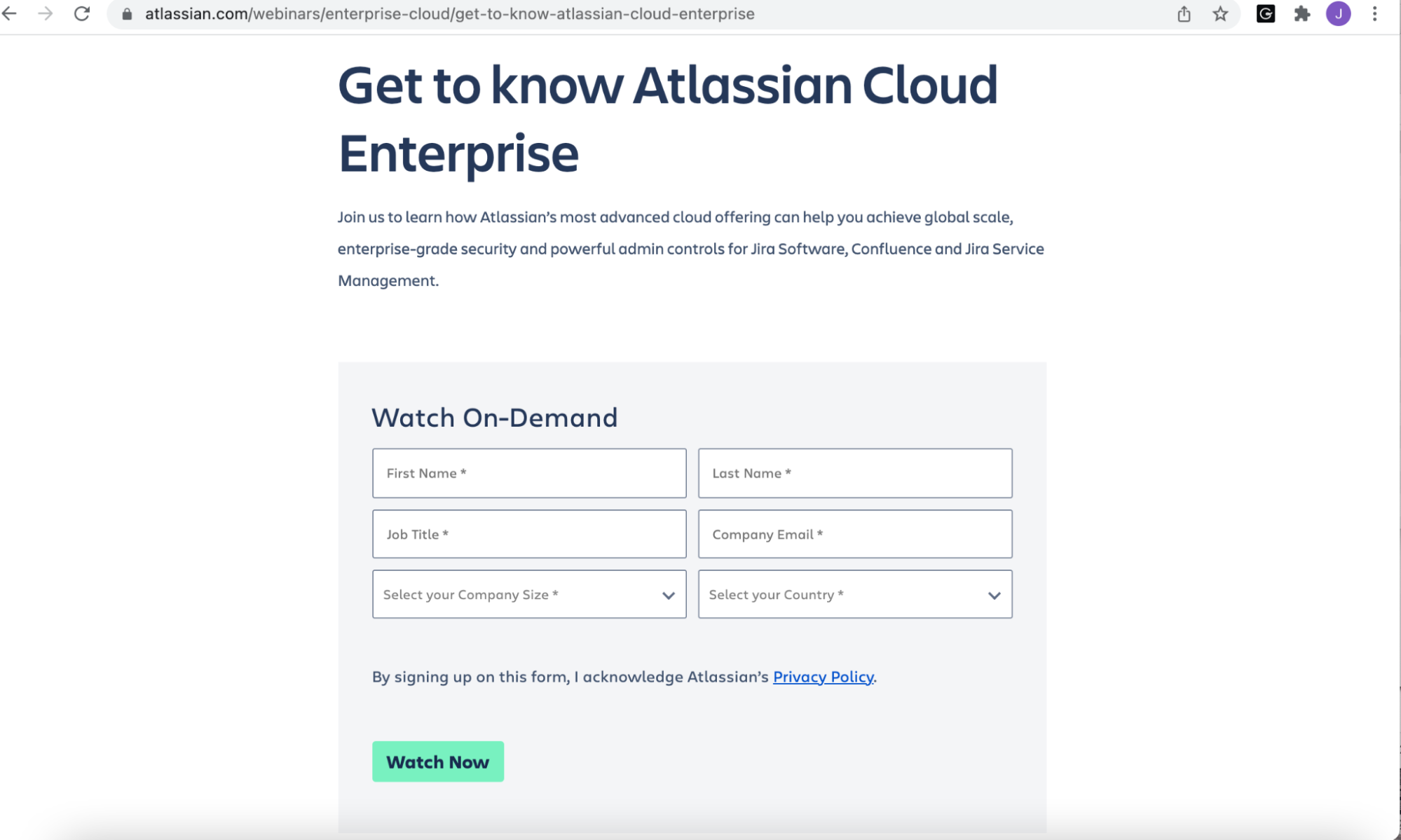

Atlassian offers an enterprise demo on-demand, which enables the company to collect leads while giving customers the ability to get to know the platform before a sales call.

Just getting started in SaaS? How to find out which SaaS billing solution is right for you

If you’re just starting out, we have two simple tips for you: keep it simple and start with flat-rate pricing.

Keep it simple with flat-rate pricing

Flat-rate pricing isn’t common anymore, but it can be particularly effective for SaaS companies that are just getting started. A simple monthly flat-rate subscription is a perfect way to introduce your product to the market without a lot of complexity.

We do see the occasional well-established company still using a single pricing scheme when they have good brand recognition and a simple product.

Flat-rate pricing tip: highlight self-service

Flat-rate pricing is commonly tied to a product-led growth (PLG) sales model, in which you make it easy to sign up and try out your product for free, then offer customers an upsell to a paid plan.

If you’re working on a tight budget and looking for additional runway, consider adding an annual plan with a discount. That’s a simple way to create additional cash earlier in your growth cycle.

There’s no reason to overly complicate your pricing as you grow, either. Kyle MacDonald, VP of marketing and business development at Force by Mojio, recommends keeping pricing simple as you scale: “The more complicated it is, the likelier it’ll be that you’ll make errors, and the harder it’ll be for the customer to understand.”

Common billing pain point: Should you require a credit card for a trial signup?

You’re not going to like this answer, but it depends.

In general, from our internal data on this issue, it seems that software that is more “use every day”-type software converts better without requiring a credit card. If we were offering a free trial of a project management software, for example, we’d probably set it up as a free trial without a credit card as our first test.

That said, companies that collect a credit card at signup will see an advantage in overall conversion rate.

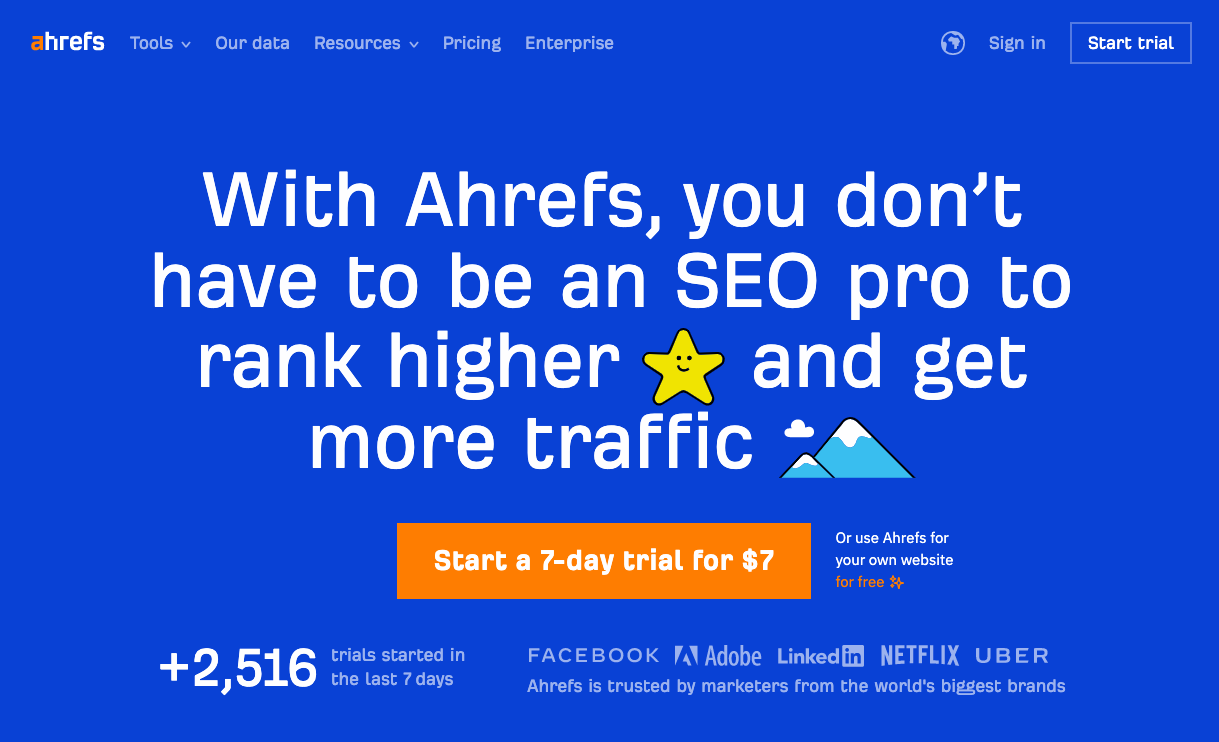

Other subscription businesses don’t have a free trial at all. Ahrefs, for example, charges $7 for a one-week trial, a model that guarantees they have credit card information at signup.

Test, test, test. That’s our best advice.

Because what’s best for other SaaS companies might not be what’s best for you.

One more recommendation: Take advantage of the MoR business model

There’s one last recommendation we have for those of you really looking to optimize your SaaS billing process:

Take advantage of the merchant of record business model — a unique option available only to SaaS and software companies like yours.

What does a merchant of record give you that a simple payment processor doesn’t?

1. Let someone else manage VAT, sales taxes, and compliance

VAT and sales taxes aren’t calculated based on your location — they’re based on the location of your buyers.

For that reason, as SaaS companies grow, they often incur more and more accounting costs as they start to have to pay taxes in new jurisdictions.

A merchant of record takes this off your hands — managing all VAT and sales taxes globally so you don’t have to.

This is a unique option available to SaaS and software companies — but not to most other ecommerce businesses (e.g., those that sell and ship physical goods).

Choosing a merchant of record billing solution means you don’t have to worry that a tax authority from another country will come after you for VAT or sales tax for purchases made by people within their jurisdiction.

Because a merchant of record handles that for you.

2. Prevent revenue leakage from declined credit cards

Failed payments are an unfortunate part of SaaS billing. However, that doesn’t mean you should accept them as inevitable.

When choosing a payment provider, one thing that might not be on your radar is how to improve your payment approval rates — a key source of revenue leakage for SaaS.

SaaS companies using a simple payment processing service sometimes see very high decline rates on purchases from certain areas of the world.

At FastSpring, we use a network of payment gateways from all over the world. Behind the scenes, we use an intelligent routing algorithm to route every transaction to the payment gateway most likely to approve it.

Using our system, you get the best approval rates possible.

3. Stop churn before it happens

Dunning management tools can help automate and optimize revenue recovery with proactive payment retries and timely email reminders as a built-in part of their functionality. Your customers are also given a self-service portal that can cut down on support ticket requests.

A subscription management system is included as part of our service. You also won’t be forced to set up and maintain integrations with a separate payment management system.

This includes advanced subscription management, including our built-in dunning tools to update cards for upcoming payments — preventing churn before it happens and increasing your monthly recurring revenue (MRR).

Pro Tip: Instead of completely cutting off a customer from your platform when their payment fails, consider giving them a little extra time to renew.

A grace period of 24-48 hours will act as a safety net to lower your churn from those who simply got too busy, forgot their payment info, or were unaware that their card expired.

4. Localize your currency and payment options

Want to show customers a personal touch? Show them prices in their local currency at checkout. FastSpring’s checkout tool makes this conversion in real-time, making it easy to localize your prices for customers in different locations.

You can also give customers the option to use payment methods popular in their area — not just the standard Visa, MasterCard, and PayPal options.

5. Avoid hidden fees

Simple payment processors often advertise prices such as $2.9% + $0.30 per transaction. In reality, when you add in fees for cross-border transactions, international credit cards, and other fees, simple payment processors can easily average at least 4% to 5% per transaction.

How do we know this?

Because we’ve reviewed the financials of thousands of SaaS businesses during the FastSpring onboarding process.

We can’t tell you how many SaaS leaders we’ve met who believed they were paying 2.9% + $0.30 per transaction, but they were actually averaging 4% to 5% per transaction after we studied their billing platform and cash flow.

And that’s just for payment processing, not for a full merchant of record service that manages taxes, VAT, compliance, and the many other add-ons and extra services SaaS companies often pay separately.

Are you getting enough from your SaaS billing provider?

Our financial specialists can help you evaluate your billing management process, and we can work with you to see if our merchant of record business model makes sense for your situation.

We’ll also create an objective breakdown of your costs for billing, subscription management, VAT and sales tax management, fraud protection, and the many other features that come standard with FastSpring’s merchant of record service.

We’ll do all this for you free of charge.

Who knows? Our merchant of record service might free you from worrying about sales taxes, VAT, compliance, audits from foreign tax agencies, and much more.

If you’d like to evaluate if FastSpring makes sense for your SaaS business, we invite you to request a demo and speak to one of our specialists.

![[Customer Story] Why TestDome Considers FastSpring a Real Partner](https://fastspring.com/wp-content/themes/fastspring-bamboo/images/promotional/2023/FastSpring-TestDome-blog-thumbnail.jpg)