Whether you’re a restaurant or retail business owner, you probably know there aren’t many POS systems that can integrate with any payment processing solution. Most POS companies offer their own payment processor or have a specific processor they work with – you either accept their processors or pay extra fees to use the desired processor.

Integrating payment processing with your point of sale system is crucial to running a smooth and efficient business operation. And, whether you’re using a POS system that is processing agnostic or not, understanding how to connect your payment processor to your POS system is essential for success. Read on to learn how to go about it.

Key Takeaways:

- Most POS systems have partnerships or integrations with specific payment processors, so you won’t have the flexibility to choose a payment processor.

- Connecting your payment processor typically involves gathering the required information, configuring POS settings, entering payment processor details, testing the connection, and training staff.

- When selecting a payment processor, consider transaction fees, security compliance, integration capabilities, advanced features, customer support, and contractual terms.

- All-in-one POS solutions with integrated payment processing may limit payment processing options and customization.

- Processing-agnostic POS systems like KORONA POS allow businesses the flexibility to integrate with any payment processor.

How to Connect Your Payment Processor to Your POS System

Here’s a general guide on how to connect your payment processor to your POS system:

Step 1: Choose a compatible payment processor

Select a compatible payment processor with your POS system. Many POS systems have partnerships or integrations with popular payment processors, making the connection process smoother. Check with your POS provider for a list of recommended or compatible payment processors.

Step 2: Gather the required information

Before you begin the integration process, gather all the necessary information from your payment processor. This information may include merchant account details, payment gateway credentials, API keys, or any other relevant information required for the integration.

Step 3: Configure POS system settings

Access your POS system’s settings or administration panel, and look for the section related to payment processing or payment integrations. Here, you’ll typically find options to add or configure a new payment processor.

Step 4: Enter payment processor details

Follow the prompts or instructions provided by your POS system to enter the details of your payment processor. This may involve entering your merchant account information, payment gateway credentials, API keys, or any other required information.

Step 5: Test the connection

Once you’ve entered all the necessary details, your POS system may prompt you to test the connection with your payment processor. Follow the instructions to ensure the connection is successful and that transactions can be processed smoothly.

Step 6: Configure payment settings

After a successful connection, you may need to configure additional payment settings in your POS system. This could include setting up payment types (credit cards, debit cards, etc.), defining tax rates, configuring tips or gratuities, and customizing receipt layouts.

Step 7: Train staff

Ensure your staff is trained to use the integrated payment processing system within your POS. It may include instructions on processing different payment types, handling refunds or voids, and generating reports related to payment transactions (merchant statements). It’s important to note that the specific steps and procedures may vary depending on your POS system and payment processor. Consult the documentation or support resources your POS and payment processor providers provide for detailed instructions and guidance.

How to Choose a Payment Processor For Your Point of Sale System

Nowadays, most POS systems come bundled with integrated payment processors, limiting your ability to choose independently. When selecting a POS system, you’ll typically have to go with the payment processor options provided by that POS company.

However, some POS systems remain “processing-agnostic,” allowing you the freedom to integrate with any payment processor of your choice.

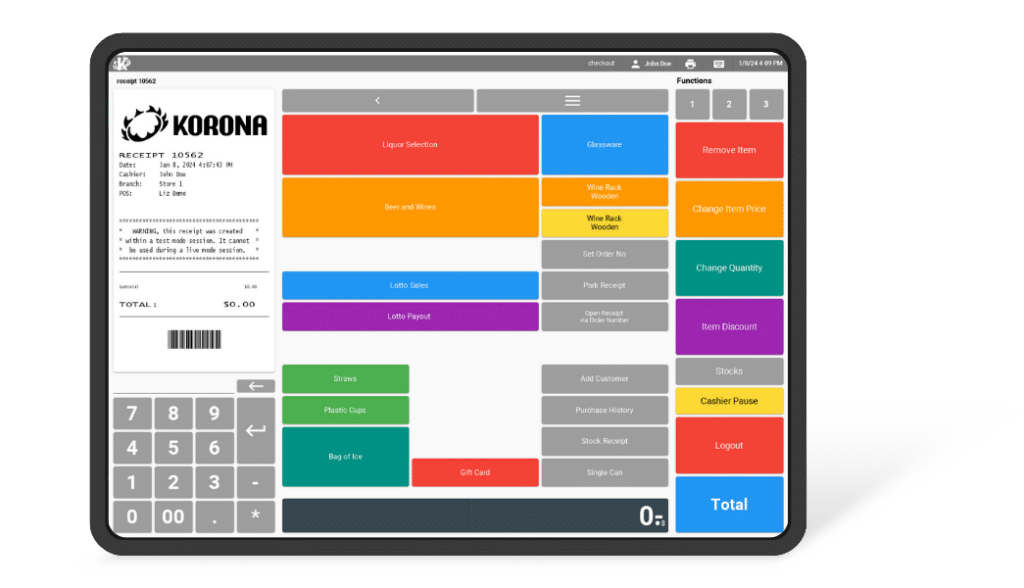

KORONA POS is one of the best retail POS systems and is devoted to providing all merchants with a great product, outstanding customer support, and full transparency. That’s why the solution is devoted to remaining one of the very few processing agnostic POS solutions.

Are payment processors

giving you trouble?

We won’t. KORONA POS is not a payment processor. That means we’ll always find the best payment provider for your business’s needs.

Here are some factors to consider when choosing a payment processor for your point of sale system:

Understanding your business needs

- Transaction volume and type: Do you have a high volume of low-value transactions (e.g., coffee shop) or fewer high-value transactions (e.g., jewelry store)? Processors often have tiered pricing based on volume, and some may have fees specific to transaction types (e.g., keyed-in vs. swiped cards).

- Customer base and preferred payment methods: Do your customers primarily use credit cards, debit cards, or contactless payments like Apple Pay? Understanding their preferences ensures you have a processor that supports those methods.

- Industry-specific needs: Certain industries have specific compliance requirements. Smoke shops, due to the nature of some products they sell, fall under the high-risk category for payment processors. Be completely transparent with the processor about your product mix and business practices. Open communication builds trust and minimizes the risk of account termination.

Deep dive into fees and pricing structures

- Transaction fees: This is the bread and butter of processor fees. Look beyond the headline rate and understand how it’s calculated (percentage, flat fee, or per-network fee). Some processors charge a monthly subscription fee on top of transaction fees. Factor this into your cost analysis.

- Hidden fees: Beware of sneaky charges like PCI compliance, statement, or early termination fees. Get a clear breakdown of all potential costs.

- Chargeback fees: Chargebacks occur when a customer disputes a transaction. Understand the processor’s chargeback policy and any associated costs.

Security and data compliance

- PCI DSS compliance: The Payment Card Industry Data Security Standard (PCI DSS) is a rigorous security framework. Ensure your processor is PCI DSS compliant to protect customer card data.

- Data encryption: Look for processors with strong encryption standards to safeguard sensitive information during transactions.

- Fraud prevention tools: Processors often offer prevention tools like address verification and velocity checks. These can minimize fraudulent transactions and protect your business.

Seamless integration and compatibility

- POS system integration: Ensure the payment processor integrates smoothly with your chosen POS system. This avoids clunky workarounds and streamlines the checkout process.

- Hardware compatibility: Verify compatibility with your POS hardware (card readers, terminals). Upgrading hardware can add unforeseen costs.

Customer support and reputation

- Support availability: What are the processor’s customer support channels (phone, email, chat)? How quickly and effectively do they address issues?

- Customer reviews and industry recognition: Research online reviews and industry awards to gauge the processor’s reputation for service and reliability.

Contractual terms and flexibility

- Contract length and termination fees: Be wary of long-term contracts with hefty termination fees. Negotiate flexible terms if possible.

- Data ownership and portability: Ensure you retain ownership of your customer data and explore data portability options if switching processors becomes necessary.

- Recurring billing: If you offer subscriptions or memberships, look for processors that facilitate recurring billing.

Beyond the basics

- Scalability: Consider your future growth plans. Will the processor support your business as it expands?

- International payment processing: Do you have global customers or plan to expand overseas? Choose a processor that facilitates international transactions.

- Emerging payment technologies: Stay ahead of the curve by considering processors that embrace new payment methods like contactless payments, cryptocurrencies, and digital wallets.

The Benefits of POS and Payment Integrations

While it’s important to be wary of getting locked into long-term contracts, hidden fees, and a lack of customization, the pros of modern payment systems far outweigh the cons. Below are a few of the biggest benefits:

Streamlined operations

Combining POS and payment processing streamlines operations by eliminating the need for separate systems. It simplifies the checkout process for employees and customers, reducing wait times and increasing efficiency.

Enhanced customer experience

Integrated payment solutions offer customers a seamless and convenient experience. They can choose their preferred payment method and complete transactions quickly, leading to higher satisfaction and potentially increased loyalty.

Improved accuracy

With an integrated system, there’s less chance of errors in recording transactions or processing payments. This accuracy improves accounting and helps maintain customer trust and satisfaction.

Comprehensive reporting

All-in-one POS solutions typically offer robust reporting capabilities. Merchants can access detailed insights into sales, inventory levels, and customer trends, enabling better decision-making and strategic planning.

Cost savings

While the initial investment may seem significant, integrated POS solutions can save money in the long run. They often come with bundled pricing or lower transaction fees than separate POS and payment processing services.

KORONA POS Can Integrate With Any Payment Processor

KORONA POS offers businesses the ultimate flexibility when it comes to payment processing. Designed as a processing agnostic point of sale system, it seamlessly integrates with any payment processor a merchant chooses.

This open approach empowers companies to select the payment solution that best aligns with their unique requirements, negotiated rates, and existing banking relationships.

With KORONA POS, you can streamline their operations, accept various payment methods, and provide a seamless checkout experience for their customers, all while leveraging the payment processor of your choice.

Schedule a KORONA POS Demo Today

Speak with a product specialist and learn how KORONA POS can power your business needs.

FAQ: Integrating Payment Processing With a POS

You typically need to use the payment gateway’s API (Application Programming Interface) or SDK (Software Development Kit) to integrate a payment gateway into a POS system. This involves establishing a secure connection between your POS software and the payment gateway and implementing the necessary code to handle payment requests, responses, and transactions.

A POS system is a software and hardware solution retailers use to facilitate transactions, manage inventory, and track sales. Payment processing is how electronic transactions are authorized, captured, and settled between the merchant, the customer’s bank, and the merchant’s bank. POS systems often integrate with payment processors or gateways to enable electronic payment acceptance.

Integrate Payment Processing With a POS: Final Thoughts

Before integrating a payment processor with a POS system, ensure that the POS software is processing agnostic or not. Then, you should carefully select a compatible and reliable payment processor, configure the integration correctly, and train your staff to ensure a seamless transaction process.

Remember to consider factors such as fees, security, and advanced features when choosing a payment processor to align with your business needs. With the right integration, you can streamline operations, improve accuracy, and gain valuable insights through comprehensive reporting.