Use Innovations To Reshape The B2B Cross-Border Payment Experience

Businesses increasingly operate across borders; the rise of B2B e-commerce and online marketplaces is driving more cross-border transactions. But several factors complicate these payments: Payment infrastructures vary by country; the landscape of regulations governing cross-border transactions is fragmented by geography; and providers are plagued by complex internal business processes and operations. All of this makes B2B cross-border payments slow, opaque, expensive, and heavily manual. B2B cross-border payment providers have emerged to solve the pain points in the market.

Forrester defines B2B cross-border payment providers as:

Solution providers that use technologies such as AI, APIs, blockchain, cloud, and robotic process automation to help businesses send and receive cross-border payments rapidly, cheaply, transparently, seamlessly, and securely.

Market Dynamics

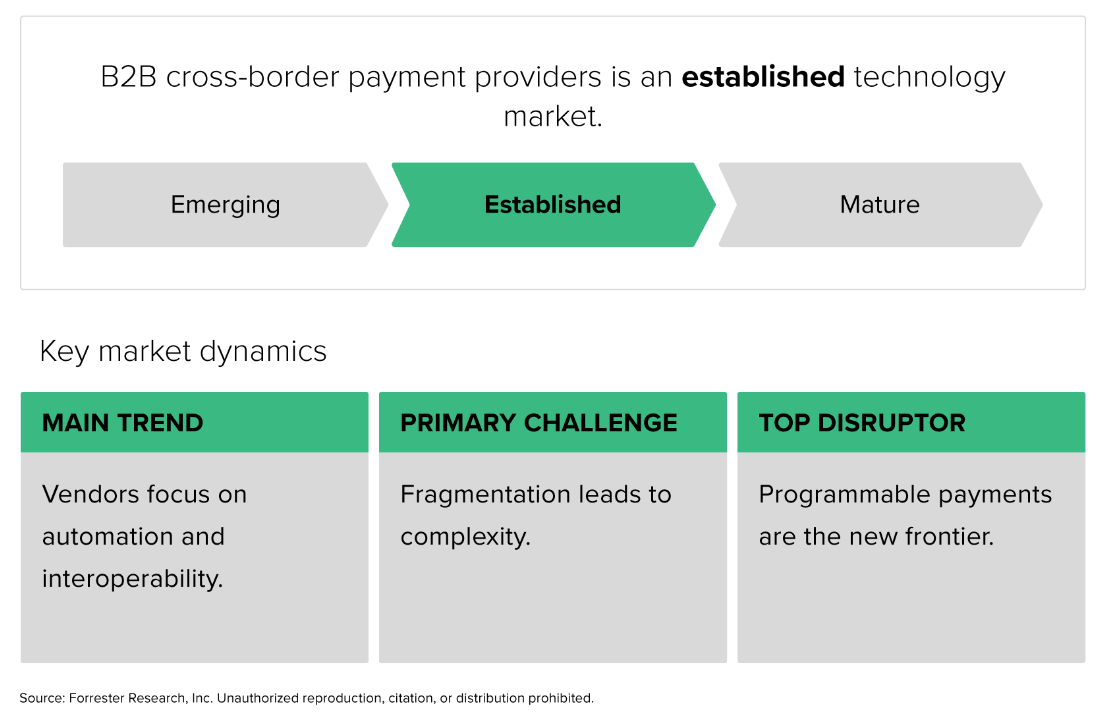

We believe that B2B cross-border payment providers have evolved into an established market, and the growing focus on automation, interoperability, and embedded payments is shaping the market’s current trends, primary challenges, and potential disruptions.

- Main trend: Vendors focus on automation and interoperability. The rise of B2B platform and marketplace business models drives businesses’ demand to connect with more payment methods, lending options, and sales channels across markets. Vendors increasingly use APIs and modular solutions to improve integration and interoperability with multiple systems and companies.

- Primary challenge: Fragmentation leads to complexity. The nature of cross-border B2B payments creates complex risks, such as constantly shifting patterns of financial crime and frequently changing regulations governing compliance issues like taxes and sanctions. This fragmentation, and the complexity it creates, is a recipe for inefficiency and poor experiences.

- Top disruptor: Programmable payments are the new frontier. Programmable payments can set conditions such as payment value, location, beneficiary, and operations. This can lessen the complexity of B2B cross-border payments and the need for manual intervention. Many fintechs are building solutions to support programmable payments — but adoption will depend upon the creation of a robust and globally applicable regulatory and risk framework.

In our recent report, The B2B Cross-Border Payment Providers Landscape, Q3 2022, payment leaders can realize the value that they can expect from a B2B cross-border payment provider, learn how providers differ, and select one based on size and market focus.

In the report, we identified 21 B2B cross-border payment vendors with relevant revenues. Based on their global B2B cross-border payment service revenues, we segmented them into three market presence segments — large, medium, and small — and five primary segments based on their top use cases: marketplace payout and collection; accounts receivable by SMEs; accounts payable by SMEs; accounts payable by large corporations; and accounts receivable by large corporations.

To learn more details about B2B cross-border payment providers, Forrester clients can read the full report or schedule an inquiry.