Trends Analysis: The State of Mobile Payment

ESW

MAY 11, 2020

Consumers used physical currency in just over one quarter (26%) of transactions in 2018, according to research by the Federal Reserve. Debit and credit cards are now the most popular choice for consumers, but even these trusted payment methods are under threat. Electronic and mobile payment solutions are proliferating.

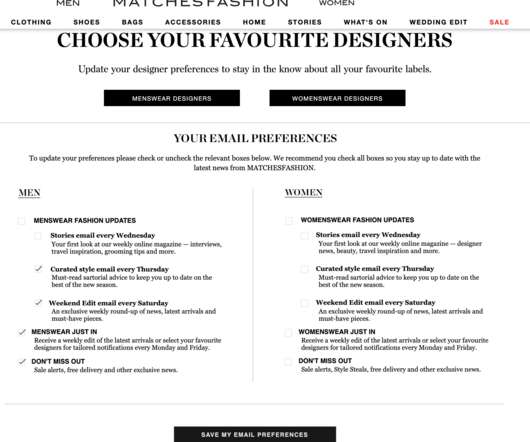

Let's personalize your content