Mobile Express Checkout: PayPal’s Payment System

Groove

JANUARY 31, 2022

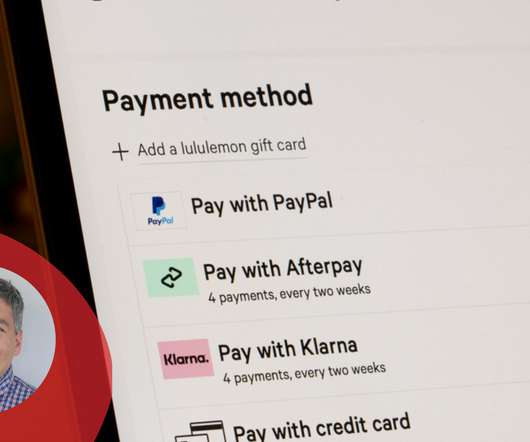

With over 377 million users, PayPal oversaw nearly $1 trillion in payment volume in 2020 - according to Forbes Magazine. This payment processing system gives businesses the opportunity to expand their mobile sales tremendously. Mobile express checkout is PayPal’s mobile version of their express checkout service.

Let's personalize your content