Crypto-Commerce: Banking on Blockchain for B2B Payments

GetElastic

MARCH 3, 2022

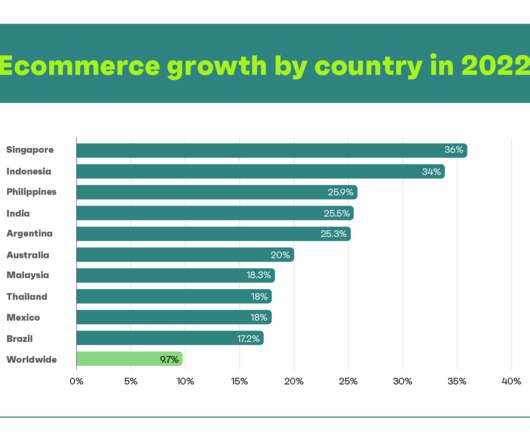

After significant hype with the rise of cryptocurrencies, there was a ‘Blockchain winter.’ The predictions for rapid adoption by 2020 never materialized; however, the underlying technology, Blockchain, still holds promise, especially in the B2B payments space. This trend is expected to continue with a CAGR of 21% from 2021-2030.

Let's personalize your content