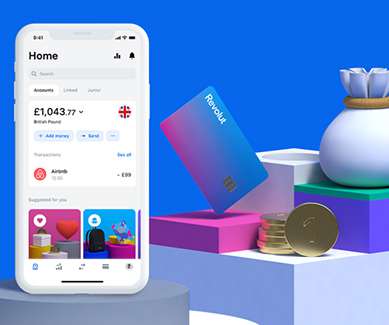

The Best Payment Processing Companies in 2023

Ecommerce Platforms

MARCH 22, 2023

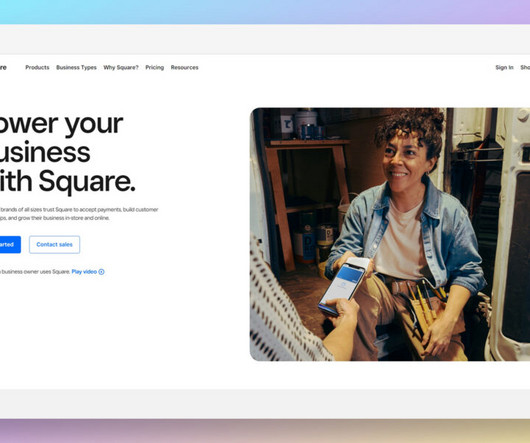

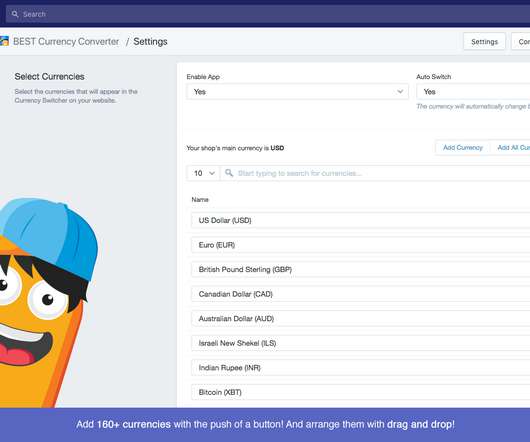

There are a huge range of payment processing brands out there, all offering tools to help make your organization a money-making entity. After all, how do you know you’re selecting a payment processor that can simultaneously keep your costs low, and ensure you’re offering a great service? for EU cards, or 2.9%

Let's personalize your content