Digital Wallets: What’s Good for the Payments Industry is Good for Retailers…Right?

Retail TouchPoints

JULY 5, 2023

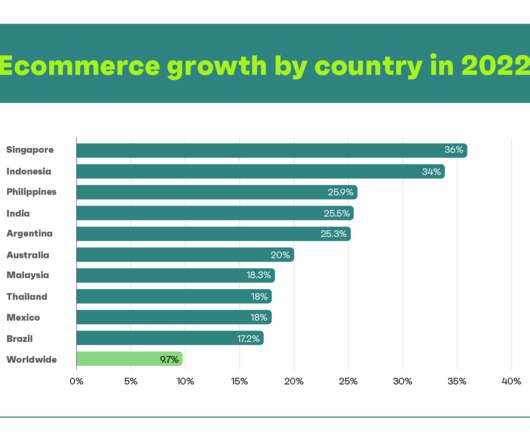

As the online payments industry continues to evolve, new digital wallet solutions, such as mobile payment apps and e-wallet platforms, are becoming increasingly popular and reshaping the way consumers transact. 4 Pros of Digital Wallets Some of the advantages of digital wallet payment options include: 1.

Let's personalize your content