Exclusive Q&A: Venmo GM on the Company’s ‘Natural Extensions’ into Business Payments

Retail TouchPoints

OCTOBER 21, 2022

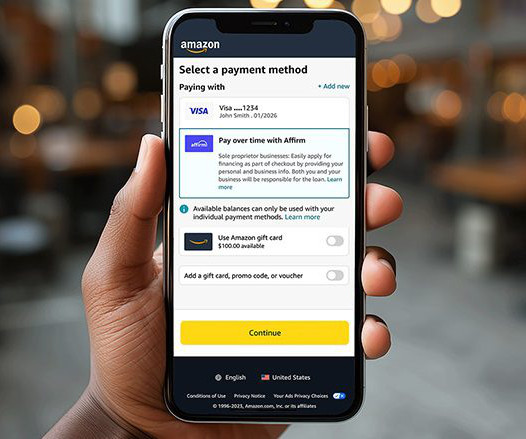

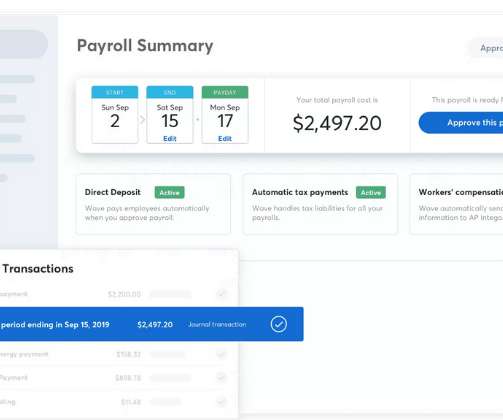

That inherent distaste for the transaction phase is one reason payment companies are so eager to expand into other parts of the shopper journey. Embedded finance has become big business: McKinsey estimated that the sector reached $20 billion in revenue in the U.S. Denise Leonhard, VP and GM, Venmo.

Let's personalize your content