Consumer Spending Trends — 2023 Edition

Has The Economy Got You Down?

It’s 1840. Inflation is rampant, and beleaguered consumers are reeling from high prices. It’s also presidential election season, and economic woes are weighing down the campaign of incumbent President Martin Van Buren, who eventually loses to William Henry Harrison (who, for all you trivia fans, had the shortest presidential tenure, dying 31 days after his inauguration).

It’s 1840. Inflation is rampant, and beleaguered consumers are reeling from high prices. It’s also presidential election season, and economic woes are weighing down the campaign of incumbent President Martin Van Buren, who eventually loses to William Henry Harrison (who, for all you trivia fans, had the shortest presidential tenure, dying 31 days after his inauguration).

High inflation, consumer distress, presidential elections — sound familiar? Yes, history has this vexing habit of repeating itself. And so we find ourselves, in 2023, just as distraught as the hapless shopper from James Henry Beard’s 1840 painting “The Long Bill,” looking in disbelief at his grocery bill.

Let’s Do The Numbers

At Forrester, we track various economic data to make sense of consumer sentiment, including consumer expenditure data from the US Bureau of Economic Analysis (BEA). Our latest report, What US Consumers Are Buying: Implications For Growth Strategy, analyzes data for the first half of 2023 (in aggregate and for several categories) to derive insights useful for brands as they think about their revenue growth strategies.

Here are some highlights:

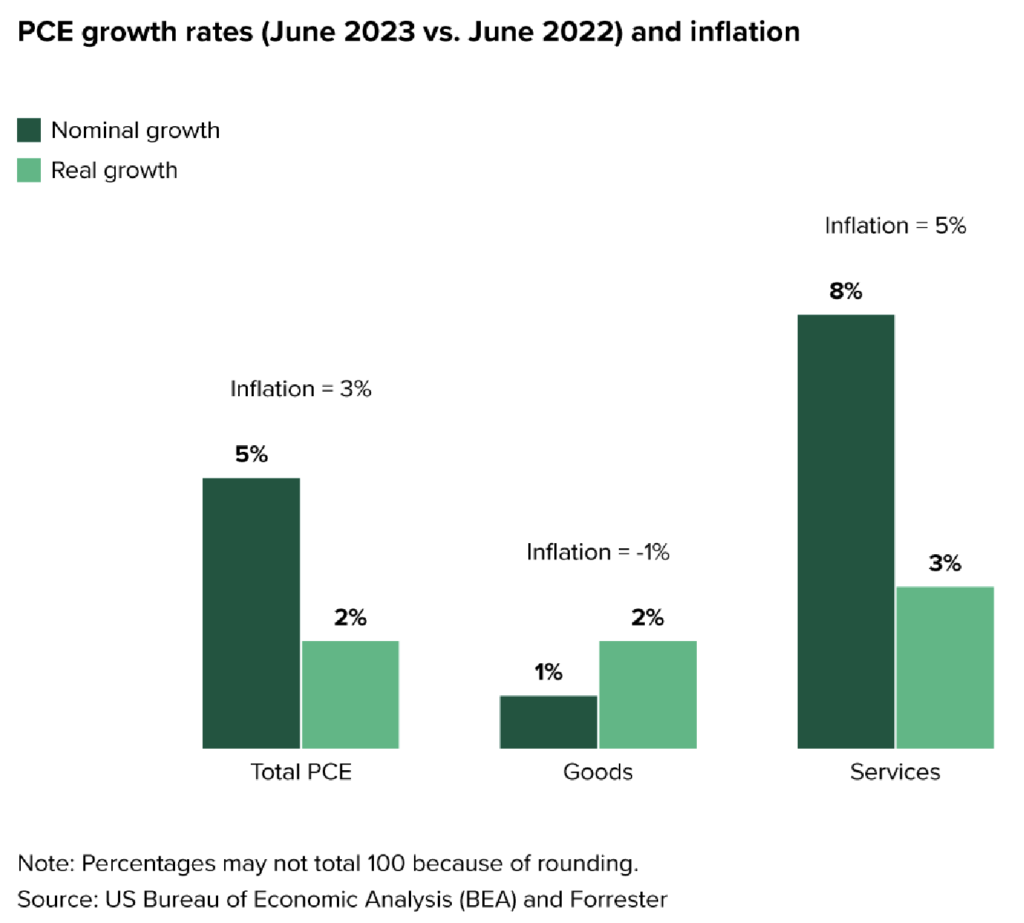

- Consumers are spending more but at a slower rate than before. In June 2023, growth was 5% year over year, versus 9% in June 2022. But here’s the twist: Consumer expenditure is slowing down not because people are buying less but because they are paying less for what they buy.

- The deflationary effect is most dramatic with “goods” (things you buy versus “services” you pay for). In this category, inflation is down 11 percentage points from the year before. Yes, there is still inflation in most categories compared to last year, but it’s a lot less.

- Real growth in consumer expenditure for goods and services is roughly the same, at 2% in June. But services see much higher inflation and, hence, much higher nominal growth (8% versus 1% for goods).

- Results vary by industry: Categories such as “food and beverages” and “furnishings and durable household equipment” have seen expenditure pressure from declining inflation, despite steady real demand. Others, like “pharmaceutical products,” grew 9% in June, buoyed by both real growth and higher prices.

Want To Dive Deeper?

Our report showcases consumer spending behavior for only a few of the innumerable categories that the BEA tracks. If you are interested in some of the other categories relevant to your business, please schedule time with me and my colleague and coauthor, Jitender Miglani (who manages the data and analysis), to discuss.

If you haven’t read our growth strategy framework report, I recommend starting here: Unlock Your Revenue Growth Potential.

To stay connected to these topics and my other research, go to my Forrester bio and choose “Follow.”