Forrester Reviews And Scores Indian Mobile Banking Apps: What We Learned

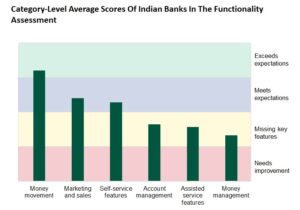

India is emerging as a powerhouse in mobile banking adoption. According to Forrester’s Consumer Asia Pacific Survey, 2023, a staggering 87% of online Indian adults expressed their desire to do all their banking on a smartphone. This statistic marks the highest percentage among the countries surveyed in the Asia Pacific region. It also underscores the integral role that mobile banking apps play in the financial journey of Indian consumers. To navigate this ever-evolving landscape and determine the key to creating exceptional mobile banking experience, we conducted an in-depth analysis of the digital functionality offered by nine prominent Indian banks: Axis Bank, Bank of Baroda, HDFC Bank, ICICI Bank, IDBI Bank, IDFC First Bank, Kotak Mahindra Bank, State Bank of India (SBI), and Yes Bank.

We found that:

- IDFC First Bank leads in digital functionality. In our digital functionality evaluation, IDFC First Bank emerged as the front-runner. It excels in account management, marketing, and sales. The IDFC First Bank mobile app exemplifies how a bank can enhance the experience by providing robust functionality in these areas.

- ICICI Bank is a financial well-being pioneer. ICICI Bank has distinguished itself by placing its customers’ financial well-being at the forefront. From automated savings tools to budget allocation and recommendations, ICICI Bank’s app offers a holistic approach to managing finances. It even goes the extra mile and provides comparisons to similar spenders and auto-categorizes transactions.

- The quest for personalization continues. Indian customers place high value in personalized financial services, yet many banks are taking a narrow approach to personalization. We found that many mobile banking apps lack the customization options that users desire. From account management to money management and even marketing, there is an untapped potential for personalization across the app. Banks must focus on personalization in a way that delivers customer value, not just product sales.

There is more where that came from:

As we delve deeper into the digital age, banks must meet challenges such as rising user expectations and delivering personalized financial experiences — but that’s just the beginning. For a more detailed exploration of best practices and a deeper dive into the world of Indian mobile banking, be sure to check out our comprehensive report, The Forrester Digital Functionality Review: Indian Mobile Banking Apps, Q3 2023.

To assist digital business strategy leaders and their teams, we have also introduced The Forrester Mobile Banking App Functionality Assessment. It’s an excel-based tool designed to help you measure progress and identify areas for improvement in your customers’ digital journeys.

If you’re keen to dive deeper into these research findings, explore the methodology behind them, or discuss your specific challenges and opportunities and best practices (domestic and global), ask your account manager to help you connect or book a guidance session here.