Worth £14bn each year (before tax), smoking and smoking alternatives offer significant value for convenience store retailers, not only for the revenue they bring in themselves, but also as a driver of footfall and repeat business from regular customers and the associated basket spend that goes with it.

The big news is that disposable vapes face prohibition as part of the UK government’s plan to tackle the surge in young people vaping in addition to the category’s escalating environmental impact.

As it stands, disposable vapes account for 88% of all vape sales and the disposables market saw a remarkable increase from £141m in 2021 to £973m in 2022. It’s estimated that more than 1.3 million disposable vapes hit landfills every week.

Youth access

The proposal has prompted a mixed response within the industry. Oliver Kutz, general manager for the UK & Ireland at Imperial Brands, says: “We are encouraged by the government’s continued recognition of the role played by vaping to reduce UK smoking levels to the lowest on record. At the same time, we agree that the benefits of switching smokers to a potentially less-harmful alternative must be balanced with the need to prevent youth access.

“As the responsible owner of the vape brand Blu, we have long called for action to prevent the deliberate marketing of vaping products to young people. We are therefore pleased that the government will act on issues such as vape flavour names, packaging, retail display, and penalties for those selling to under-18s, and we look forward to reviewing the details of the bill when it is published.”

Pre-filled pods

Manufacturers are concerned, however, at the likely impact of removing disposable vapes, as it may fuel the illegal trade of unregulated products, already a sizeable problem for enforcement authorities.

Kutz continues: “It is important that new restrictions do not compromise the ability of vaping products to transition adult smokers away from combustible cigarettes. Disposable vapes are currently used by more than half of adult vapers, and a ban threatens to undermine the country’s significant progress to reduce smoking.”

Possibly pre-empting the new legislation, one of the largest single-use vaping brands, Elfbar, has been quick to respond by producing and raising awareness of its products that align with regulations.

An existing example is Elfbar’s Elfa Pro, a pre-filled pod, and its sister brand Lost Mary recently launched Tappo, its first pre-filled pod system with a rechargeable battery and replaceable pods.

Illicit market

In response to the announcement of the possible ban, Angelo Yang, associate general manager for the UK at Elfbar, says: “The expected ban on single-use vapes will undoubtedly reshape the category.

As per the recent University College London study funded by Cancer Research UK, we understand the critical role single-use vapes play in the journey of adults seeking to quit smoking.

The outright ban may deter adults from switching from cigarettes to vapes and even cause potential relapses from vapes to cigarettes, negatively impacting the government’s target to make the UK smoke-free by 2030. Additionally, banning single-use vapes will help fuel the already burgeoning illicit market.

“Australia’s experience of stringent vaping regulations led to the flourishing of an illicit market and failed to substantially reduce youth usage. A similar approach in the UK might inadvertently empower criminals by relinquishing a significant portion of the regulated nicotine market.

“Therefore, in response to these apprehensions, legislators must ensure Trading Standards are empowered with enhanced authority and the supporting resources to issue immediate and substantial fines to non-compliant retailers, coupled with increased funding for border controls.”

Sensible measures

The announcement has also left the UK vape industry in a state of uncertainty. The absence of clear timelines and a coherent plan raises concerns and has prompted the Vape Protection Alliance (VPA) to attempt to raise £15,000 for a King’s Counsel barrister to provide expert legal advice and direction on the best course of action to challenge the government’s proposed vape restrictions.

In a statement, the group, led by Arcus Compliance, says: “Supporters of this action are not looking to prevent a ban of disposable vape products but to work with the government on sensible measures and timescales to phase them out, ensure former smokers have access to a broad range of flavours, prevent the illegal market from growing any further and to assist the government in forming more sensible regulations such as putting vape products into a licensing scheme.

Flavoured products

“However, the proposed ban on disposable vapes and additional restrictions such as limiting flavours overlooks the significant consequences. This oversight endangers hundreds of legitimate businesses and perpetuates the misconception that vaping is equally as harmful as smoking.”

Arcus Compliance managing director Robert Sidebottom says: “We firmly believe that vaping products save lives. Our mission with the Vape Protection Alliance is to ensure sensible regulation that further reduces youth access and ensures that adult former smokers continue to access a broad range of flavoured vape products, while safeguarding the viability of the vape industry.

“Our case has the potential to make a significant difference. We aim to work collaboratively with the government to phase out disposable vapes over a reasonable timeframe, maintain adult consumer access to a diverse range of flavours, and implement sensible regulations that prioritise public health and industry sustainability.”

Heated tobacco

Although vapes have hogged the headlines recently, they are not the only alternative to smoking for people who want to give up but aren’t ready to ditch nicotine completely.

The heated tobacco category continues to evolve and grow in popularity as customers look for an alternative but familiar tobacco experience with devices that heat tobacco instead of burning it, drastically reducing the amount of harmful chemicals produced.

The category is currently worth £105m in traditional retail and independent and symbol stores in the UK have seen heated tobacco sales of £35m in the last year.

The category is expected to be worth about a quarter of a billion pounds by 2025, so there’s no doubt it provides a big opportunity for retailers, especially those with a competitive range and strong product knowledge.

Saving money

Mark McGuinness, marketing director at JTI UK, says: “Our Ploom brand has gone from strength to strength over the past few years, and device sales have doubled compared with last year, while Evo tobacco stick sales have tripled year on year.

“The cost-of-living crisis is fuelling the growth in lower-priced nicotine alternatives, and 70% of heated tobacco consumers are switching from value tobacco lines.

“The competitively priced Ploom X Advanced bundle offers value for money within the category. As well as being more cost-effective for consumers, heated tobacco sticks also offer higher margins to retailers when sold at RRP.

“Existing adult smokers could also save up to £3,600 a year with Ploom. This is based on comparing the average cost of 20 cigarettes (RRP £14.54) with 20 Evo tobacco sticks (RRP £4.50) per day.”

Diverse range

Flavours are also helping to drive the heated tobacco sector forwards.

Sales of tobacco flavoured variants account for 50% of all refill sales in traditional retail, with Menthol flavours accounting for 38%.

Manufacturer Philip Morris believes providing adult smokers with a full range of alternatives means they have a better chance of leaving cigarettes behind for good. “We are committed to phasing out cigarettes,” says Duncan Cunningham, director of external affairs. “Within 10 to 15 years we could stop selling cigarettes in the UK with the right measures in place.

“However, while vaping enjoys government support as a valuable tool to help smokers quit, concerns over marketing to minors and environmental impacts have recently been highlighted by the growth of disposable vapes. E-cigarettes, though successful for some, don’t work for all smokers.

“Data shows that vaping has begun to stall, with less than a quarter of adult smokers sticking with it in 2023.

“To truly enable smokers to break free from cigarettes, a diverse range of smoke-free alternatives should be embraced. These options, including nicotine pouches and non-combusting tobacco products such as heated tobacco, offer adult smokers a more appealing and better choice than continuing to smoke.

“Other countries provide evidence of the effectiveness of smoke-free alternatives. In Sweden, smokeless tobacco products have significantly reduced smoking rates (some of the lowest in Europe), while Japan’s introduction of heated tobacco products led to a sharp decline in smoking.

Harm reduction

“We believe heated tobacco can significantly accelerate the decline of smoking rates in the UK. Philip Morris International has spent more than $10bn developing IQOS—the largest heated tobacco device globally – which has a similar reduced-risk profile to vaping. It emits on average 95% lower levels of harmful chemicals compared to cigarettes.”

Meanwhile, and despite their long-term decline, traditional tobacco products remain a valuable category for independent stores and are also the number one footfall-driver.

There is nearly a 50:50 market share split between ready-made cigarettes and roll-your-own (RYO), at 54% and 46% respectively, and with more consumers looking for ways to reduce spending amid soaring household costs, there is a growing shift towards value products across the entire tobacco category.

The sub-economy segment now makes up 63% of cigarette sales, while the economy segment accounts for just over half (56%) of RYO, and these segments are showing growth of 3% and 5% year on year.

Economy products

Yawer Rasool, consumer marketing director for the UK & Ireland at Imperial Tobacco, says: “Value products are much more popular at the moment than premium products, given that many consumers are looking to reduce spending, so retailers need to ensure they are responding to this trend by stocking brands in the value tier like Embassy Signature and Richmond, as well as added-value formats like Players JPS Easy Rolling Tobacco, which offers filters and papers in one pack, and Riverstone, which provides papers in the same pack.”

Gemma Bateson, sales director at JTI UK, agrees: “As the cost-of-living crisis continues to put pressure on consumer spending, price remains a key factor for existing adult smokers,” she says. “Value tobacco is paving the way for brands to accelerate in the market, as 58.7% of all sales volumes are currently in the value or ultra-value ready-made cigarette and RYO sectors.

Driving sales

“With existing adult smokers increasingly looking for products that offer premium quality at an ultra-value or value price-point, we have continued to innovate our value product offering, launching new products from existing brands to meet demand and help retailers drive sales.

“By offering well-known brands like Benson & Hedges and Mayfair in the ultra-value segment, retailers have been able to capitalise on both products’ brand heritage, while also offering a competitive price-point.”

Mark McGuinness, marketing director at JTI UK, adds: “Most recently, we expanded our ultra-value ready-made cigarette range with the launch of Mayfair Gold to offer existing adult smokers greater variety.

“Joining our ultra-value offering across all channels last year, Mayfair Gold joined Mayfair Silver as one of our lowest-priced cigarette brands. The product offers the same premium-quality Virginia blend that is synonymous with the Mayfair brand and has already reached 0.83% market share since launch.”

Illicit market

A major threat to both tobacco and vape sales, however, remains the illegal market in smuggled and counterfeit products.

Between 2021 and 2022, estimates show 11% of cigarettes and 34% of rolling tobacco were non UK duty paid, meaning the government lost £2.8bn in tobacco tax revenues.

The sale of illicit tobacco and vapes continues to be a major thorn in the side of legitimate retailers across the UK, taking away thousands of pounds in revenue. In the UK, the illegal tobacco trade is thriving, with 11% of cigarettes and 35% of rolling tobacco being smuggled into the UK in 2021 to 2022, according to HM Revenue & Customs.

James Hall, anti-Illicit trade manager at Imperial Tobacco UK & Ireland, says: “Illicit trade remains a huge challenge within the category. The sale of illicit tobacco is a global industry that harms honest traders and damages communities, and we firmly believe it should not be tolerated.

“The current cost-of-living crisis and rising tobacco taxes are driving illicit trade in the UK, with many consumers seeking cheaper products – which can mean purchasing from illegal sources.

“In fact, 73% of smokers bought illicit tobacco within the last year (compared with 71% in 2021) and nearly four in 10 consumers claim that increased living costs have impacted their purchasing habits and where they now choose to buy ‘cheaper’ (illicit) tobacco.

“Unfortunately, the reporting of illicit tobacco by those who are aware of it has decreased from 32% in 2021 to just 29% in 2022 . It’s crucial that any suspected illicit activity is flagged to the relevant authorities so that action can be taken.

“Therefore, we strongly encourage retailers to report any potential illicit trade activity in their area by contacting our salesforce through our dedicated SARA trade platform, emailing suspectit.reportit@uk.imptob.com, or calling us directly through our anti-illicit trade hotline on 0800 0495992.”

Organised crime

Many in the industry believe there is a real risk that the government’s proposed generational ban on smoking – which will see those born after 2008 never legally allowed to purchase tobacco – could exacerbate problems further, handing money to serious and organised crime groups that manufacture and sell illegal tobacco and vapes.

The prohibition of legal products always has dangerous side effects, manufacturers claim, opening the door to criminal gangs to sell illegal products, as was seen in South Africa in 2020 following a temporary ban on tobacco products there.

Sarah Connor, director of communications at JTI UK, says: “There is currently a real concern among retailers around the policing of the illicit trade, and with the proposed generational ban this fear is growing.

“In fact, 66% told us that they don’t believe the government has the required funding or resources to enforce the legislation and New Zealand, the only country in the world to introduce legislation for a generational ban, has chosen to repeal it.

“Retailers can play a vital role in combatting the illicit trade. We’re working closely with our retail partners to ensure they are knowledgeable and confident in communicating the dangers of illegal products to their customers.”

Top 4 vaping sales tips

❚ Improve staff knowledge of vaping products by running product demonstrations using samples of the devices being sold in-store.

❚ Allowing staff to handle the products themselves, so they get to know the different components using demonstration models, or sample liquids, will really help them understand more about how the products work, meaning they can pass this information on to customers.

❚ Using similar demonstration models can also be a great way to educate customers on the devices before they buy, so they leave the store fully informed on how to use a product.

❚ Reading up on the latest category developments and news in the trade press is also a really great way to increase understanding of the key trends, different terminology and new products. There’s a wealth of information at retailers’ fingertips that will go a long way to help them get to grips with the category.

Cigars tap into value market

Nataly Scarpetta, marketing manager, Scandinavian Tobacco Group

The total UK cigar category is worth £295m in annual sales, which is a value increase of 3.2% versus the same time last year. This positive performance is mainly down to sales of cigarillos, which account for the largest of the four segments in the cigar category and is the only one currently in growth. Cigarillos are now worth more than £111m in annual sales and are responsible for very nearly half of total cigar volume sales.

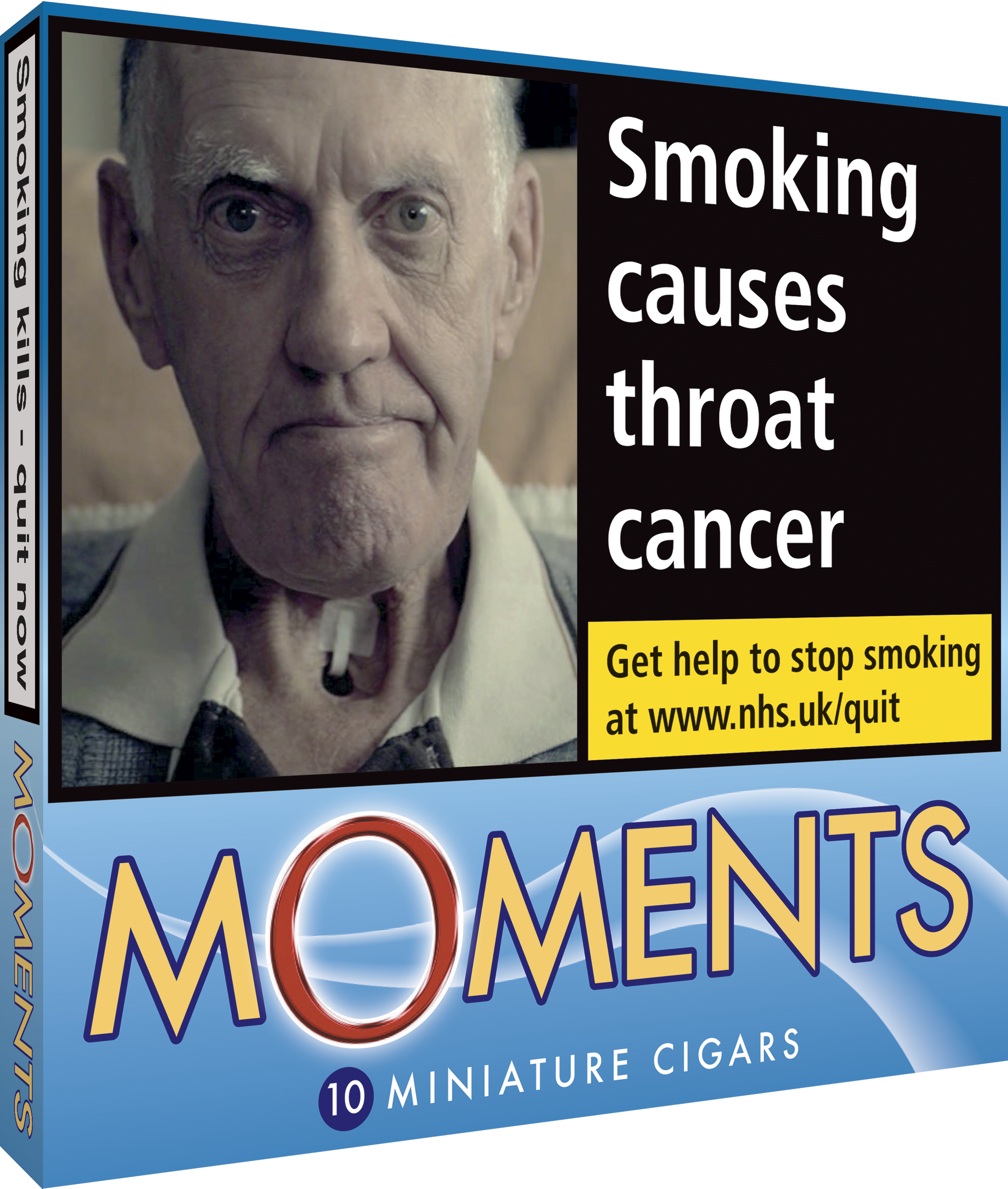

Nataly Scarpetta, marketing manager at Scandinavian Tobacco Group, says: “The ongoing cost-of-living crisis has certainly brought into sharp focus the importance of value in the tobacco category. That said, the value trend has certainly been around the cigar category for quite some time now, which is evidenced by the success of our Moments Blue brand.

“In fact, our Moments 10s packs are the biggest brand in the value-for-money segment and are well known among tobacco-selling retailers as a popular choice among those customers who are looking to save money. It’s also worth mentioning our Signature Action brand is the most affordable in the cigarillo segment. With these challenging financial times that the country is going through, price is always going to be high on many shoppers’ agenda, so we always advise retailers to make sure they are highlighting their value brands to customers to help them save money.”

Top 5 tobacco category facts

❚ The value of tobacco in the UK totalled £14.1bn in the last year, with the ready-made cigarettes market accounting for £9.9bn.

❚ Value ready-made cigarettes form the leading price sector, with a market share of 21.3%.

❚ 6.4 million kilograms of rolling tobacco are sold in the UK each year

❚ Ultra-value RYO is the fastest growing in share terms and currently stands at 8.7% of the combined tobacco market.

❚ The total value of the cigar market in the UK is approximately £283m

Merchandising tips

Stocking the right range and maintaining product

availability are key to tobacco sales, say leading manufacturers

In terms of merchandising, it’s important to remember that every store is different, so retailers should analyse their sales data and talk to their customers on a frequent basis to understand what products they are looking for and purchasing often. Once retailers understand this, then they can tailor their range accordingly.

Making sure stock levels are continuously maintained is also key to improving sales. If retailers run out of popular products, it can be costly, particularly within a category that is mainly driven by brand loyalty.

With this mind, store owners and their staff should regularly check their stock levels – both on the shelf and in the stock room – to make sure they are not missing out on any sales opportunities.

Top 4 RYO accessories

❚ The category’s robust performance resulted in year-on-year growth of 6.8%, with annual sales of accessories now valued at £352m.

❚ The category’s fastest-growing sector is rolling papers, which is also the highest in value, growing at 13.3% and worth more than £73m in convenience alone.

❚ The ‘slim and tips’ sub-category is

also recording impressive growth, with value sales upwards of £32m as more consumers opt for premium formats.

❚ Roll-your-own products are becoming even more synonymous with value

and look set to appeal to even more consumers who want to cut costs without having to make major lifestyle changes or compromise on quality.

Talking Retail Grocery and product news for independent retailers

Talking Retail Grocery and product news for independent retailers