Forecasting In Uncertainty: We Are Raising Our 2020 And 2021 US Tech Market Growth Forecast

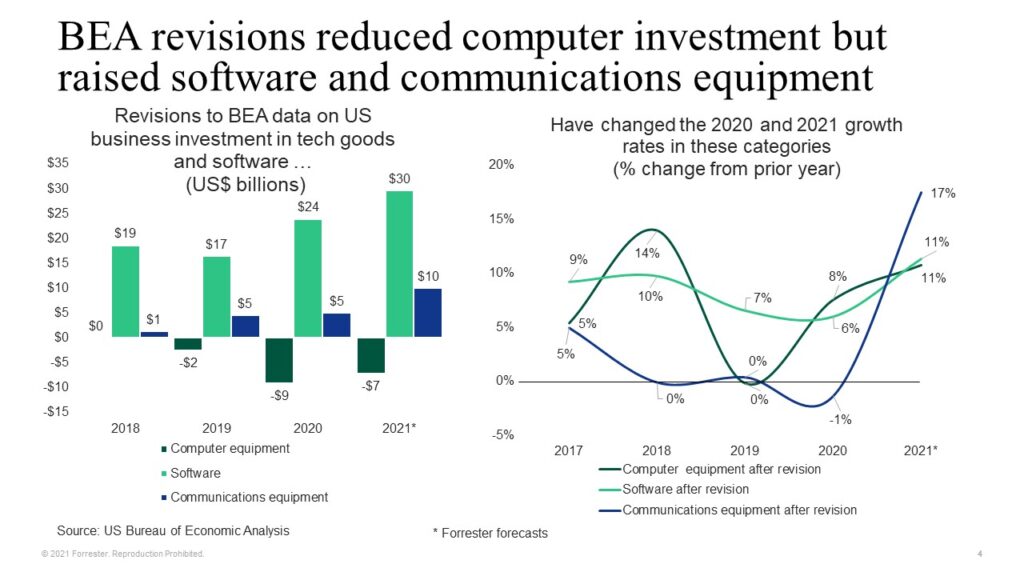

Two weeks ago on July 29, 2021, the US Bureau of Economic Analysis released its Q2 2021 data on US GDP: “Gross Domestic Product, Second Quarter 2021 (Advance Estimate) and Annual Update.” The headline stories focused on continued, strong 6.5% growth in real GDP in Q2 and the surge in inflation to a 5.7% annualized rate. But for tech executives and tech vendors, the real news was in the data on business investment in computer and communications equipment. BEA not only released data for this spending in Q2, it also revised all the data going back to 2017. These revisions reduced the level of computer equipment investment in 2020 and the first part of 2021 but increased levels of investment in communications equipment, especially software (see left figure in graphic below). Growth rates also changed, with the new numbers showing good growth in business investment in computer equipment and software in 2020 and double-digit growth now projected for 2021 in all three categories (see right figure in graphic).

Here are the details in the new BEA numbers:

- Computer equipment investment is smaller but growing faster than we thought. One of the puzzles in the BEA data in 2020 was the reported growth of 13% in business investment in computer equipment. That kind of growth rate that did not show up in the US revenues of leading computer vendors. The revised data now shows computer equipment investment growth in 2020 was 8% from 2019. With the revised Q1 and new Q2 2021 data on business investment in computer equipment, we now think that category will post an 11% increase. That will be an improvement over our previous projection of 9% growth.

- Software spending is going higher in 2021. BEA’s undercounting of software investment is an old story. Every July for the past several years, BEA has revised its estimates for business investment in software to a higher number, and it did so again this year. We think these underestimates are the result of undercounting the revenues of startup software-as-a-service vendors. For 2021, BEA revised its Q1 2021 software investment by an increase of $21 billion and estimated Q2 2021 software investment at $498 billion (annualized). If these trends continue, business software investment will come in at around $505 billion for 2021, an 11% increase from 2020. That’s in line with our earlier forecast, but the higher base for 2020 makes it even more impressive.

- Communications equipment is poised for a banner 2021. The BEA revisions raised communications equipment investment by about $5 billion in 2019 and 2020, and improved growth rates to basically flat from a negative 2%. The Q1 and Q2 2021 numbers for business investment in communications equipment were also strong at annualized rates of $137 billion and $142 billion, respectively. That continues a pattern of improving growth that started in Q3 2020. The cause is most likely a combination of increased federal funding to support the expansion of broadband service and carrier willingness to invest in capacity, given increased business and consumer demand for telco services.

Tech Market Growth Will Be Even Better Than We Projected In June 2021

In our June 2021 report on the US tech market, we projected that total US tech budgets would rise by 7.4% in 2021 (see “US Tech Market Outlook By Category For 2021 And 2022“). With the new data, US tech spending will grow even faster. We still need to factor in government spending on these categories and adjust these reported numbers to align with our tech categories (for example, subtract capitalized systems integration services from BEA’s computer equipment numbers). We also won’t get the Q2 2021 Census Bureau data until mid-September on the business and government revenues of telecommunications carriers, data processing and outsourcing vendors, and tech services companies. Still, it’s likely that our 2021 growth rates for the US for business and government spending on computer equipment will be around 9% (up from our June forecast of 5.6%); for software around 12% (up from 11%); and for communications equipment around 16% (up from 13%). Spending on tech consulting services, tech outsourcing services, and telecom services are all likely to grow two to three percentage points faster. And spending on tech staff is likely to expand by 9% rather than 6.9% as higher inflation and stiff demand for IT workers pushes average tech salary increases to 5%, rather than our assumed 3%. So, overall, you should expect US tech budgets to grow by 9% to 10% in 2021.