Understanding Investors In China’s Greater Bay Area

What You Should Know About Investors In China’s Greater Bay Area

China has emerged as an attractive market for wealth management and investment firms due to its rapid economic growth and wealth accumulation. In particular, the Greater Bay Area (GBA) boasts one of the highest concentrations of high-net-worth individuals with substantial investable assets. The Wealth Management Connect pilot launched in GBA in October 2021 further incentivized retail investments by lifting restrictions related to cross-border investments, thus boosting capital flows in the region. Our recent report, Understanding Investors In China’s Greater Bay Area, examines wealth management and investing in GBA. Here are the key findings of this report:

- The proportion of investors is among the highest in Asia Pacific. Our data indicates that 43% of online adults in Guangdong and 58% in Hong Kong are mass affluent or affluent; 56% of online adults in Guangdong and 68% in Hong Kong are investors.

- Younger consumers become more important as digital offerings increase. According to our survey, 55% of investors in Hong Kong and 50% in Guangdong were under 35. Younger generations are also more receptive to new technology concepts: Half of Hong Kong investors under 35 are interested in automated investment managers, compared with 44% of investors aged 35 and over.

The Typical GBA Investor Is Engaged And Self-Directed

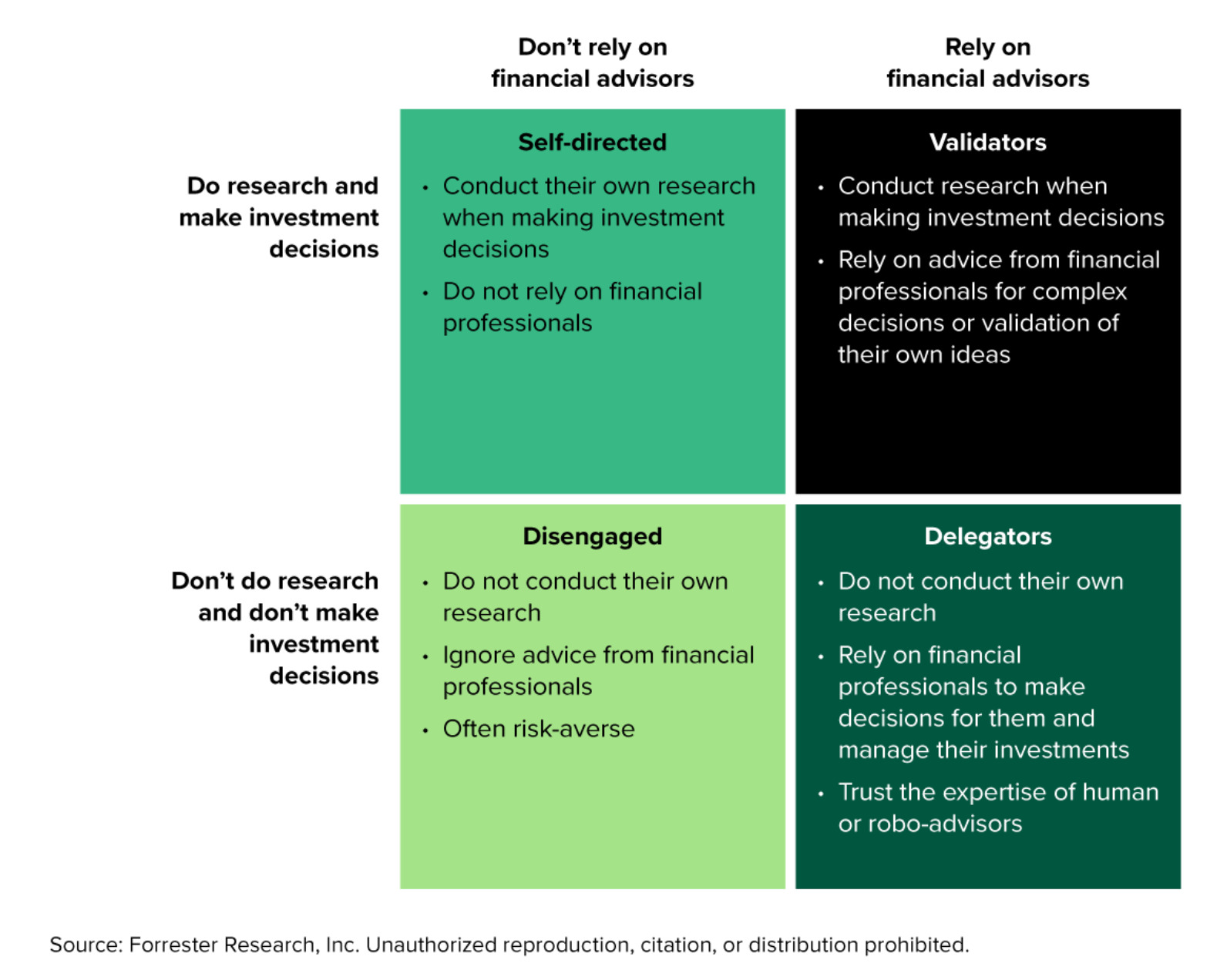

We used Forrester Analytics data to examine investor attitudes and divide investors into four primary groups according to their level of self-directedness (see Figure 3). These segments exhibit different demographics and dramatically varying levels of self-directedness. We discovered that:

- A majority of GBA investors are validators. Validators gather their own information, make their own decisions, and seek advice and validation from experts. They dominate in GBA: Validators comprise a whopping 91% of investors in Guangdong and 71% in Hong Kong. Validators are the most likely to research wealth management products on their own and ask for professional advice when needed.

- Delegators and self-directed investors are more common in Hong Kong. Delegators hand off most investment decisions to experts such as human financial advisors and, increasingly, robo-advisors. In Guangdong, only 3% of investors are delegators, but in Hong Kong, this group accounts for 14% of all investors. Few delegators say that they personally conduct research before making investment decisions. Self-directed investors have the confidence to choose their own investments: They gather their own information and rely on financial tools to make investment decisions. This segment claims 5% of investors in Guangdong and 13% in Hong Kong.

- Disengaged investors are scarce in GBA. Disengaged investors do not conduct investment research or rely on advice from financial professionals. They are generally risk-averse and don’t put much time into managing their investments. However, our surveys did not detect significant numbers of disengaged investors in GBA in general or Hong Kong in particular.

Investors in each segment have distinct behaviors and attitudes. In addition, investors in Guangdong and Hong Kong exhibit similarities and differences in their behaviors. For example, validators in Guangdong are more open to paid professional services, and professionalism is important to winning over Hong Kong delegators. Wealth management firms should understand these behavioral differences to better serve customers in GBA.

If you’re interested in the detailed findings about today’s GBA investors and how to build your strategy and products to satisfy their needs, please schedule an inquiry. We have also published Understanding Investors In China’s Greater Bay Area; Forrester clients can read this report to learn more about investors in GBA. You can also join our upcoming webinar to discuss the investor segmentation in GBA.