Best Recurring Payment Systems (Oct 2020)

Ecommerce Platforms

OCTOBER 27, 2020

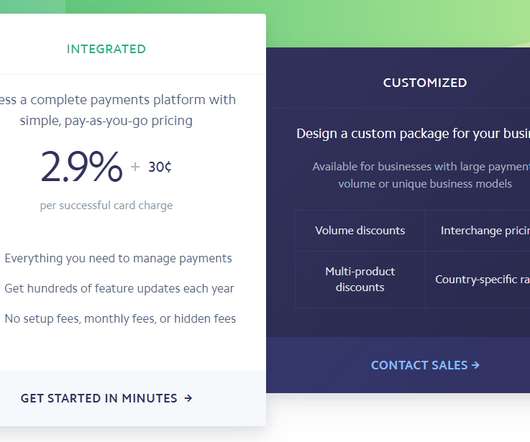

Whether you're launching a subscription-based product or service, setting up customer payment plans, or conducting ongoing work for your clients, you'll want the best recurring payment system for your budget. Chargebee is explicitly designed for subscription-based businesses. Pricing ??. Invoices are free to send. Pricing ??.

Let's personalize your content