Despite the nearly $3 billion in declines across U.S. retail in the first quarter due to a shift in Easter timing and changing consumer preferences, growth is not completely elusive. In fact, some food and beverage manufacturers are finding pockets of growth, most notably small manufacturers.

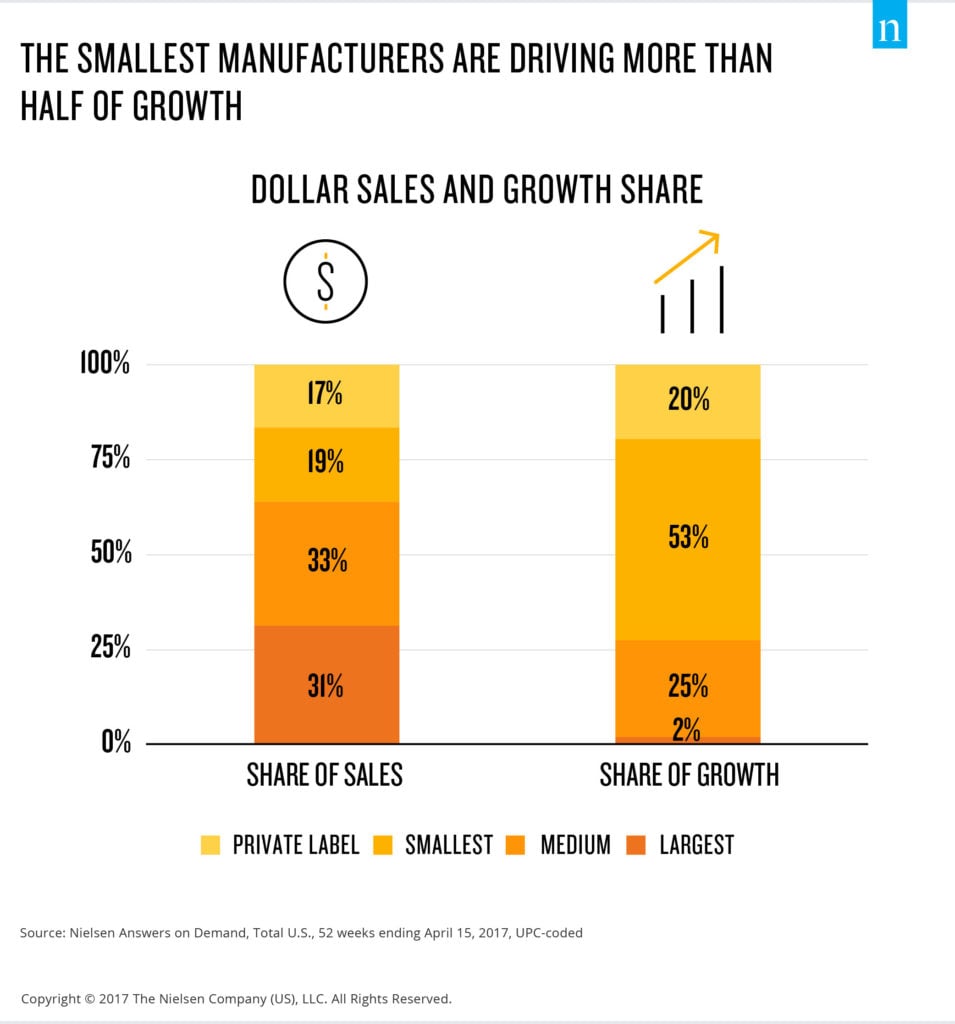

Looking back five years ago, the largest food and beverage manufacturers accounted for one-third of dollar sales. Today, they account for 31%, while smaller manufacturers (those with at least $100,000 in annual sales) have gained two percentage points of market share, equal to about $2 billion. Today, the smallest manufacturers, nearly 16,000 companies, account for 19% of dollar sales and are driving more than half of the growth (53%).

But in a time where the U.S. retail industry is largely contracting, how are small manufacturers finding growth? What’s causing this shift? We decided to find out, so we conducted an analysis to identify commonalities among product offerings from smaller manufacturers. The analysis showed that smaller companies are putting a great emphasis on health and wellness to meet consumer demand for transparency, while also selling products at premium price points. As a result, retailers are making room for them on shelves.

The Rise Of Product Transparency And Clean Labeling

One area we looked at is product transparency, with a particular focus on how brands are addressing consumers’ desire for clean labels. “Clean label” products are free of artificial flavors, colors, preservatives and sweeteners in all food and beverage categories, and free of hormones and antibiotics in applicable categories, and also contain a specific marketing claim.

As detailed in Nielsen’s global ingredients survey, consumers place close attention to product details. In fact, 73% of respondents said they feel positively about companies that are transparent about their product sourcing; 68% are willing to pay more for food and beverages that don’t contain undesirable ingredients; and 64% of consumers’ diets prohibit certain ingredients. This shift to transparency means that consumers are flocking to clean labels.

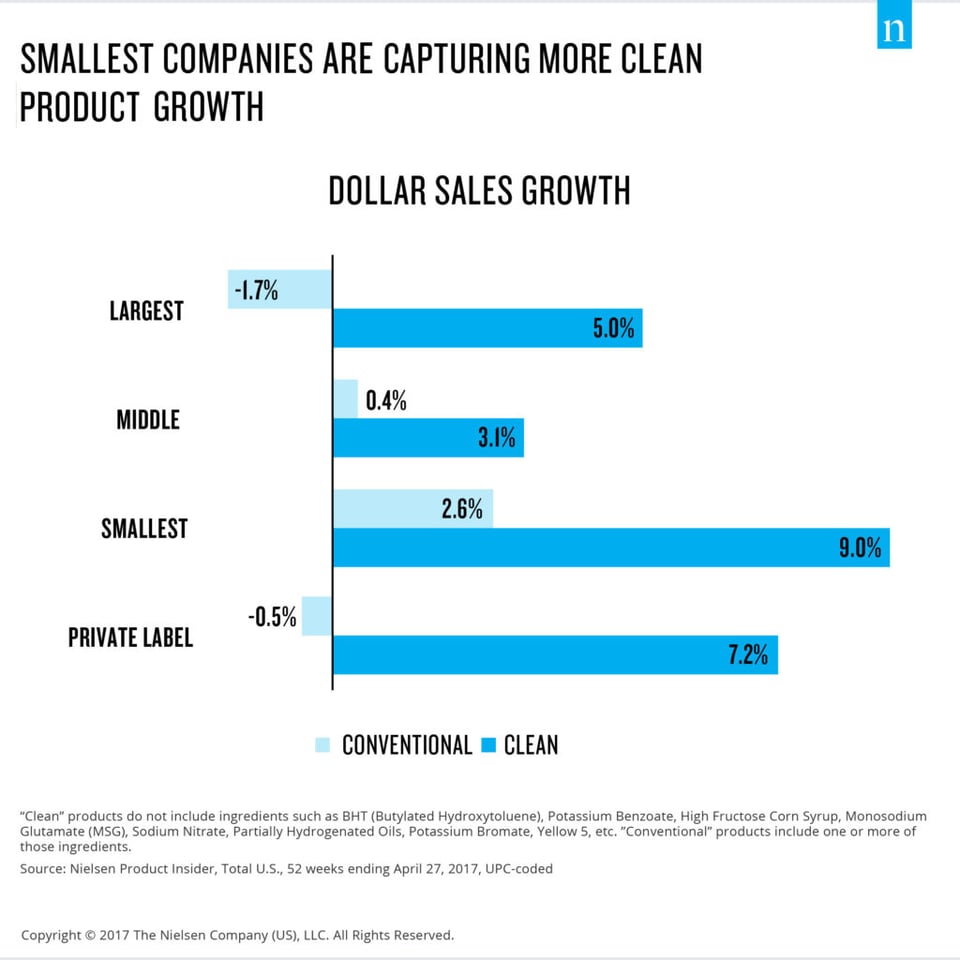

According to Nielsen Product Insider, powered by Label Insight, clean label foods and beverages account for 30% share of food and beverage sales and grew 5.6% of dollar sales over the last five years.

And when it comes to clean label, small manufacturers are leading both dollar sales and growth. In the last year, small manufacturers sold the highest share of clean label products when compared to their conventional sales (40% vs. 60%, respectively) than large manufacturers (24% vs. 76%), middle-sized manufacturers (38% vs. 62%) and private-label manufacturers (27% vs. 73%).

Winning With Premium Price Tiers

Smaller manufacturers are also winning with premium price tiers. In the year ended April 29, 2017, premium-priced sales accounted for 44% of small manufacturers’ sales (compared to large manufacturers’ premium price sales at 32%; middle at 39% and private-label at 17%).

Retailers Make Room For More Shelf Space

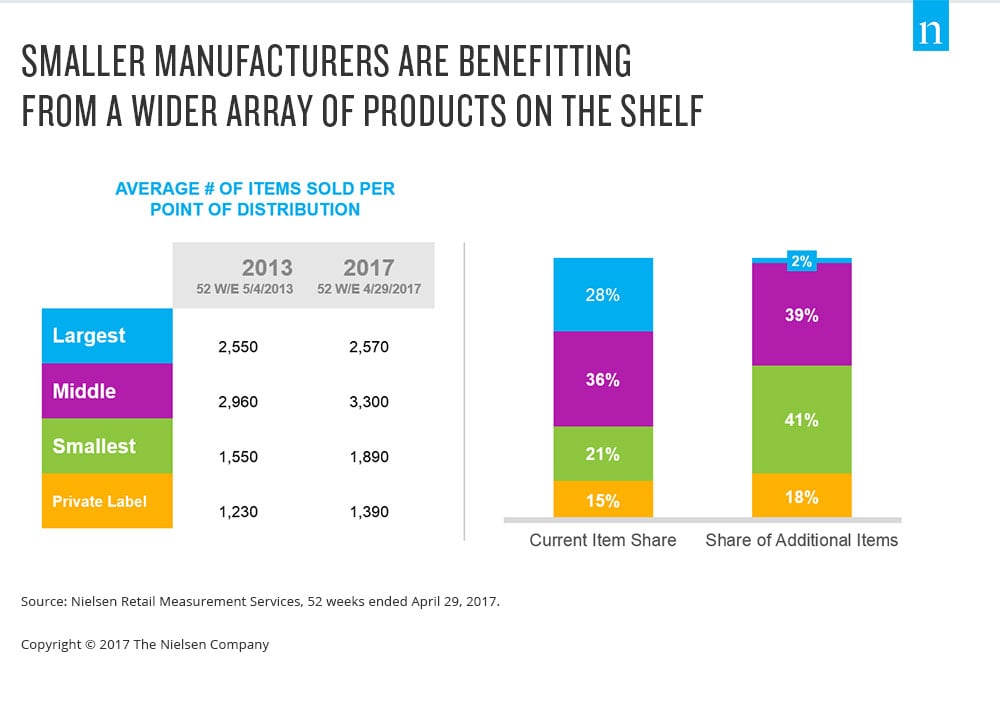

In the last five years, small- and medium-sized manufacturers have increased their distribution across regions, meaning more shelf space at stores. For approximately 900 food and beverage items that have been added to the shelves since 2013, 88% came from small- and medium-sized companies. For example, small manufacturers’ products that may have previously only existed in six markets now exists in 10 or more, indicating that retailers across markets are giving them more shelf space and more opportunity to get in front of consumers in-store.

Capturing Sales Volume Through Promotion

With greater variety and connection to actual consumer desires, smaller and private-label manufacturers have also been able to win while promoting their offerings less than larger companies. In fact, large food and beverage manufacturers have spent more than average on trade promotions, while smaller operators have kept promotions relatively low. In the year ended April 29, 2017, sales sold on promotion accounted for 40% of large manufacturers’ dollar volume, compared with just 27% of small manufacturers’ dollar volume.

As consumers continue to demand products with clean labels, they’re willing to pay the price, regardless of promotions. As smaller manufacturers capitalize on this trend, retailers have opened up shelf space to cater to their offerings—and meet consumer demand. However, for large, middle and private-label players, the opportunity for growth is still ahead.

Methodology

Insights from this article were derived from:

- Nielsen Product Insider, Total U.S., 52 weeks ended April 29, 2017

- Nielsen Retail Measurement Services, total U.S., 52 weeks ended April 29, 2017

To keep track of new and emerging brands winning on Amazon, download Profitero’s FastMovers reports, available across 50+ categories every month.