Stripe vs Square: Summarizing Your Options for 2020

Ecommerce Platforms

NOVEMBER 27, 2019

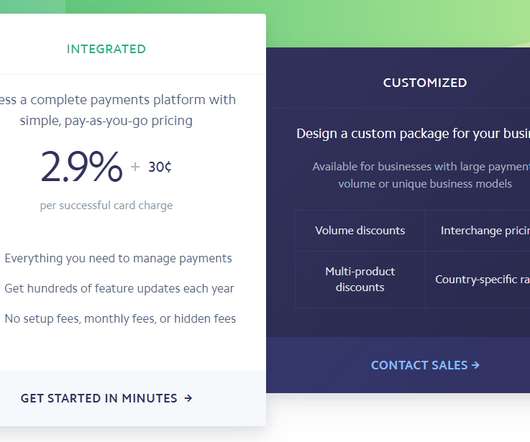

for ACH transactions ($5 max). and 30 cents for every transaction to add Stripe payments to your website. Additionally, Stripe provides a great variety of payment processing options to choose from, including ACH payment processing, to help you save some extra cash. Stripes prices are: 2.9% plus 30 cents online.

Let's personalize your content