Challenger Brands Are Failing On Online Delivery – Things Must Change

RetailMinded

MARCH 31, 2021

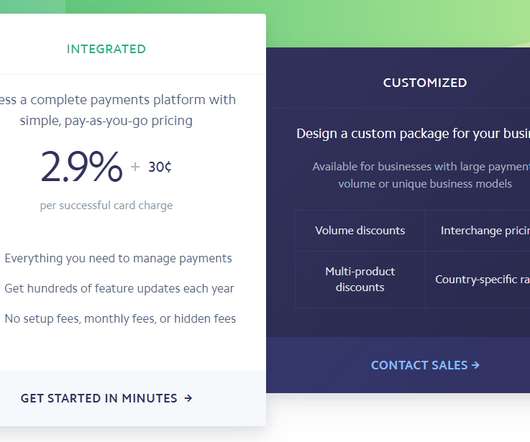

E-retail revenues are set to re ach $6.54 There’s clearly a massive opportunity here for challenger brands – especially those in the DTC space – to capitalise on the huge increase in online custom, especially as shoppers – as much as 81% of them – want to buy products from brands directly. .

Let's personalize your content