Dwolla Review 2019: ACH Payments Made Easy

Ecommerce Platforms

AUGUST 8, 2019

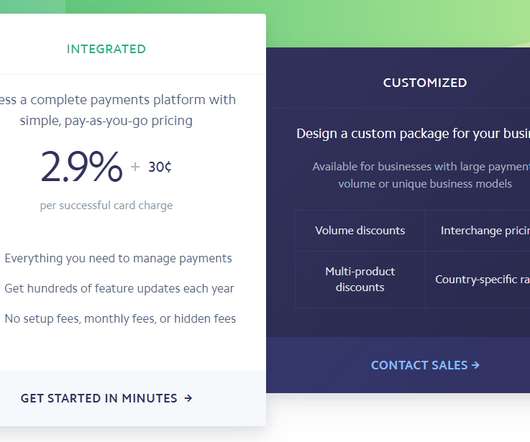

This solution helps to simplify automated clearing house payments (ACH) and white label bank transfers for businesses. But, instead of providing a platform like other companies using ACH rather than credit or debit cards ( like PayPal ). Dwolla facilitates ACH payments. Or are you considering launching a brand? Cue, Dwolla.

Let's personalize your content