What Is a Third-Party Payment Processor? The Ultimate Guide

Korona

FEBRUARY 4, 2023

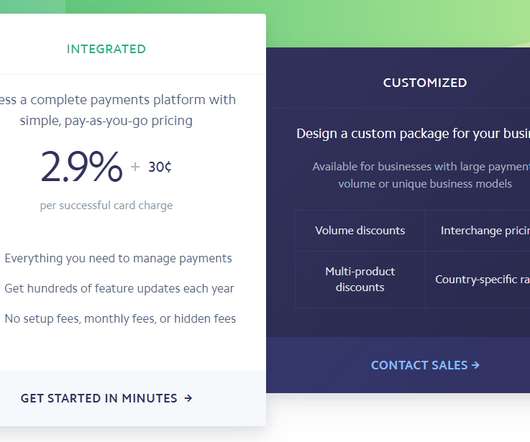

A payment processor is also the third-party processor of ACH bank transfers. The payment gateway is used through the retailer’s point of sale (POS) card reader device to securely transmit transaction and card data to credit card networks, acquirers, and card issuers. For their services, payment processors charge a fee.

Let's personalize your content