Consumers and Merchants Should Look Before They Leap into BNPL Services

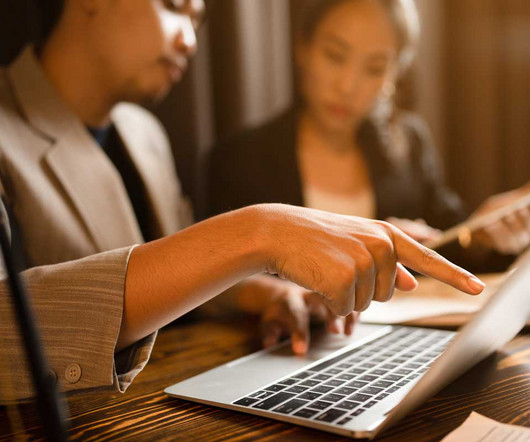

Retail TouchPoints

APRIL 27, 2021

The economic fallout from the COVID-19 pandemic accelerated demand for buy now, pay later (BNPL) payment options. over the five years through 2024-25, to $1.1 As the popularity of BNPL increases, it is important for consumers and merchants to weigh the benefits and the drawbacks of using/offering these payment options.

Let's personalize your content