Why Backend Orchestration is the True Payment Experience Unlock

Retail TouchPoints

JANUARY 26, 2024

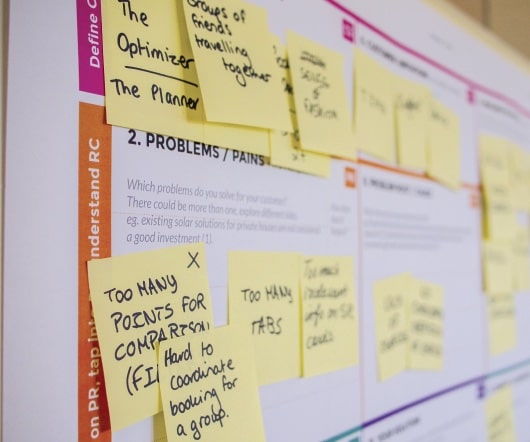

“Too many friction points all along the customer journey is a big pain point for consumers, and certainly the checkout or transaction moment plays a part in that friction,” said Margot Juros, Research Director for Retail Technology Strategies at market intelligence and advisory firm IDC in an interview with Retail TouchPoints.

Let's personalize your content