The Best Credit Card Processing Companies (In-Depth Review)

Kissmetrics

SEPTEMBER 4, 2020

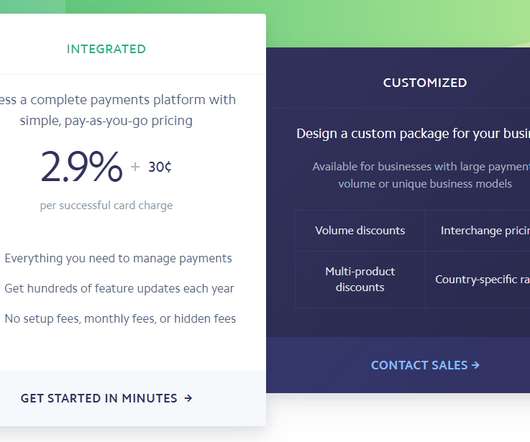

So, the way in which you accept payments matters for both you and the customer. Not only that, as a business owner you need to know that you’re not shelling out cash on inferior services or unnecessary additional fees. Therefore, this post will cover everything you need to know about choosing the right credit card processing company.

Let's personalize your content