Where Payment Processing Systems Are Headed In 2020

RTP blog

DECEMBER 30, 2019

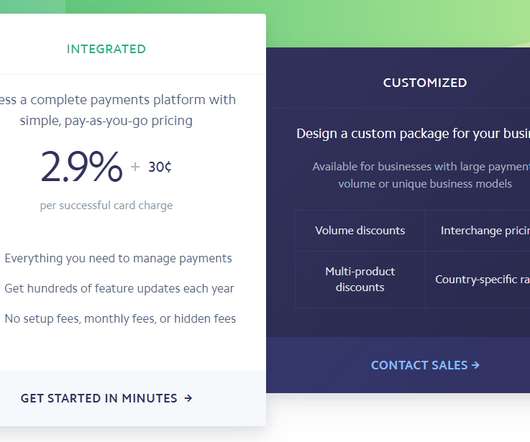

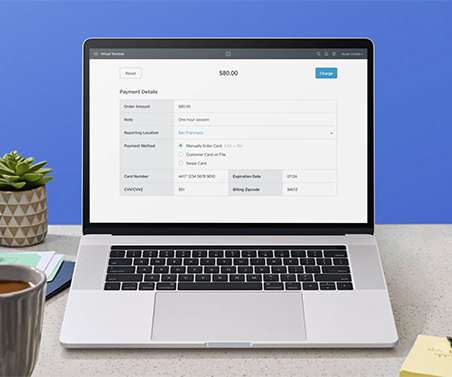

market for payment systems is complex. We have over 21 million businesses, and every one of them needs some form of a payment processing solution. Payment processing is complex. However, payment technology is perhaps the best it’s ever been. Better Payment Security Credit card fraud is on the decline.

Let's personalize your content