Laying the Operational Foundation for Autonomous Stores

Retail TouchPoints

AUGUST 14, 2023

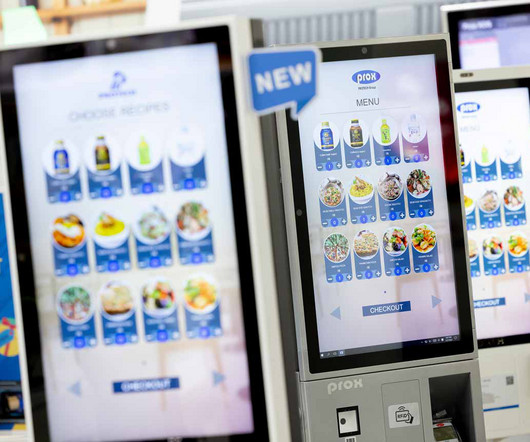

While autonomous stores and technological innovation are high on the retail agenda, the infrastructure and operational efforts that enable them aren’t often given the same broad attention. Grocery retail is rooted in a traditional brick-and-mortar business model, with many longstanding and comprehensive internal processes.

Let's personalize your content