Shopify Payments vs Stripe (2023): Choosing a Payment Processor

Ecommerce Platforms

JUNE 1, 2023

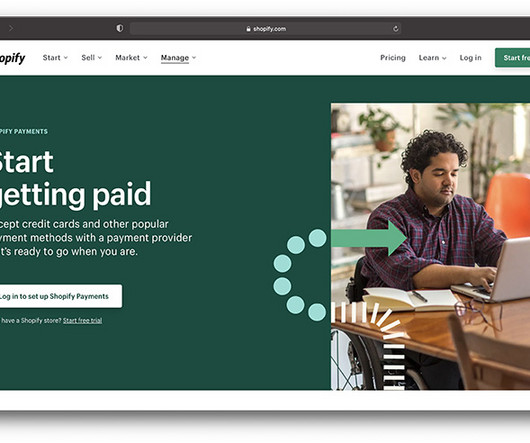

Shopify Payments vs Stripe: Which solution should you really be using for your ecommerce store? Both Shopify Payments and Stripe offer very similar services to business owners. Both allow you to accept and process payments online, ensuring your ecommerce company can make a profit. What is Shopify Payments?

Let's personalize your content