Embedded Finance: Making Payments Possible in New Frontiers

Retail TouchPoints

MARCH 27, 2023

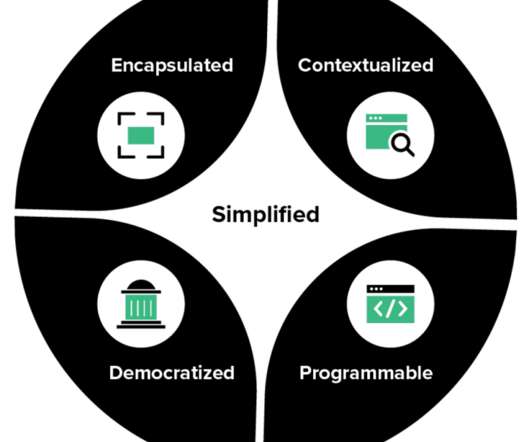

If we thought the pandemic-driven shift to digital payments was an evolution, we’re about to be catapulted into a new world, where payments will become possible in places thought impossible just a few years ago. In fact, embedded finance will be a $777 billion opportunity by 2029. So how can businesses get a piece of it?

Let's personalize your content